Introduction and Overview

Although SSF IV had only invested in two companies as at December 2022, we are pleased to release this abbreviated Sustainability and Impact report to highlight our progress, across the portfolio and as a team. In May, we announced the final close of our fourth Sustainable Solutions Fund (SSF IV), which brings us to a total of USD 3.9 billion raised across four funds.

For the Growth Equity team, 2022 was a year of inward focus on the portfolio, strategic reflection and operational improvement. We continued to push forward on roadmaps, roundtables and events, authoring 13 roadmaps and assessed 52 qualified companies, across roadmap topics such as food systems, machine learning Platforms, Identity and Anti-fraud, Healthcare Staffing, Mental Health, and ESG & Sustainability tools. In parallel to deal activity, we made intentional investments in our operating platform scalability and efficiency to drive future growth. These included a significant program of investment in our portfolio management approach, and process updates in response to changes in the regulatory landscape.

Growth Equity

Overview

Investment Strategy & Approach

Strategy

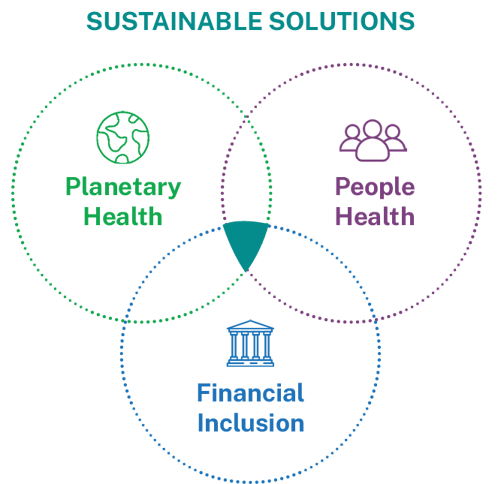

We invest in companies whose products, services and operations contribute to the global outcomes of Planetary Health, People Health and Financial Inclusion.

We seek to back companies that drive clear impact across our three outcomes domains, as detailed in the table below. Using our systems thinking lens, we also understand that these outcomes are often interrelated, and we take this into account in our investment research and evaluation – Planetary Health influences People Health and Financial Inclusion, and the other way around.

We believe this will be the defining decade for driving the transformational changes needed in climate and social action. Click on the video below to hear more from Lucia Rigo, Partner in Growth Equity.

Hear about The Defining Decade

Approach to Portfolio Impact and ESG Performance Measurement

We select at least one ‘North Star’ impact metric to measure each business’ contribution to the above goals, and report on outcomes mapped to the UN Sustainable Development Goals (SDGs), alongside core ESG performance metrics. For companies contributing to Financial Inclusion and People Health, we conduct social outcomes benchmarking using beneficiary surveys. For companies contributing to Planetary Health, we analyse their total environmental impact through Life Cycle Assessments (LCA). We also analyse our business’ overall contribution and risks to impact using the norms established by the Impact Management Project (IMP) framework. Finally, using GHG emissions measured as part of our core ESG performance metrics, we have also begun to engage our portfolio in reporting aligned to the Task Force on Climate-related Financial Disclosures (TCFD) and in setting Science-Based Targets (SBT), in line with Generation’s commitment to align our portfolio to net zero by 2040 or sooner.

Planetary Health | People Health | Financial Inclusion | Reporting Frameworks: | |

| Impact Outcomes | GHG Mitigation Pollution Avoidance Resource Efficiency | Access Health Outcomes System Cost Efficiency | Access Individual Growth Earnings System Cost Efficiency |

|

| Impact Metrics |

|

|

|

|

| ESG Performance Metrics | Environmental, Social, and Governance (ESG) information captured across the portfolio |

| ||

Portfolio Results

We made our first two investments of SSF IV in 2022, in Gloat and WEKA.

Click on the logos below to read more about results from companies in the portfolio.

Gloat

What it Does

Gloat's Agile Workforce Operating System enables businesses to deploy talent and resources quickly and at scale. It provides continuous visibility into strengths and gaps, cost-efficient models for upskilling and retaining talent, and dynamic Talent Marketplace applications for projects, mentorships, internal mobility, and career planning. The system is supported by Skills Foundation consoles to adapt to emerging trends and powered by Gloat's deep-learning AI-driven Workforce Graph for understanding work relationships.

System Positive Thesis & Solution

As many as 375 million workers will have to switch occupations or acquire new skills by 2030,3 and it is estimated that by 2030 there will be a global human talent shortage of 85 million people according to Korn Ferry and McKinsey research.4 Our vision for a sustainable Future of Work includes diverse, resilient, skill-based workforces – and we believe this is only possible by ensuring ongoing, accessible, high-quality, affordable upskilling and reskilling. We believe Talent Marketplace is the best wedge into the broader talent management stack, and that Gloat can become a system of record for employee skills for its customers.

Impact Insights

- What. What. Generation worked with Gloat to determine product impact KPIs. In 2022, Gloat facilitated over 822k unlocked hours5, defined as the sum of the number of hires (of employees to projects, as facilitated by Gloat) multiplied by the respective hours on the project for the calendar year. In late 2022, Gloat launched Gloat Hiring, enabling businesses to give candidates more access, visibility and control over career opportunities.6

- How. Gloat is setting up a global AI ethics committee and has joined the WEF Global Innovation Forum to advance the technology community’s AI governance. In 2022, Generation sponsored Gloat’s first carbon footprint.

Investment Detail

Year Invested

2021

WEKA

What It Does

WEKA offers a modern subscription software-based data platform delivering 10x+ performance and scale demanded by today’s cloud and AI workloads. As an infrastructure software company, founded in 2013, Weka sells a “data platform for AI and HPC (High Performance Computing).” WEKA’s platform acts as the software layer of data storage, which is hardware agnostic and delivers an entirely new architecture for large-scale unstructured data use cases (i.e., AI).

System Positive Thesis & Solution

The market for high-performance, AI-related computing workloads is large and quickly growing. Given advances in computing processes and networking, storage is increasingly the bottleneck for advanced workloads – storage innovation is needed to fully utilise expensive GPU resources. Weka is being chosen for the workloads of some of the world’s most sophisticated customers (autonomous vehicle companies, cutting-edge intelligent manufacturing, media giants), delivering 10x improvements in performance and exceptional ROI, while dramatically reducing customers' hardware footprint and energy use.

Impact Insights

- What. In 2022, Generation spearheaded WEKA’s first carbon avoided analysis, finding the platform avoided 88k tCO2e7. Moreover, initial modelling suggests a much more significant order of magnitude for potential carbon savings at scale, i.e., hundreds of thousands of tCO2e.8

- How. Generation is supporting the search for WEKA’s newest Board member to improve diversity and has indicated support for the creation and adoption of an ethical use policy during 2023. In early 2023, WEKA launched their Sustainable AI Initiative, promoting climate-positive investments and prompting conversations around the efficient and sustainable use of AI.

Investment Detail

Year Invested

2022

Data Partners for this Report

Click on the logos below to read more about the data partners for this report.

Environmental Capital Group

Environmental Capital Group (ECG) advises investors and companies on impact and ESG issues, with deep expertise in quantitative Life Cycle Assessments (LCA) of carbon, energy, pollution and resources across investment portfolios. Starting in 2007, ECG served as an environmental adviser to CalPERS’ Clean Energy and Technology Program, developing one of the largest programs of sustainability impact accounting and reporting in the world. Cliff Brown, Managing Director of ECG, has led this work for 14+ years, advising investors and companies on strategy and sustainability, including ESG issues.

Cliff has prepared the ESG assessment of our portfolio companies in accordance with best practices for ESG accounting and reporting. For the 2022 year, ECG performed the impact analysis for WEKA, including the Life Cycle Assessment compared to business-as-usual.

Emitwise

Emitwise’s AI technology empowers companies to automatically measure, report and reduce their carbon footprint across their operations and supply chain, future-proofing businesses for a net-zero carbon world. Based in London, Emitwise is a software solution enabling companies to automate their carbon accounting across business units and suppliers, liberating them from the burden of collecting and processing emissions data. The platform utilises artificial intelligence to precisely measure or estimate emissions in real-time, enabling businesses to identify and tackle carbon hotspots and devise a trackable roadmap to net-zero carbon. Used by companies internationally and across various sectors, the platform aligns businesses with global climate targets and reporting standards, helping them mitigate risks and accelerate their transition to net zero.

In 2022, Emitwise calculated greenhouse gas emission inventories for both companies.

Glossary of terms

Terms | Definitions |

API | Application programming interface |

Board gender diversity | Share of Board members self-defined as identifying as female and non-binary as of period end. |

Board independence | Non-executive board members defined as share of members of the Board who are not employed by the Company as of period end. |

BQ | Business Quality |

CDP | Carbon Disclosure Project |

CO2 | Carbon dioxide |

Carbon intensity | Aggregate tonnes of carbon dioxide (CO2 equivalent) per USD M revenue (not restricted to CO2, includes a basket of emissions). Intensity for prior years based on conversion to USD M based on May 2022 FX rates. |

CSR | Corporate Social Responsibility |

EDI | Equity, Diversity and Inclusion |

ESG | Environmental, Social, Governance |

GHG | Greenhouse Gas |

GIM | Generation Investment Management |

IFRS | International Financial Reporting Standards |

IGPCC | Intergovernmental Panel on Climate Change |

Impact domain | Organised into the categories of i) Planetary health ii) People health and iii) Financial inclusion, Impact domains to allow us to communicate the social and environmental outcome domains to which our portfolio companies contribute. |

IMP | Impact Management Project |

IP | Intellectual property |

ISSB | International Sustainability Standards Board |

Jobs provided | Employee count (FTE) as of period end. FTE is calculated by taking into account the number of hours worked in a full-time weekly schedule and the actual number of hours employees work. |

KPI | Key Performance Indicator: Impact as defined through GIM’s system positive analysis of the Portfolio Company. Metrics have been individually defined for each Portfolio Company to capture the contribution of the company’s product or service on the Sustainability objective, as well as overall Impact domain. |

LCA | Life Cycle Assessment |

Management | The following was provided to Portfolio Companies during data collection: As outlined in SASB E commerce sector guidance, which can be applied across industries for this topic, management includes executive/ senior level officials and managers as well as non-executive first/mid level officials and managers. For non-U.S. employees, the entity shall categorize the employees in a manner generally consistent with the definitions provided above, though in accordance with, and further facilitated by, any applicable local regulations, guidance, or generally accepted definitions. |

MQ | Management Quality |

NED | Non-Executive Director |

Other Staff | The following was provided to Portfolio Companies during data collection: All other employees includes those employees who are not classified as management or technical staff. For non-U.S. employees, the entity shall categorize the employees in a manner generally consistent with the definitions provided above, though in accordance with, and further facilitated by, any applicable local regulations, guidance, or generally accepted definitions. |

SASB | Sustainability Accounting Standards Board |

SBT | Science-based target |

SDG | Sustainable Development Goal |

SMB | Small and Medium-sized businesses |

TCFD | Task Force on Climate-related Financial Disclosures |

tCO2e | tonnes of carbon dioxide equivalent |

Technical Staff | The following was provided to Portfolio Companies during data collection: As outlined in SASB E commerce sector guidance, which can be applied across industries for this topic, Technical staff includes employees categorized in the 15-0000 group (Computer and Mathematical Occupations) or 17-0000 group (Architecture and Engineering Occupations) of the U.S. Bureau of Labor Statistics' 2018 Standard Occupational Classification System. For non-U.S. employees, the entity shall categorize the employees in a manner generally consistent with the definitions provided above, though in accordance with, and further facilitated by, any applicable local regulations, guidance, or generally accepted definitions. |

UN PRI | United Nations Principles for Responsible Investment |

UNEP FI | United Nations Environment Programme Finance Initiative |

UREG | People self-identified as belonging to an under-represented group (i.e. belonging to an ethnic minority within a given country’s context). Note, GIM has previously used "POC" in the position of UREG. |

Voluntary turnover | Turnover is defined as the number of FTEs (Full Time Equivalents) leaving the business, excluding those from M&A, over the course of the reporting period divided by the average number of FTEs in the previous year multiplied by 100 |

Disclosure Frameworks

Generation believes in the principle of integrated reporting on financial and sustainability activities, performance outcomes and risks. In certain cases, we also publish supplementary reporting to ensure our reporting meets specific regulatory or voluntary commitment requirements. A summary and links to these disclosures is below.

Task Force for Climate-related | Generation has made a commitment to use the TCFD’s recommended framework for disclosing its climate-related exposure each year. Our most recent TCFD report, covering 2021, was published in 2022. | |

Sustainable Finance Disclosure | Generation adheres to the European regulatory framework SFDR and discloses its sustainability risks, remuneration, consideration of Principal Adverse Impacts (PAIs) and the classification of its funds, in its fund offering documents and/or on its website, according to SFDR’s required practices. | |

UK Stewardship Code | Generation is pleased to have been accepted by the Financial Reporting Council as one of the initial signatories to the UK Stewardship Code last year. Generation’s Stewardship Report has just been submitted and is available publicly on our website under Our Strategies. |

Key Frameworks

|

|

|

|

|

|

|

|

Read the report in full

Download- We have been investing for 16 years as a Growth Equity team – beginning with our research ahead of the final close and launch of our first Climate Solutions Fund in 2008.

- Growth Equity team as at 31 December 2022, excluding individuals who are not 100% allocated to the Growth Equity team and long-term consultants.

- Jobs lost, jobs gained: Workforce transitions in a time of automation. (McKinsey & Company, Dec. 2017)

- The $8.5 Trillion Talent Shortage (kornferry.com). (Korn Ferrry, 2018)

- Data on impact over time comes directly from Gloat internally tracked metrics. Metrics were finalised in 2023 and provided for the year ended 31 December 2022. (Gloat, 2023). N.b. Unlocked hours are 54% cross departmental and 43% cross regional.

- How Gloat Hiring will enable a next-generation talent ecosystem. (Gloat, Nov. 2022)

- Data on impact over time comes from WEKA’s LCA conducted by ECG. For more information on ECG, please see Data Providers for this Report.

- Environmental Capital Group, Jan. 2023.

Important Information

The material contained in this document (the “Document”) has been prepared by Generation Investment Management LLP (“Generation”) for informational purposes only and reflects the views of Generation as at May 2023. It is not to be reproduced or copied or made available to others without the consent of Generation.

The Document is compiled in part from third party sources believed to be accurate, including the Fund’s investee companies themselves. Generation believes that such third party information is reliable, but does not guarantee its accuracy, timeliness, or completeness. It is subject to change without notice. The information should not be considered independent; it may be subject to error or omission and should not be relied upon.

Generation accepts no liability for loss arising from the use of this material. Any opinions expressed are our current opinions only. This Document is not meant as a general guide to investing. It is expressly not a source of any specific investment recommendations. It makes no implied or express recommendation concerning the manner in which any client's account should or would be handled. Under no circumstances is it to be considered as an offer to sell or a solicitation to buy any investment referred to in this Document. It is not investment research. Should you disregard this caution, you should further be aware that, in consequence, it does not take into account your individual circumstances nor your financial situation or needs. Securities can be volatile and entail risk and individual securities presented may not be suitable for you. You should not buy or sell a security without first consulting your financial advisor or considering whether it is appropriate for you and your respective portfolios.

Generation, its employees, partners, consultants, and/or their respective family members may directly or indirectly hold positions in the securities referenced.

Any statements of opinion or belief contained in this Document, all views expressed and all projections, forecasts or statements relating to expectations regarding future events or the possible future performance of any product in respect of which Generation or any affiliates provide management or advisory services (or any other product) are those of Generation and represent Generation's own assessment and interpretation of information available to it as at the date of this Document and are subject to change without notice. No representation or warranty is made, nor assurance given, that such statements, opinions, projections or forecasts are correct or that the objectives of Generation or any products in respect of which Generation or any of its affiliates provide management or advisory services (or any other products) will be achieved. No responsibility is accepted by Generation or any affiliates in respect thereof.

The Fund is a private and unregulated fund and is not registered for distribution to the public or for private placement in any jurisdiction. Specifically, the Fund is not and will not be registered under the Securities Act of 1933 or registered or qualified under any US state securities act. The Fund is not and will not be registered as an investment company under the Investment Company Act of 1940. No regulator has approved the units in the Fund or their distribution.

Nothing in this Document should be interpreted to state or imply that past results are an indication of future performance. There is no assurance that any securities included within this report will remain in the Fund portfolio.

This communication has been issued in the United Kingdom by Generation Investment Management LLP ("Generation IM"), which is authorised and regulated by the Financial Conduct Authority of the United Kingdom and is a limited liability partnership registered in England and Wales. Registered No: OC307600. ARBN: 116 045 526. It is not a financial promotion. Generation IM is the parent entity of Generation Investment Management US LLP ("Generation US"), an investment adviser registered with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser with the SEC does not imply a certain level of skill or training. Generation IM and Generation US may only transact business in any state, country, or province if they first are registered, or excluded or exempted from registration, under applicable laws of that state, country, or province. In particular, Generation IM does not conduct business in the United States and persons in the United States should engage with Generation US only. Generation IM and Generation US are collectively referred to above as “Generation”.

If you have any questions relating to this report, please contact Generation Client Service at Generation Investment Management LLP, 20 Air Street, London W1B 5AN. Email: [email protected] Tel: + 44 (0) 207 534 4700.