Introduction

While several companies within Sustainable Solutions Fund III are early in the journey of measurement and reporting, 2020 marked a significant step forward in disclosure and transparency.

We continue to work with our portfolio companies on capacity building to help them and their boards fully understand and embed the key sustainability metrics (or KPIs) that will drive long-term impact performance.

With this fund, we committed to a measurement of outcomes (i.e., the effects of outputs on an issue we aim to address) as opposed to outputs themselves (i.e., what a company’s activity produces). This applies across the three pillars of the fund Planetary Health, People Health and Financial Inclusion.

Additionally, last year Generation was a founding signatory of the Net Zero Asset Managers initiative (NZAM) and committed to align its investment portfolios with net zero emissions by 2040.

This year proved to be a seminal year in terms of mainstream recognition of the relevance of sustainability topics such as the pandemic, the Black Lives Matter movement and the climate crisis to investment analysis. While many pockets of the economy faced headwinds, we saw tailwinds from an increased and urgent demand for solutions businesses addressing these and other sustainability challenges.

1. See our contribution to the SASB Report, Integrating ESG Holistically in Private Equity: A Strategic Approach.

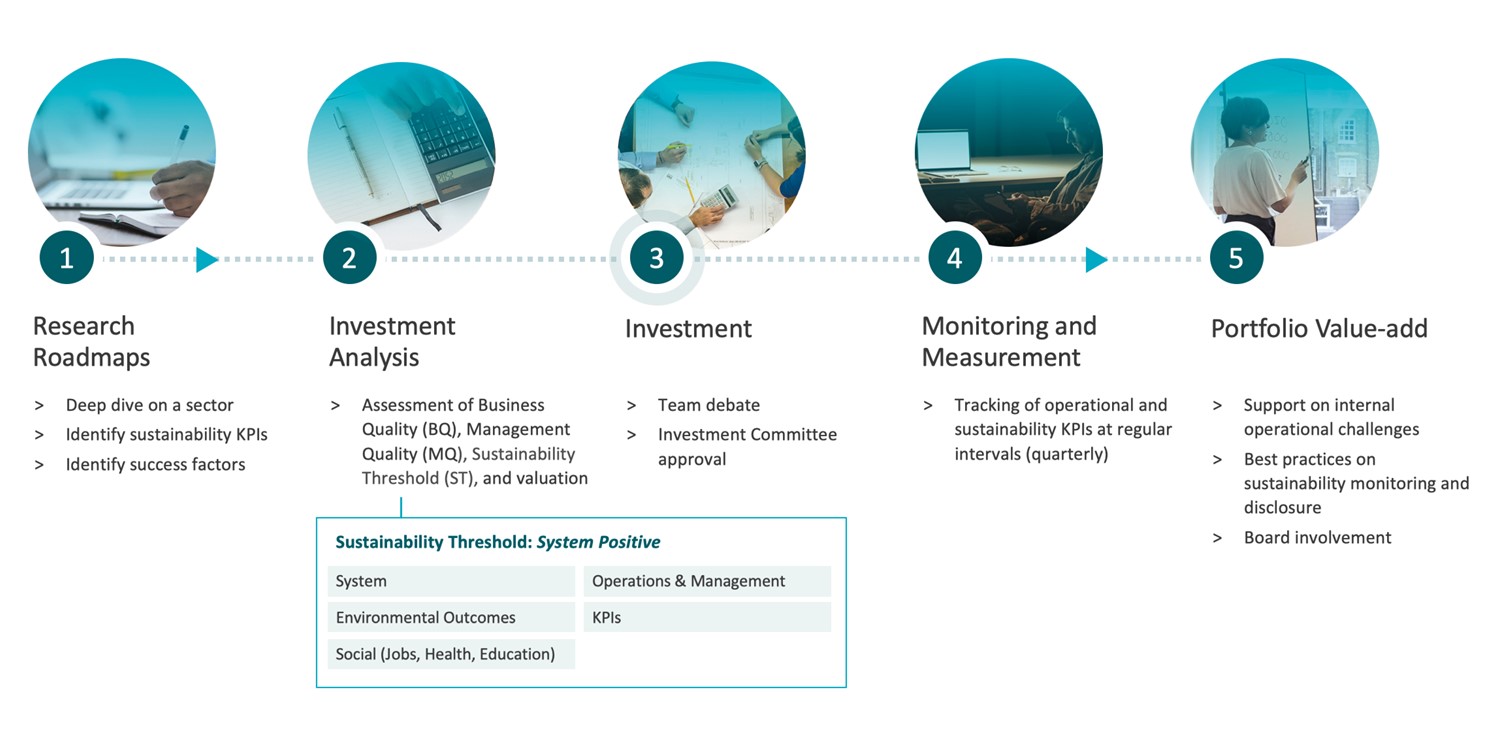

OUR SUSTAINABILITY & IMPACT FRAMEWORK IN GROWTH EQUITY

Our System Positive approach means that we review how sustainability factors drive value across industries within our research roadmap process.

This research helps us identify the companies that we believe will drive the transition to a more sustainable future, and how our portfolio specifically contributes to the Sustainable Development Goals (SDGs).

In this year’s report, we provide colour with real case studies, in some instances powered by customer surveys, to benchmark how each company is improving outcomes for its stakeholders. We share this data through the Impact Management Project (IMP) five dimensions analysis.

In addition, we chose SASB’s framework as our broad approach to ESG disclosure. Its sector-based method focuses on materiality and financial impact, and the wide uptake amongst public companies makes it an aspirational standard for our private companies. We have also incorporated further elements on topics like the living wage and pay gap analysis.

IMPACT IN OUR PROCESS

Our process and team-based approach are key to the success of our fund, both in terms of impact and financial returns. There is no separate ESG or impact measurement team at Generation. We are all responsible for the alignment of our investments with a sustainable world view.

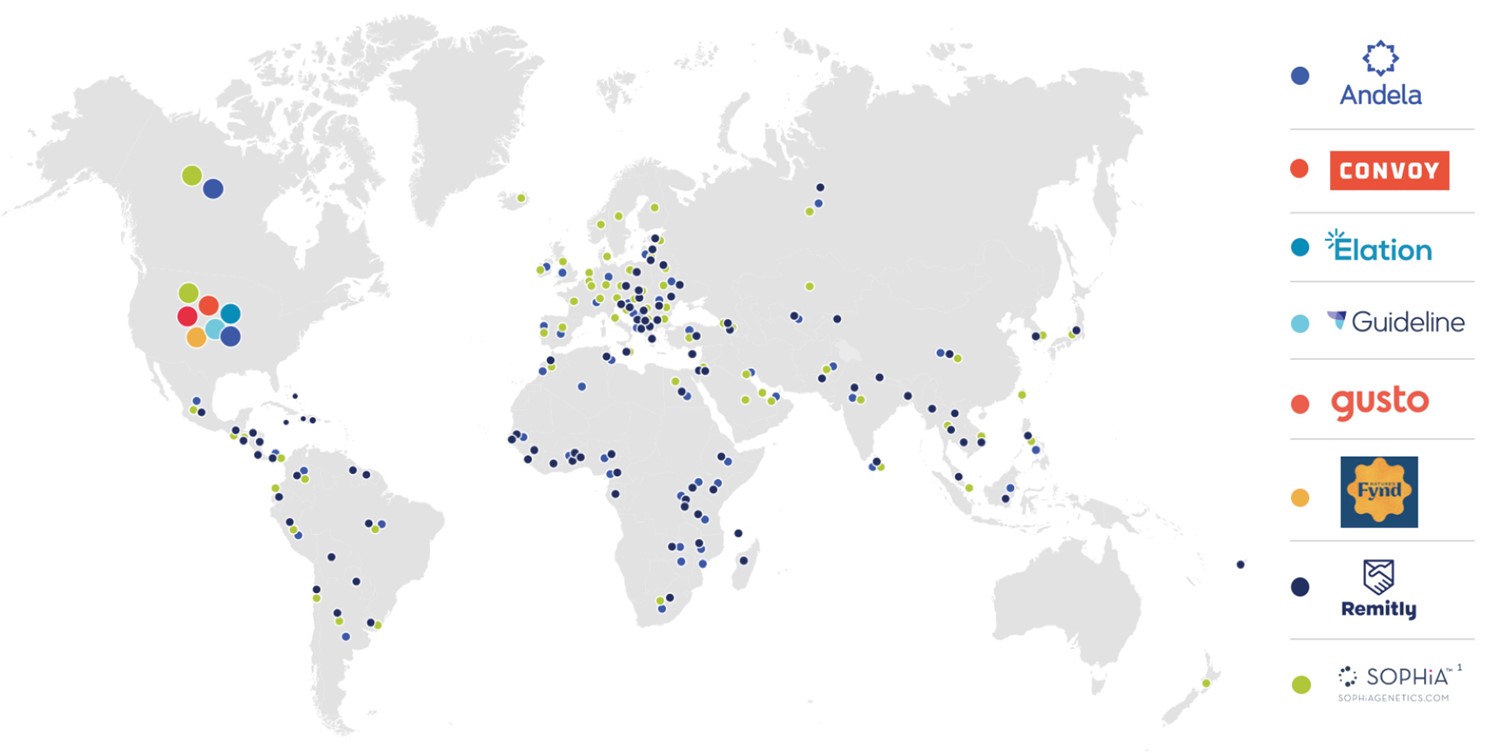

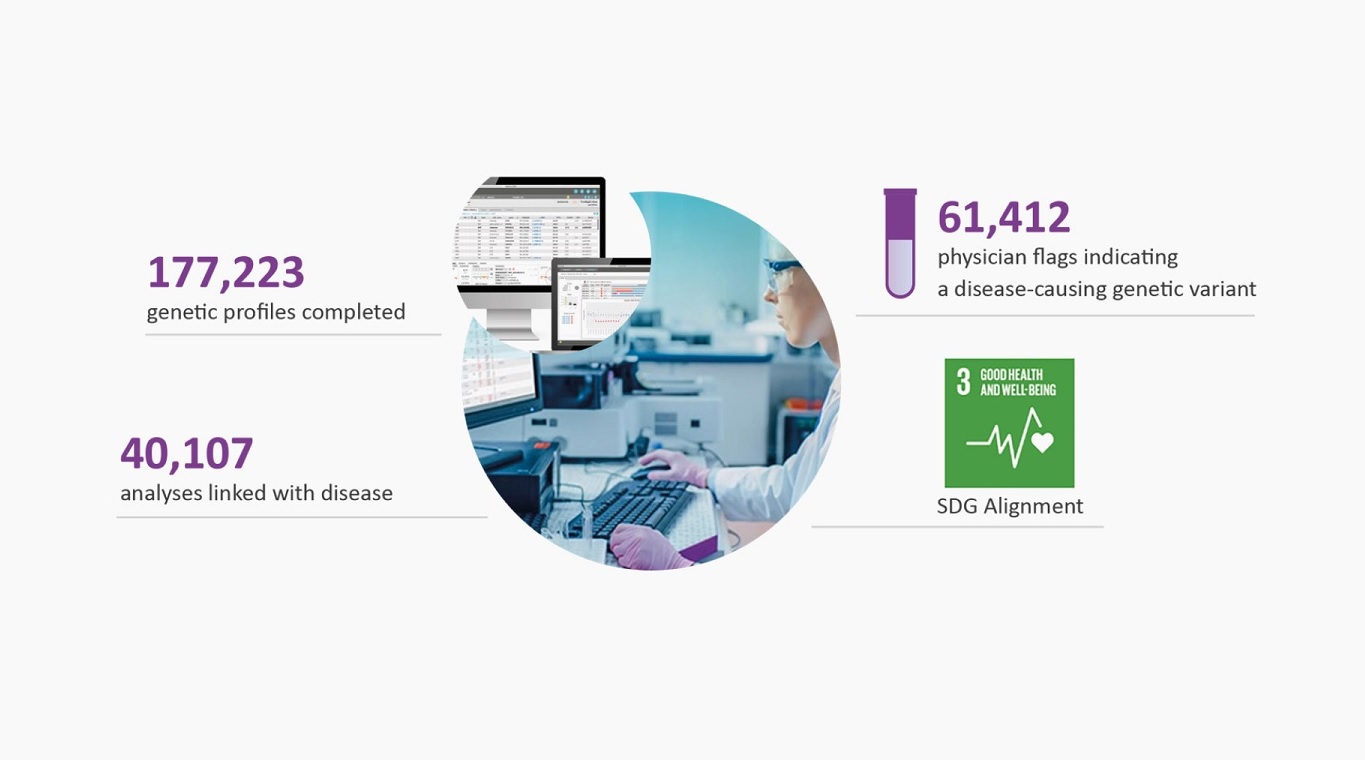

1. For Sophia Genetics, we have included countries where at least ten patients' genomic profiles were completed in 2020.

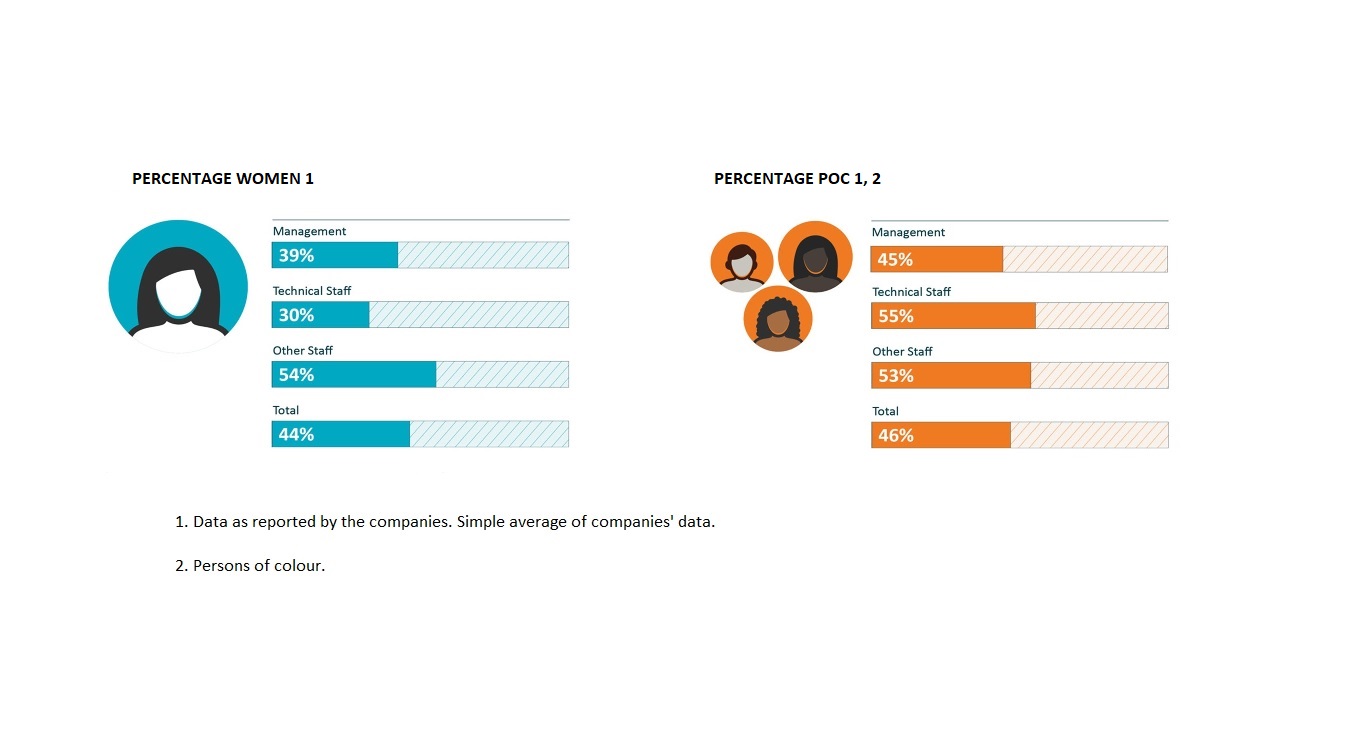

IN FOCUS: DIVERSITY, EQUITY AND INCLUSION (DEI)

Engagement: 2020 served as a turning point that highlighted the acute need for greater progress across diversity and inclusion initiatives at all levels of the financial sector. In particular, the disproportionate impact of COVID-19 on ethnic minority communities and the Black Lives Matter movement provided catalysts for further action. While we still have work to do, we already engage with all current companies on this topic, as well as continue to request measurement and reporting on the diversity of teams, management and boards.

Metrics: At the portfolio level we saw good workforce diversity by both gender and ethnicity, broadly in line with last year, and improving disclosure, although more work remains to be done at the board level. Moreover, five out of eight companies regularly review pay equity and four have clear DEI frameworks and plans in place.

IN FOCUS: ENVIRONMENTAL FOOTPRINTING

Engagement: This year, we have chosen to make comprehensive evaluations of emissions at every company in the SSF III portfolio, using a software solution from Emitwise that supports the automation of full carbon accounting. This enabled the establishment of a baseline year for GHG emissions, against which companies may choose to set reduction targets and take action according to areas identified as material. Additionally, this year our portfolio avoided the emission of 730 tCO2e1.

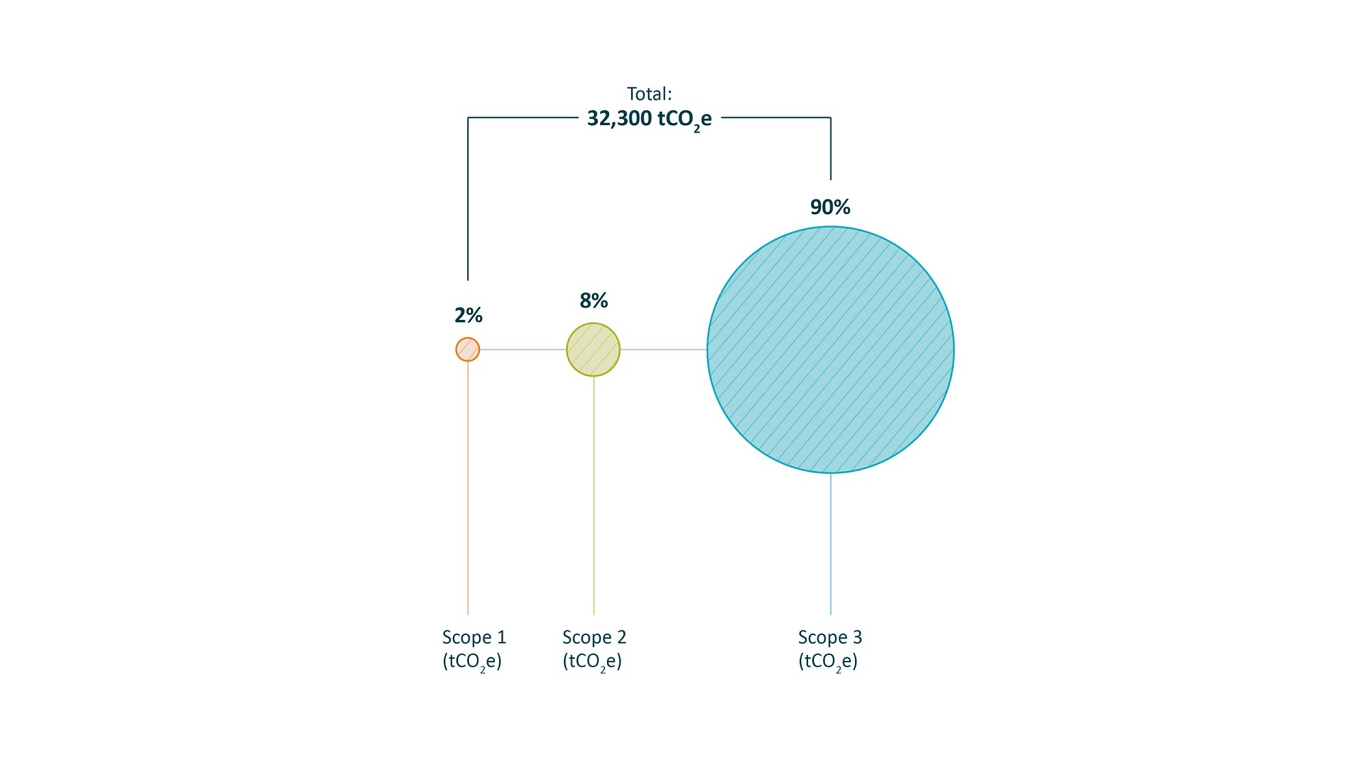

Metrics: The analysis indicates that the portfolio as a whole emitted 32,300 tonnes of carbon dioxide equivalents (tCO2e) in the year.

- While Scope 1 + Scope 2 made up 10% of this, the largest contribution was from Scope 3, accounting for 90% of portfolio emissions1. This is to be expected, given the lean internal operations of the companies, which are mainly composed of their offices.

- Purchased electricity emissions (Scope 2) were split as: 48% renewables, 42% fossil, 10% nuclear.

- Out of Scope 3 emissions, two thirds were derived from purchased goods and services2. Of these, over 30% were from professional services, and another 30% from IT & Communications services.

1. Please refer to the methodology in the Appendix for a definition of Scopes.

2. Estimated based on industrial activity of spend data - please refer to the methodology in the Appendix.

IMPACT OVERVIEW IN 2020

Case studies

PLANETARY HEALTH

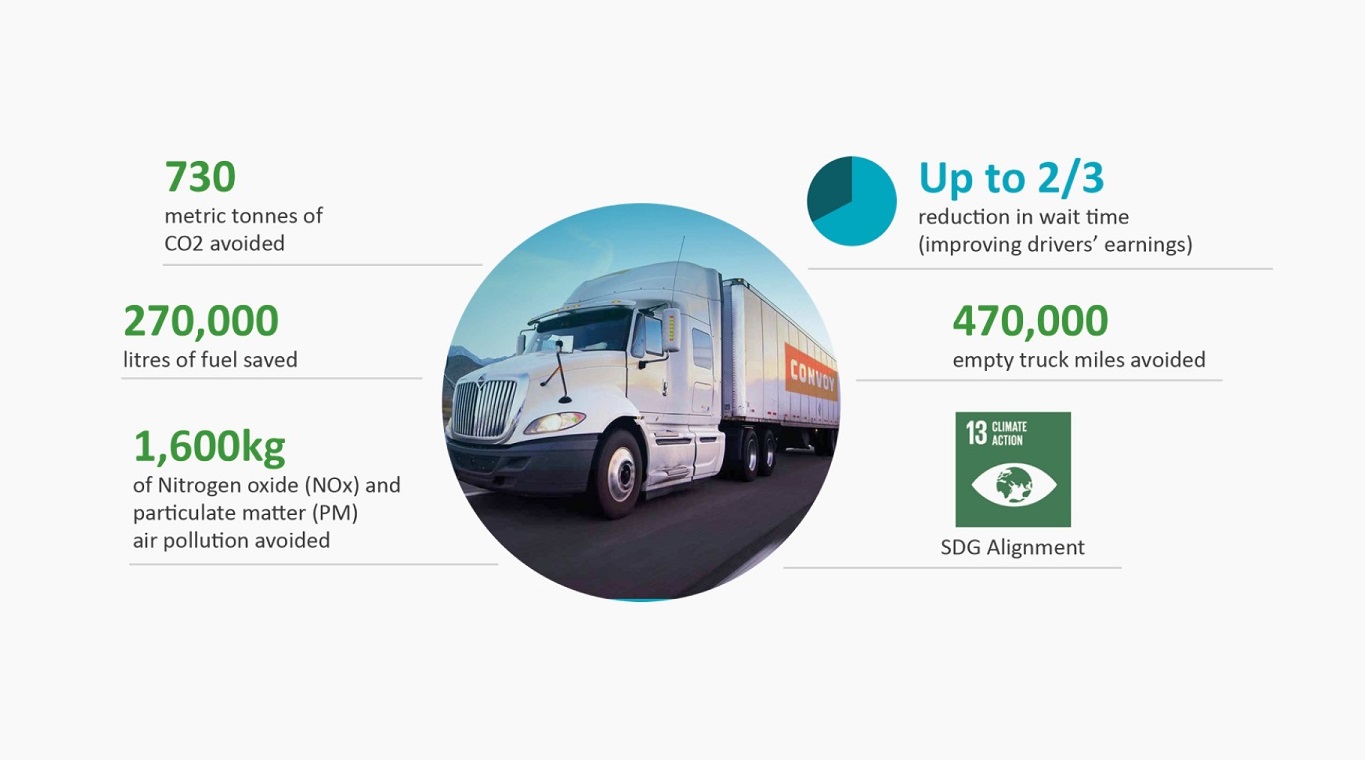

CASE STUDY I: CONVOY

Convoy is a digital freight network that connects shippers and carriers to move thousands of truckloads each day, saving money for shippers, increasing earnings and reducing hassle for carriers, and reducing carbon waste for the planet. Truck freight accounts for 7% of all US greenhouse gas (GHG) emissions, (i.e., 436.5 million tons CO2e). Of this, 49% are booked as full truckloads, of which ~30-35% are empty miles, leading to 72 million tonnes of CO2e in avoidable emissions from this segment alone1.

IMPACT

CLIMATE CHANGE MITIGATION:

By improving trucking utilisation, we believe that Convoy can deliver higher earnings for carriers, lower shipping costs and reduce empty miles driven and carbon emissions.

Data Source: LCA carried out by ECG.

PEOPLE HEALTH

CASE STUDY II: SOPHIA GENETICS

SOPHiA GENETICS is a healthcare technology company dedicated to establishing the practice of data-driven medicine as the standard of care and for life sciences research. It is the creator of the SOPHiA DDM™ Platform, a cloud-based SaaS platform capable of analysing data and generating insights from complex multimodal data sets and different diagnostic modalities. The SOPHiA DDM™ Platform and related solutions, products and services are currently used by more than 750 hospital, laboratory and biopharma institutions globally.

IMPACT

IMPROVED HEALTH OUTCOMES:

Timely and accurate interpretation of genetic data allows for more customised and targeted diagnostics and treatment, driving more efficiency and better patient outcomes.

Source: Company data and Generation analysis.

FINANCIAL INCLUSION

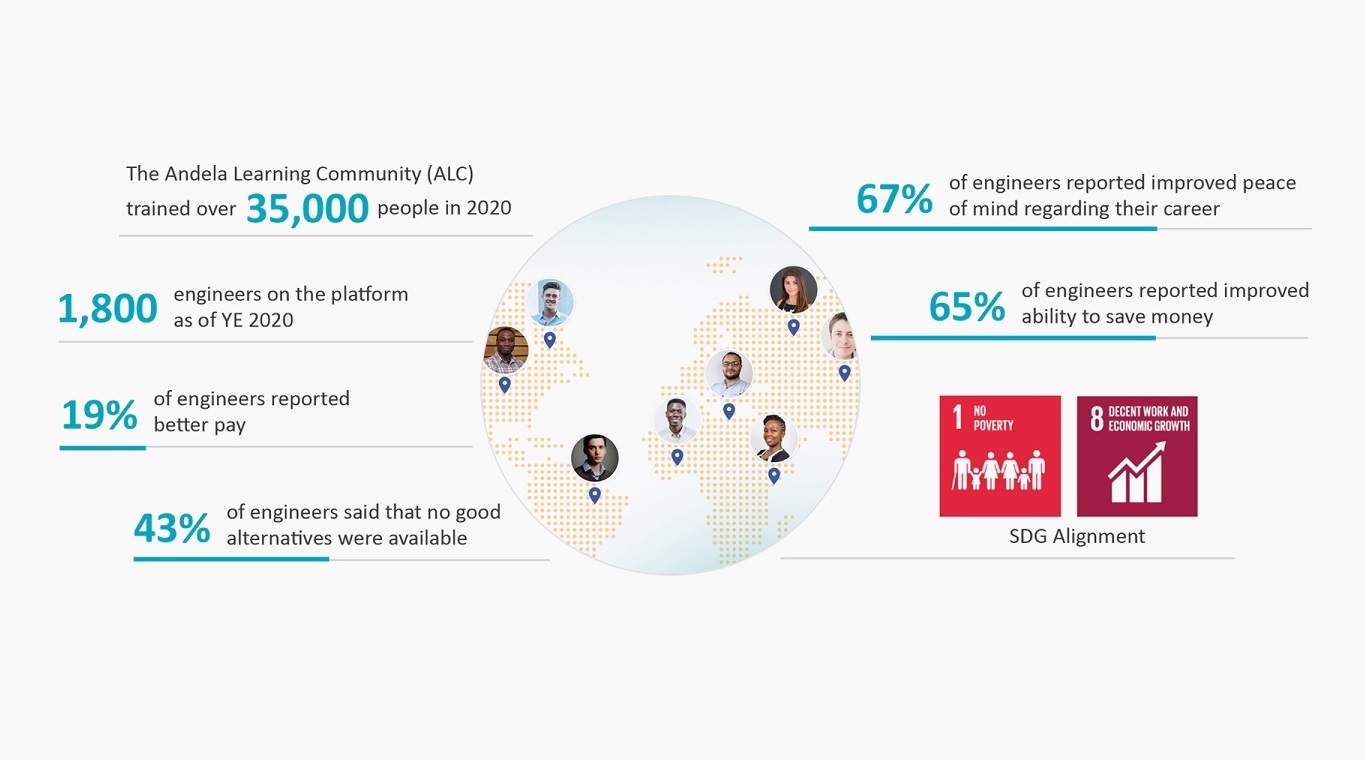

CASE STUDY III: ANDELA

Andela helps global companies to overcome technical talent shortages by building distributed engineering teams. Andela started on the African continent and is rapidly growing to where the network of talent on the Andela platform now spans five continents and over eighty countries. The continent of Africa is facing the challenge of creating nearly 12 million additional jobs to contain unemployment, according to the latest figures from the African Development Bank, which estimates the number of unemployed work-age young people on the continent at nearly 60% as of 20191.

IMPACT

ACCESS TO OPPORTUNITIES & EARNINGS POTENTIAL:

We believe Andela can help to transform the earning potential of thousands of people who see material salary increases when placed by the company.

Source: Survey of company engineers carried out by 60 Decibels.

FINANCIAL INCLUSION

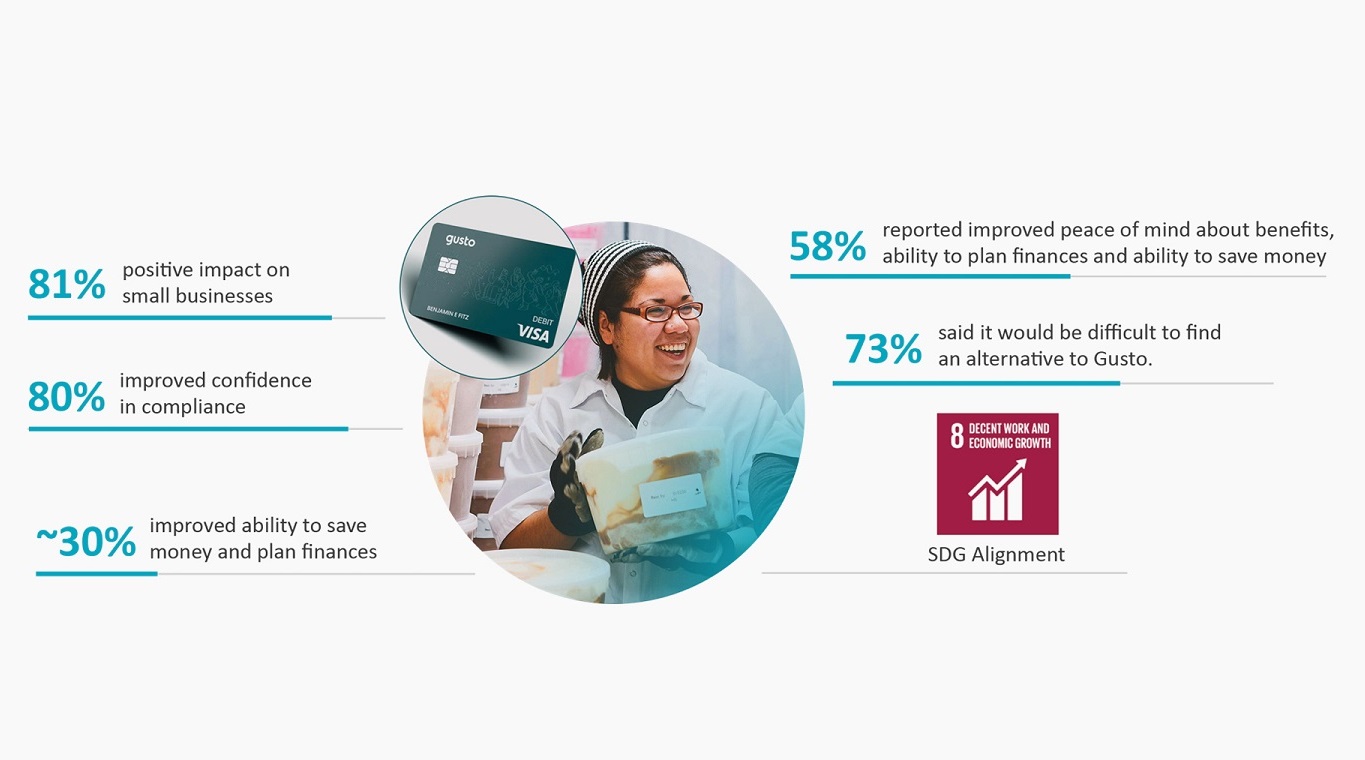

CASE STUDY IV: GUSTO

Gusto is a software platform designed to automate and simplify payroll, HR and benefits for micro, small and medium-sized business (SMBs). Gusto has created an easy-to-adopt, self-service software platform that can reliably address this segment. Gusto makes payroll, HR and benefits provision easier and more accessible for small businesses. Serving about 100,000 small businesses across the US, Gusto enables small business owners to be more productive and to increase benefits access to their employees.

IMPACT

EQUALITY OF ACCESS & EFFICIENCY:

Today across America the benefits gap continues to rise. Between 2009 and 2018, workers in the bottom tenth percentile of wages saw benefits fall by around 2% in real terms1. While most providers have focused on larger companies, Gusto’s Software as a Service (SaaS)-based solution targets smaller businesses, many of which are otherwise doing payroll by traditional time-consuming and error-prone methods.

Source: Survey of 244 Gusto’s customers (plan holders) and 115 members carried out by 60 Decibels.

FINANCIAL INCLUSION

CASE STUDY V: REMITLY

Remitly is a digital money transfer company that focuses on enabling fast and low-cost remittances from developed to developing countries. Remitly's digital platform makes remittances cheaper, faster and more transparent for migrant workers worldwide to support the living costs of their families back home. Globally, there are over 280 million migrant workers who send over USD 702 billion in remittances1.

IMPACT

EQUALITY OF ACCESS & EFFICIENCY:

Remittances provide a critical source of income for families of migrant workers but the process of transferring money is still very inefficient and costly. The convenience of digital providers translates into savings for migrants sending money, and more income in the hands of their families. Digital providers like Remitly increase the efficiency and decrease the cost of sending money, which helps to increase net remittance amounts for recipients.

Source: 2019 survey of 539 remittance senders and 270 remittance receivers, carried out by 60 Decibels. Due to the comprehensive data gathered last year, we have not run a new survey for this year’s report.

PLANETARY HEALTH

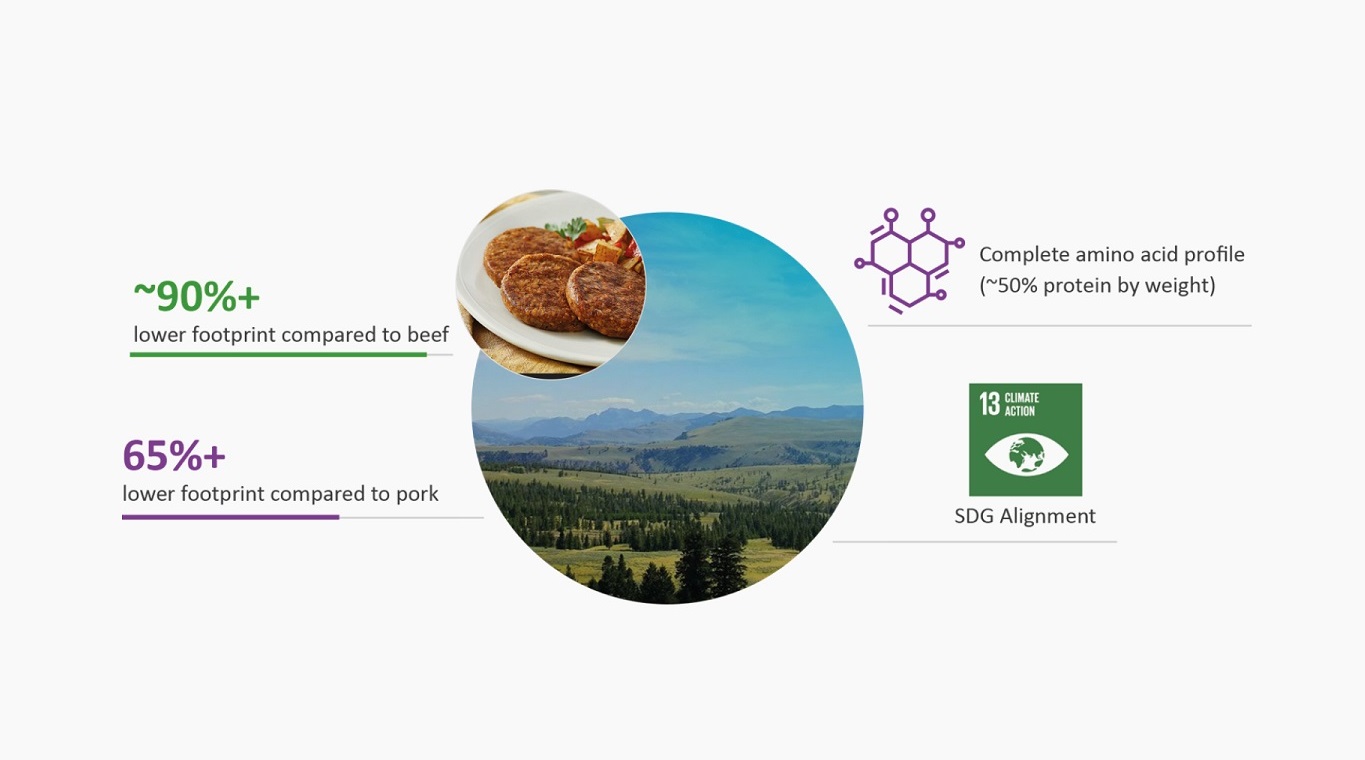

CASE STUDY VI: NATURE'S FYND

Nature’s Fynd is a Chicago-based food tech company creating versatile alternative proteins to nourish the world’s growing population while nurturing the planet. Born out of research conducted for NASA on microbes in Yellowstone National Park, the company’s breakthrough technology produces Fy™. Nature’s Fynd uses Fy to make nutritious and sustainable meat and dairy alternatives.

IMPACT

CLIMATE MITIGATION:

The food supply chain is responsible for 1/4 of global GHG emissions, which must be addressed to reach net zero targets. The food supply chain creates 13.7 billion metric tons of CO2e – 26% of global GHG emissions. Furthermore, agriculture covers 43% of the world’s usable land (ice- and desert-free) and causes 80% of land-use change and habitat destruction. Lastly, 2/3 of fresh water withdrawals are for agricultural irrigation, which is most prevalent in the places and times that water is scarce, driving 90-95% of global, scarcity-weighted water use1. Nature’s Fynd’s technology relies on a fraction of the resources required by traditional agriculture and with minimal processing to create a nutritious and versatile alternative protein source.

Source: Comparative lifecycle assessment (LCA) from cradle to factory gate. Nature’s Fynd’s estimates use modelled production data that may differ from actual operations.

FINANCIAL INCLUSION

CASE STUDY VII: GUIDELINE

Guideline is an all-inclusive, low-cost 401(k) provider to over 21,000 small businesses. The company has built an in-house technology solution that automates record-keeping and administration and allows employers to seamlessly onboard employees (through auto-enrolment) while ensuring plan and regulatory compliance. Guideline’s increasing size (USD 4.5 billion in AUM) has further permitted it to increase leverage with index funds and collectively bargain on behalf of small businesses to further drive down costs. Lastly, Guideline leverages integrations with payroll and other channel providers to deliver its go-to-market strategy.

IMPACT

EQUALITY OF ACCESS & EFFICIENCY:

There are 5.8 million small businesses in the US; only 10% offer a 401(k) plan to their employees, and when they do, historic participation is around 52%. We assert that there are two key reasons why 401(k) penetration has been low amongst SMBs. The first is price: current plans offered by incumbents are too expensive. They charge high administrative fees and are resource-intensive for SMBs; equally, AUM pricing is complex and opaque. The second is simplicity: traditional plans tend to be cumbersome to implement. Guideline’s focus on small businesses is helping to close the retirement savings gap.

Source: Survey of 300 Guideline participants conducted by 60 Decibels.

PEOPLE HEALTH

CASE STUDY VIII: ELATION HEALTH

Elation Health is a healthcare technology company powering the future of independent primary care. The company works with 14,000 independent clinicians serving more than seven million patients across the United States. Elation’s application programming interfaces (APIs) and data exchange tools enable organisations to transform the patient and provider experience and implement their own outcomes-based models of data-driven, value-based care (VBC).

IMPACT

IMPROVED HEALTH OUTCOMES & EFFICIENCY:

In the US, primary care is an underinvested part of the healthcare system. Salaries and reimbursement rates are lower than specialty care, constraining the supply of physicians. The incumbent software tools for primary care physicians are poor quality, many of them not cloud-hosted or API-enabled, with poor user experience. Elation enables organisations to transform the patient and provider experience and implement outcomes-based models of data-driven, value-based care.

More data to come in 2021. Due to our recent investment in Elation, we are still working closely with the company to track outcomes and aim to report them in the next reporting cycle.

CONCLUSION

In this year’s report we deepened our work on carbon measurement and reporting to achieve initial baseline data on Scope 1, 2 and 3 emissions across the portfolio. This work is part of our engagement on the Task Force for Climate-Related Financial Disclosures (TCFD). Finally, we engaged all our companies on their DEI initiatives and aggregated diversity metrics, where possible, at the board, management and employee level.

While there is still plenty of work to do, we are most proud that our portfolio companies are working with their Boards and broader stakeholders to best define how sustainability drives not only what their company does but also how their company operates.

Looking back, 2020 affirmed the view that planetary health, people health and financial inclusion are critically connected areas, aligned with not only the SDGs but also growth markets that can – and must – bend us towards a net zero, prosperous, healthy, safe and inclusive future economy. The System Positive lens that Generation has refined through roadmap research and over a decade of network development is more relevant than ever.

REFERENCES

Throughout this report, we refer to a number of frameworks and standards that we have used. Please find below further information on them.

The Sustainable Development Goals or Global Goals are a collection of 17 interlinked global goals designed to be a "blueprint to achieve a better and more sustainable future for all".

www.un.org/sustainabledevelopment/sustainable-development-goals/

The Impact Management Project, a collaborative effort of more than 1,000 global stakeholders, has agreed on a set of shared fundamentals for communicating, measuring and managing impact.

www.impactmanagementproject.com/

The Financial Stability Board established the TCFD to develop recommendations for more effective climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions.

SASB standards enable businesses to identify, manage and communicate financially material sustainability information to their investors.

See our contribution to the SASB Report, Integrating ESG Holistically in Private Equity: A Strategic Approach.

ENVIRONMENTAL FOOTPRINTING – SUMMARY METHODOLOGY

SSF III has partnered with Emitwise to capture greenhouse gas (GHG) emissions across the portfolio. Greenhouse gas emissions were calculated using a combination of activity data and emission factors.* Activity data is a quantitative measure of human activity that results in a GHG emission, either directly or indirectly, such as the combustion of diesel in company cars, or purchase of goods. An emission factor is a coefficient relating activity data with the corresponding GHG emission expressed in metric tonnes of carbon dioxide equivalent (tCO2e), a universally applied unit for measuring GHG emissions.

A GHG emissions source is any activity that releases a GHG into the atmosphere. Companies may release GHG emissions either directly through their activities or indirectly as a consequence of the activities of the company at sources not controlled by the company. The Greenhouse Gas Protocol distinguishes between direct and indirect emissions by separating emissions into three ‘Scopes’:

- Scope 1 emissions are direct emissions from sources that are owned or controlled by the company. These include (non-exclusively) the combustion of fuels in company-owned vehicles, the combustion of fuels in stationary devices, such as electricity generators and boilers, and accidental emissions from heating, ventilation, and air conditioning (HVAC) units.

- Scope 2 emissions are indirect emissions from the generation of purchased electricity, heat, and steam that is consumed in activities owned or controlled by the company.

- Scope 3 emissions are indirect emissions that occur as a consequence of the activities of the company, but that occur from sources not owned or controlled by the company. Scope 3 emissions may occur upstream, related to purchased goods and services, or downstream, related to sold or disposed of goods and/or services (downstream emissions were not calculated for this report). Scope 3 emissions are further separated into 15 distinct reporting categories. For most categories, Scope 3 emissions were estimated based on the ‘spend-based’ method of the GHG Protocol, which comprised the classification of spend account categories by industrial activity. Category 7 and 8 were instead estimated using the ‘average-data’ method of the GHG Protocol. Only upstream Scope 3 emissions were included in this analysis, due to higher materiality and data availability. As such, emissions linked to the use of products sold by our companies, and end-of-life emissions, were not included in this analysis.

Note: Our data partners for this report were 60 Decibels, Emitwise, and Environmental Capital Group.

IMPORTANT INFORMATION

The material contained in this document (the “Document”) has been prepared by Generation Investment Management LLP (“Generation”) for informational purposes only and reflects the views of Generation as at July 2021. It is not to be reproduced or copied or made available to others without the consent of Generation.

The Document is compiled in part from third party sources believed to be accurate, including the Fund’s investee companies themselves. Generation believes that such third party information is reliable, but does not guarantee its accuracy, timeliness, or completeness. It is subject to change without notice. The information should not be considered independent; it may be subject to error or omission and should not be relied upon.

Generation accepts no liability for loss arising from the use of this material. Any opinions expressed are our current opinions only. This Document is not meant as a general guide to investing. It is expressly not a source of any specific investment recommendations. It makes no implied or express recommendation concerning the manner in which any client's account should or would be handled. Under no circumstances is it to be considered as an offer to sell or a solicitation to buy any investment referred to in this Document. It is not investment research. Should you disregard this caution, you should further be aware that, in consequence, it does not take into account your individual circumstances nor your financial situation or needs. Securities can be volatile and entail risk and individual securities presented may not be suitable for you. You should not buy or sell a security without first consulting your financial advisor or considering whether it is appropriate for you and your respective portfolios.

Generation, its employees, partners, consultants, and/or their respective family members may directly or indirectly hold positions in the securities referenced.

Any statements of opinion or belief contained in this Document, all views expressed and all projections, forecasts or statements relating to expectations regarding future events or the possible future performance of any product in respect of which Generation or any affiliates provide management or advisory services (or any other product) are those of Generation and represent Generation's own assessment and interpretation of information available to it as at the date of this Document and are subject to change without notice. No representation or warranty is made, nor assurance given, that such statements, opinions, projections or forecasts are correct or that the objectives of Generation or any products in respect of which Generation or any of its affiliates provide management or advisory services (or any other products) will be achieved. No responsibility is accepted by Generation or any affiliates in respect thereof.

The Fund is a private and unregulated fund and is not registered for distribution to the public or for private placement in any jurisdiction. Specifically, the Fund is not and will not be registered under the Securities Act of 1933 or registered or qualified under any US state securities act. The Fund is not and will not be registered as an investment company under the Investment Company Act of 1940. No regulator has approved the units in the Fund or their distribution.

Nothing in this Document should be interpreted to state or imply that past results are an indication of future performance. There is no assurance that any securities included within this report will remain in the Fund portfolio.

This communication has been issued in the United Kingdom by Generation Investment Management LLP ("Generation IM"), which is authorised and regulated by the Financial Conduct Authority of the United Kingdom and is a limited liability partnership registered in England and Wales. Registered No: OC307600. ARBN: 116 045 526. It is not a financial promotion. Generation IM is the parent entity of Generation Investment Management US LLP ("Generation US"), an investment adviser registered with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser with the SEC does not imply a certain level of skill or training. Generation IM and Generation US may only transact business in any state, country, or province if they first are registered, or excluded or exempted from registration, under applicable laws of that state, country, or province. In particular, Generation IM does not conduct business in the United States and persons in the United States should engage with Generation US only. Generation IM and Generation US are collectively referred to above as “Generation”.

If you have any questions relating to this report, please contact Generation Client Service at Generation Investment Management LLP, 20 Air Street, London W1B 5AN. Email: [email protected] Tel: + 44 (0) 207 534 4700.