06 MAY 2020

- Now, more than ever, in this time of market uncertainty our sustainability discipline serves as our True North. It isn’t just part of what we do, it is the backbone of everything we do. As the global pandemic and economic impact unfolds, we are doubling down to support our current portfolio companies, and serving as vocal advocates for sustainability as the dominant organising construct we will need as we emerge from this crisis.

- This report looks back at 2019, which we think was a year when sustainability research and environmental, social and governance (ESG) analysis were becoming key market drivers in investing. Asset owners and managers across the board were making commitments to initiatives like the Sustainable Development Goals. We know there will be headwinds for this progress in 2020, but equally perhaps, some tailwinds. We are excited to further demonstrate that the Sustainable Solutions Fund III can play an important role in accelerating the transition to a sustainable economy.

- As our Chairman, former Vice President Al Gore, has said, “We believe we are in the early stages of a technology driven Sustainability Revolution – one that will have the magnitude of the industrial revolution and the speed of the digital revolution.”

INTRODUCTION

This is a summary of the first Sustainability Report for the Sustainable Solutions Fund III, which we closed in 2019 with just over $1 billion of committed capital, the largest of our Growth Equity funds yet.

We are reporting on a full year of outcomes from the five companies we held in the portfolio as at 31 December 2019.

With this fund we have committed to a measurement o outcomes (i.e., the effects of outputs on an issue we aim to address), as opposed to outputs themselves (i.e., what a company’s activity produces).

IMPACT IN GROWTH EQUITY

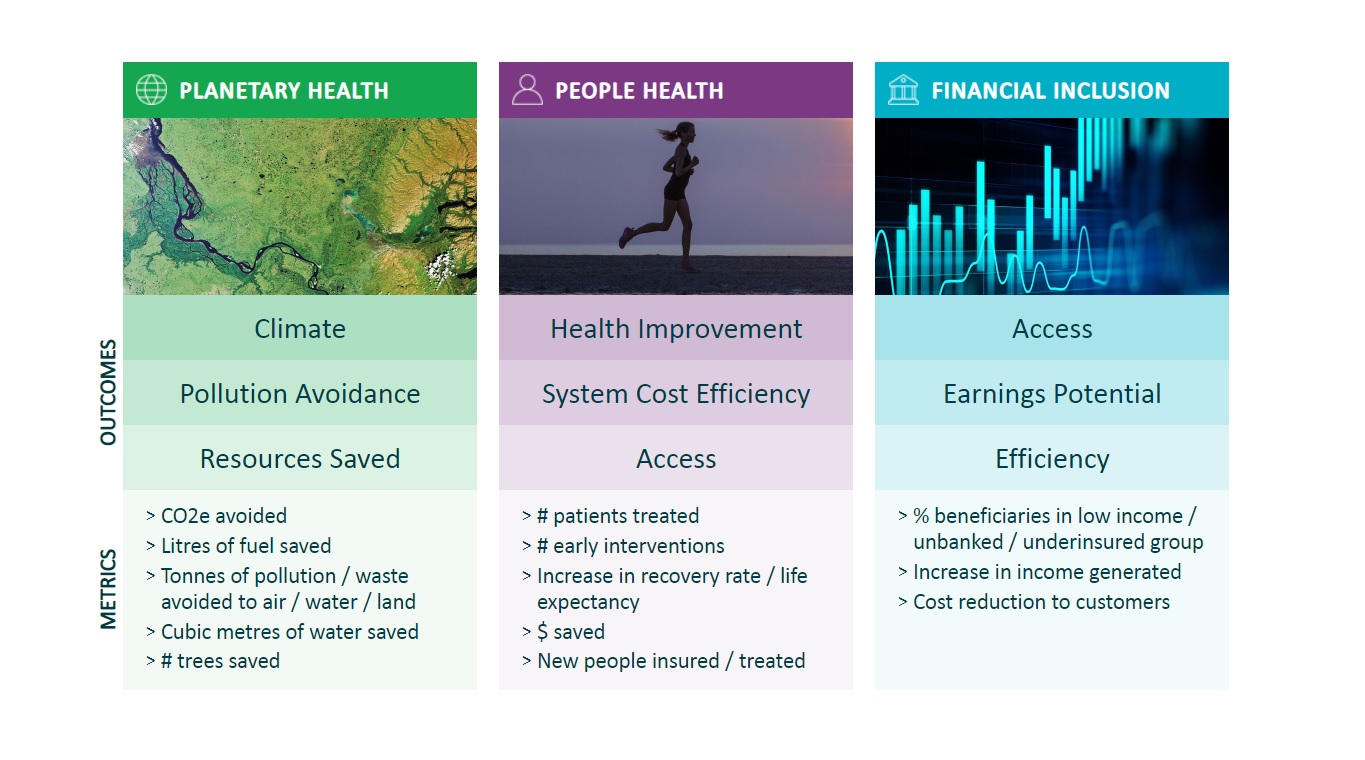

We are taking a rigorous approach to aligning clear metrics to each impact area, as opposed to looking for a unique indicator that summarises all.

Whereas with environmental externalities it is possible to calculate financial value, we do not believe it is productive, nor appropriate, to assign an equivalent monetary value to health outcomes or alleviation of poverty, in order to force a cross-category comparison.

These are all worthy goals, and their quantitative validation should be supported by a story that explains how impact is attained.

Our aim is to measure and report on outcomes of our portfolio companies. Due to data collection difficulties, at times we had to revert to outputs.

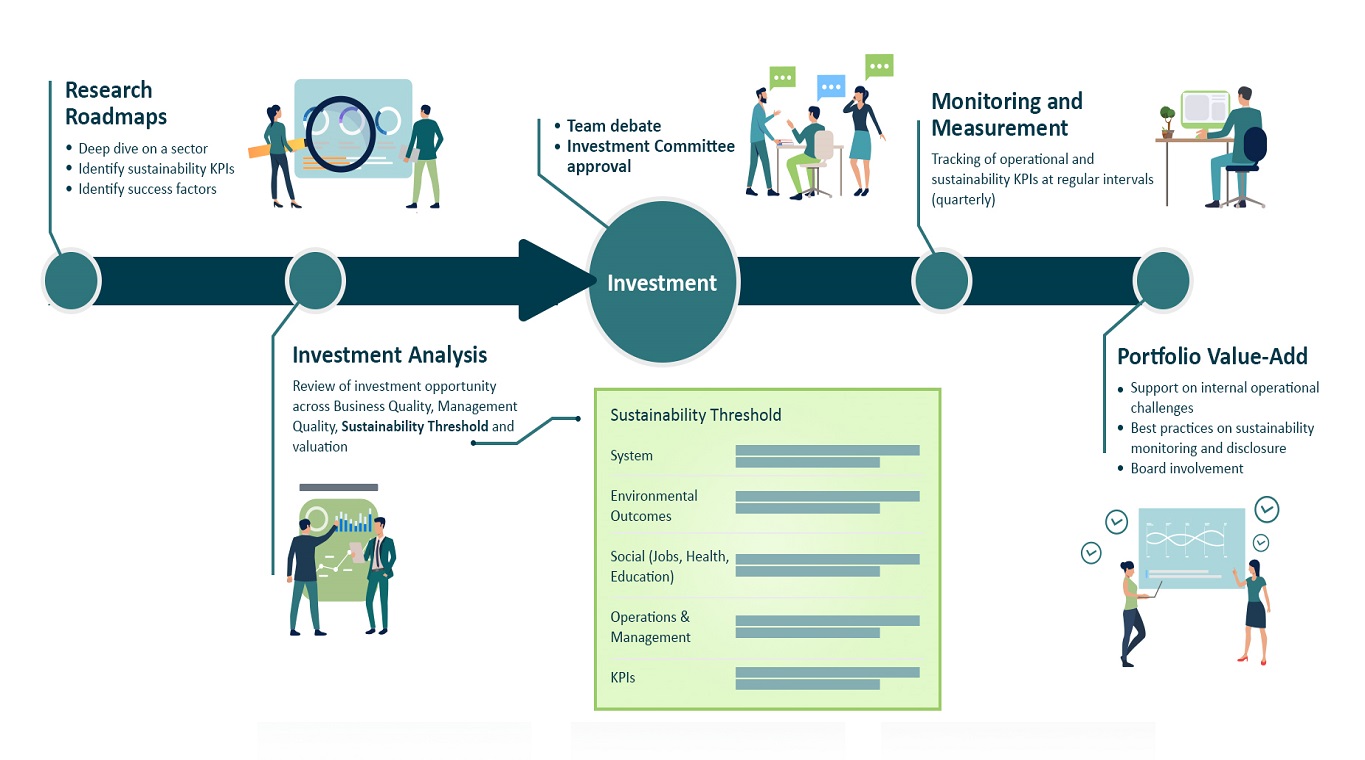

IMPACT IN OUR PROCESS

Our process and team-based approach are key to the success of our fund, both in terms of impact and financial returns. There is no separate ESG or impact measurement team at Generation. We are all responsible for the alignment of our investments with a sustainable world view.

SNAPSHOT OF OUTCOMES

We are proud to be able to report measurable outcomes for most of our companies (and outputs in a minority of cases) across the three areas of impact that we set out to address.

Planetary Health outcomes are calculated via a Lifecycle Assessment (LCA) and they are the most straightforward to quantify;

For Financial Inclusion, we found customer surveys to be a useful tool to effectively quantify outcomes (reliability is subject to amount and quality of data collected);

People Health outcomes are the hardest to estimate, requiring long history and high volumes of data for academic research to prove causality. We have therefore limited our reporting to outputs in this case.

As our companies scale, we expect outcomes to continue to grow in tandem.

IN DETAIL

Measuring impact in 2019

PLANETARY HEALTH

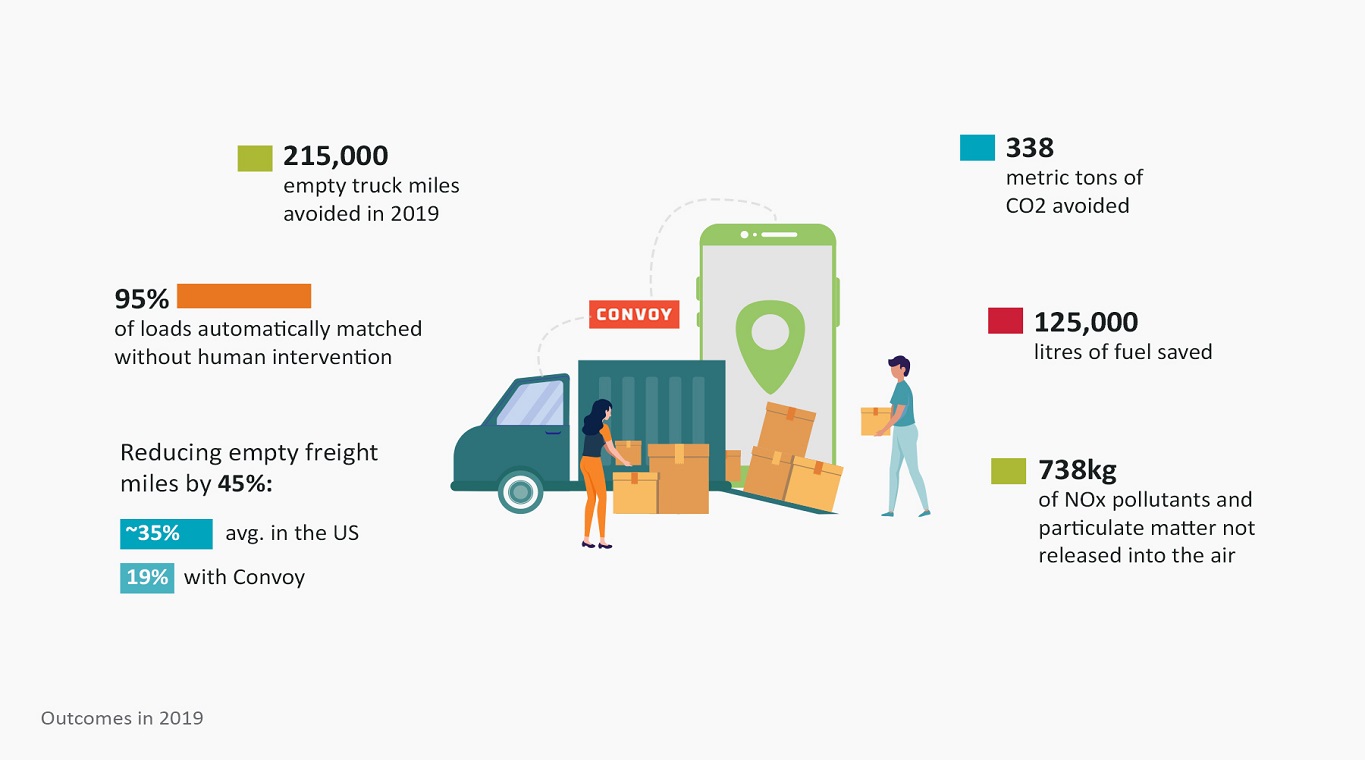

CASE STUDY I: CONVOY

Convoy is a digital freight network that connects shippers to carriers to move hundreds of thousands of truckloads, saving money for shippers, increasing earnings and reducing hassle for carriers, and reducing carbon waste for the planet. Convoy leverages technology, advanced analytics and an automated centralised decision-making platform to solve problems of inefficiency and wastage in the $800 billion trucking industry.

IMPACT

CLIMATE CHANGE MITIGATION:

Convoy makes trucking more efficient, leading to fuel savings and CO2 emissions reduction.

Truck freight accounts for 7% of all US greenhouse gas (GHG) emissions, (i.e., 436.5 million tons CO2e). Of this, 49% are booked as full truckload, of which ~30-35% are empty miles, leading to 72m tons CO2e in avoidable emissions from this segment alone1.

FINANCIAL INCLUSION

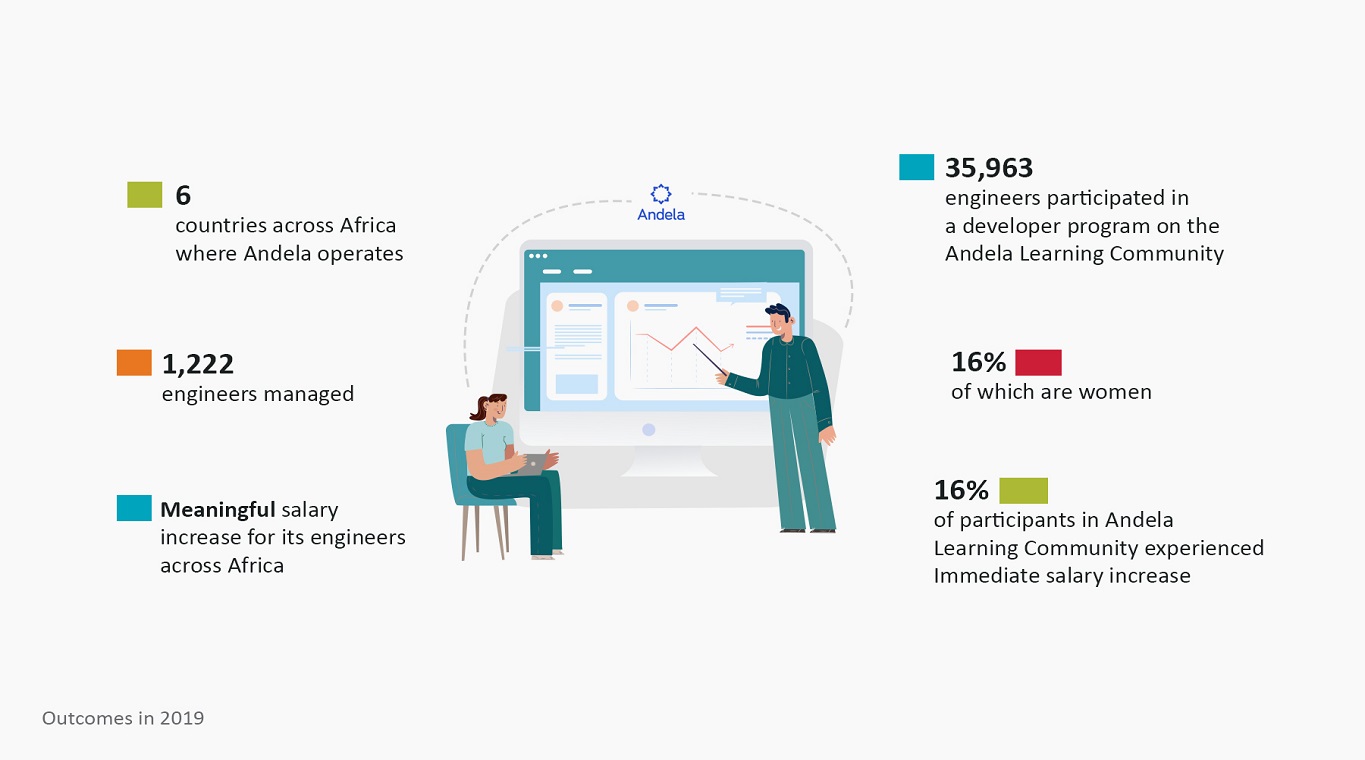

CASE STUDY II: ANDELA

Andela builds distributed engineering teams to help global companies overcome technical talent shortages. Andela hires and trains software engineers in Nigeria, Kenya, Uganda and Rwanda, with a growing presence in Egypt and Ghana, and has over 1,200 developers today.

IMPACT

ACCESS TO OPPORTUNITIES & EARNINGS POTENTIAL:

Andela enables the global labour pool to find high-quality software engineering opportunities with technology companies across the globe. Operating across Africa, Andela conducts ongoing training, greatly enhancing the skills and earning potential of its engineers. At the same time, by promoting remote work, it solves labour market inefficiencies created by an ever-worsening skills gap, facilitating companies’ ability to source high calibre engineering talent which would otherwise pose constraints on growth and productivity. Moreover, the company provides high-quality coding education to the continent through the Andela Learning Community (ALC), which has trained over 35,000 people in 2019.

FINANCIAL INCLUSION

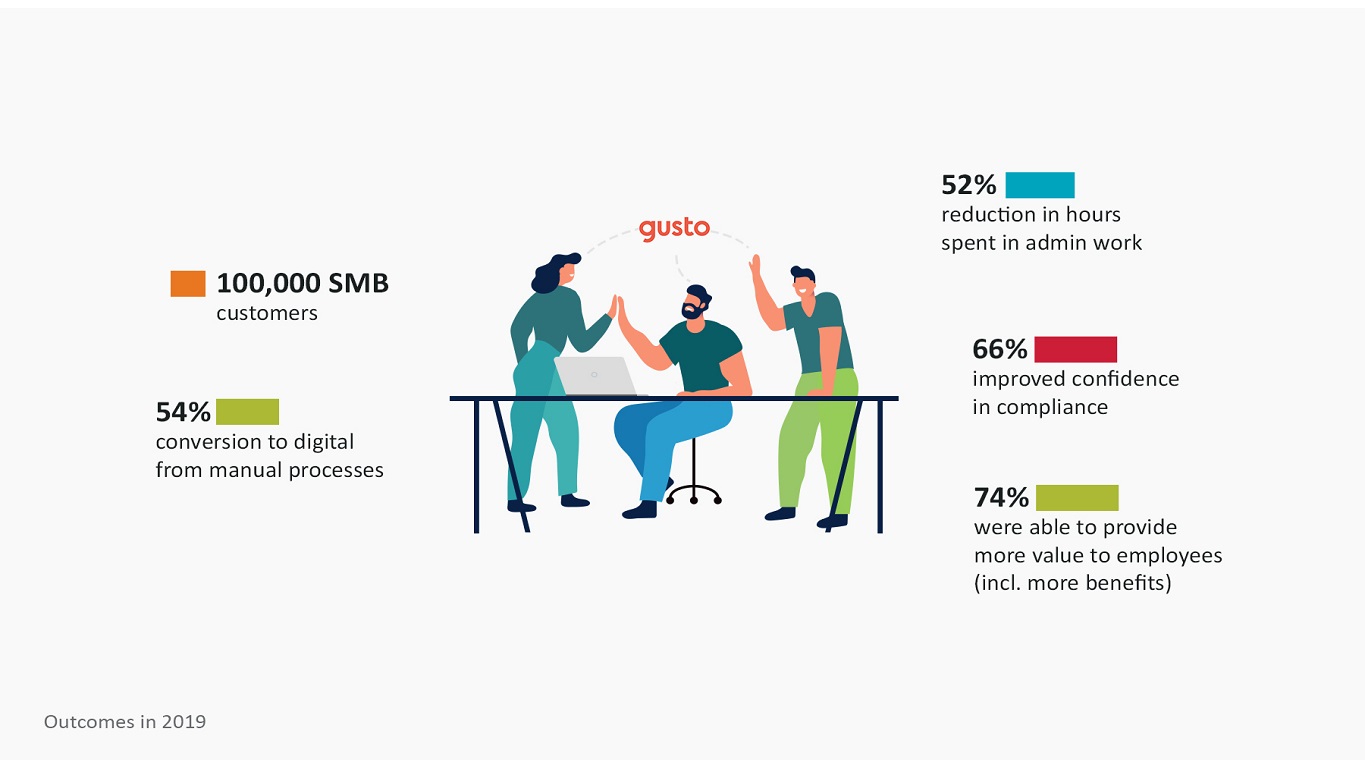

CASE STUDY III: GUSTO

Gusto is a software platform designed to automate and simplify payroll, HR and benefits for micro, small and medium sized business (SMBs). Gusto has created an easy-to-adopt, self service software platform that can reliably address this segment.

IMPACT

EQUALITY OF ACCESS & EFFICIENCY:

Gusto makes payroll, HR and benefits provision easier and more accessible for small businesses. Serving about 100,000 small businesses across the US in 2019, Gusto enables small business owners to be more productive and to increase benefits access to their employees.

Today across America the benefits gap continues to rise and real wages stagnate for many workers. This is particularly poignant for small businesses, which employ over half of America’s private sector workforce. While most providers have focused on larger companies, Gusto’s SaaS-based solution targets smaller businesses, many of which are otherwise doing payroll by traditional time-consuming and error prone methods. This improves efficiency, compliance and access to benefits.

NOTE Source: based on 60 Decibels survey of 39 customers (limited in scope due to the impact of Coronavirus) and Generation’s survey of 100 Gusto customers carried out at the time of investment.

FINANCIAL INCLUSION

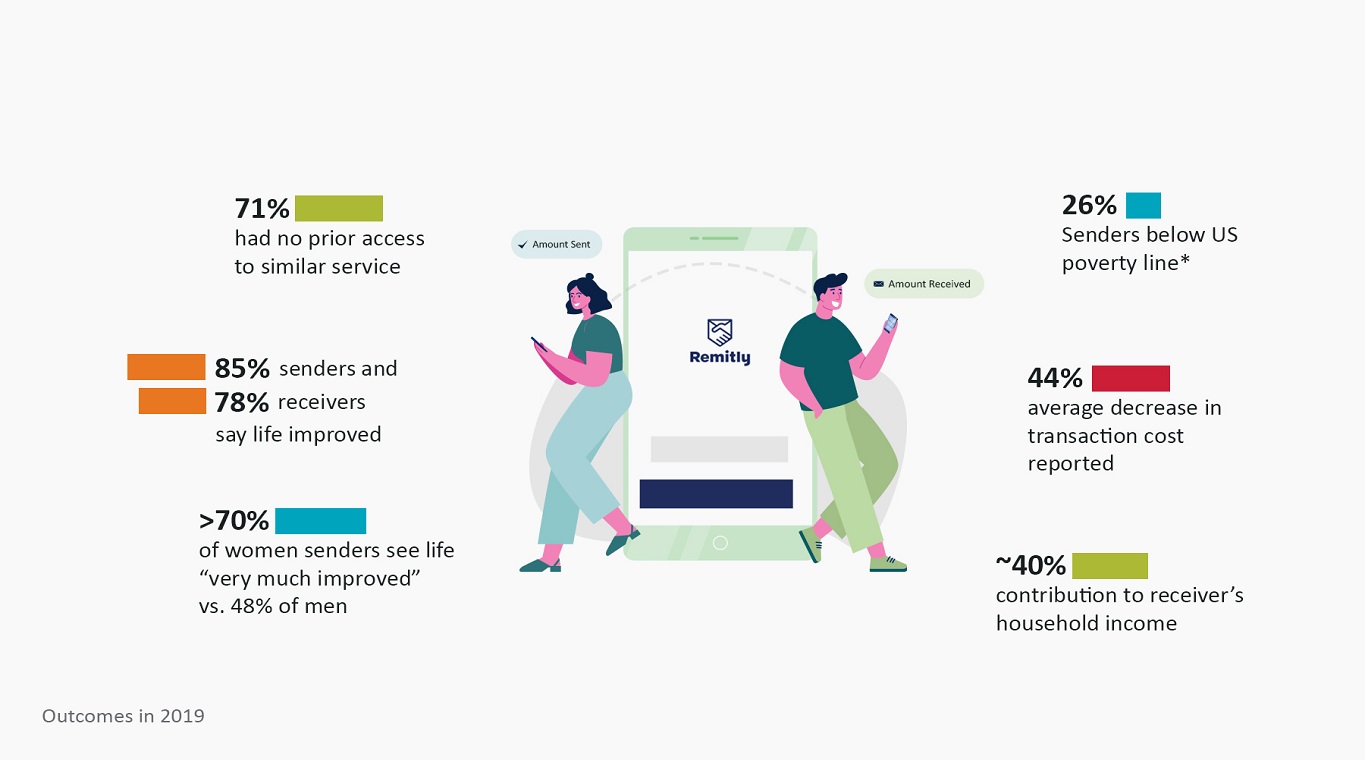

CASE STUDY IV: REMITLY

Remitly is a digital money transfer company that focuses on enabling fast and low-cost remittances from developed to developing countries. In 2019 the company reached $7 billion in transfers from 16 sending countries to 47 receiving countries across Asia, Latin America, Europe and Africa, and has nearly 200,000 collection points.

IMPACT

EQUALITY OF ACCESS & EFFICIENCY:

Remitly makes remittances cheaper, faster and more transparent with its digital platform for migrant workers globally to support living costs for their families back home. Globally, there are over 250 million migrant workers who send over $680 billion in remittances; Remitly has now served over 2 million customers. The World Bank lists remittances as a core solution to alleviating poverty and reducing income inequality.

NOTE: based on 60 Decibels survey of 539 remittance senders and 270 remittance receivers. *Income of less than $21.70 / day. Compares to 21% of overall population living below poverty line.

PEOPLE HEALTH

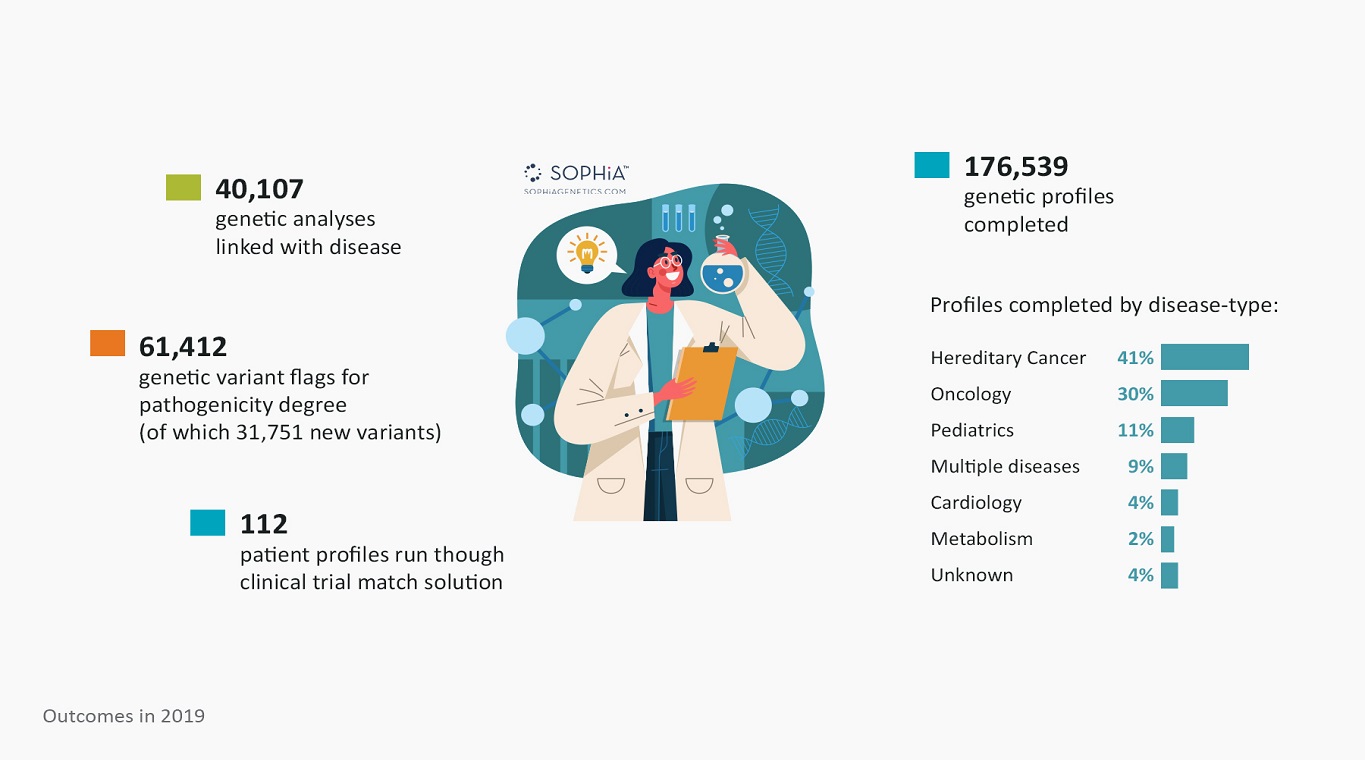

CASE STUDY V: SOPHIA GENETICS

SOPHiA GENETICS is a health tech company democratising data-driven medicine to improve health outcomes and health economics worldwide. By unlocking the power of new-generation health data for cancer and rare diseases management, the SOPHiA universal platform allows clinical researchers to act with precision and confidence.

IMPACT

IMPROVED HEALTH OUTCOMES:

SOPHiA GENETICS improves treatment options for patients by enabling decentralised genomic testing in labs across the world. SOPHiA’s next-generation sequencing analytics platform can better inform diagnosis of disease, which is linked to improved treatment accuracy – for example, in cancer patients. By empowering hospital and lab services to do testing in-house, SOPHiA enables quicker testing turnaround times for acute cases.

Conclusion

This was our first year of building the portfolio in the Sustainable Solutions Fund III. As we look back, we are pleased to see all three of our impact areas represented – Planetary Health, People Health and Financial Inclusion.

This is a result of the bottom-up research completed through our roadmap process. Indeed, in 2019 the Growth Equity team completed 17 roadmaps across a broad range of topics such as digital technology in energy, global remittances, environmental intelligence, digitising chronic care and circular economy, to name a few. Roadmaps are our primary tool to identify investment opportunities, gain a differentiated perspective on these sectors and target our sourcing efforts. The work we have done at the roadmap level has informed our Sustainability Threshold and key metrics to best understand “WHAT” a company does in terms of the outcomes (and ultimately, impact) of selling more of its products or services.

The ecosystem for impact management and reporting continues to evolve. We remain very active participants and supporters of a number of initiatives, with the hope that increased collaboration across the industry brings improved transparency and comprehensibility to results.

In the full report to our investors, we have included an ESG disclosure section, aligned with the Sustainable Accounting Standards Board (SASB), to assess “HOW” our companies operate. SASB’s sector-based approach focuses on materiality and financial impact. Its broad mandate and the wide uptake amongst public companies make it an aspirational standard for our private companies. Moreover, we have also aligned our reporting with the Impact Management Project, the Task Force for Climate-related Financial Disclosure and the UN Sustainable Development Goals.

Fundamentally, our approach is not reliant on any one external framework but instead on our own process and front-line experience as dedicated sustainable investors over the past 16 years. As we hope this report summary brings to light, sustainability research is integrated throughout our investment process and informs every dollar of capital deployed.

We look forward to continue engaging with our companies, our investors and the broader finance community to continue refining this work to best illustrate the fund’s impact over time.

Our data partners for this report are 60 Decibels and Environmental Capital Group.

IMPORTANT INFORMATION

The material contained in this document (the “Document”) has been prepared by Generation Investment Management LLP (“Generation”) for informational purposes only and reflects the views of Generation as at May 2020. It is not to be reproduced or copied or made available to others without the consent of Generation.

The Document is compiled in part from third party sources believed to be accurate, including the Fund’s investee companies themselves. Generation believes that such third party information is reliable, but does not guarantee its accuracy, timeliness, or completeness. It is subject to change without notice. The information should not be considered independent; it may be subject to error or omission and should not be relied upon.

Generation accepts no liability for loss arising from the use of this material. Any opinions expressed are our current opinions only. This Document is not meant as a general guide to investing. It is expressly not a source of any specific investment recommendations. It makes no implied or express recommendation concerning the manner in which any client's account should or would be handled. Under no circumstances is it to be considered as an offer to sell or a solicitation to buy any investment referred to in this Document. It is not investment research.

This Document is not meant as a general guide to investing. Should you disregard this caution, you should further be aware that, in consequence, it does not take into account your individual circumstances nor your financial situation or needs. Securities can be volatile and entail risk and individual securities presented may not be suitable for you. You should not buy or sell a security without first consulting your financial advisor or considering whether it is appropriate for you and your respective portfolios.

Generation, its employees, partners, consultants, and/or their respective family members may directly or indirectly hold positions in the securities referenced.

Any statements of opinion or belief contained in this Document, all views expressed and all projections, forecasts or statements relating to expectations regarding future events or the possible future performance of any product in respect of which Generation or any affiliates provide management or advisory services (or any other product) are those of Generation and represent Generation's own assessment and interpretation of information available to it as at the date of this Document and are subject to change without notice. No representation or warranty is made, nor assurance given, that such statements, opinions, projections or forecasts are correct or that the objectives of Generation or any products in respect of which Generation or any of its affiliates provide management or advisory services (or any other products) will be achieved. No responsibility is accepted by Generation or any affiliates in respect thereof.

The Fund is a private and unregulated fund and is not registered for distribution to the public or for private placement in any jurisdiction. Specifically, the Fund is not and will not be registered under the Securities Act of 1933 or registered or qualified under any US state securities act. The Fund is not and will not be registered as an investment company under the Investment Company Act of 1940. No regulator has approved the units in the Fund or their distribution.

Nothing in this Document should be interpreted to state or imply that past results are an indication of future performance. There is no assurance that any securities included within this report will remain in the Fund portfolio.

This communication has been issued in the United Kingdom by Generation Investment Management LLP ("Generation IM"), which is authorised and regulated by the Financial Conduct Authority of the United Kingdom and is a limited liability partnership registered in England and Wales. Registered No: OC307600. ARBN: 116 045 526. It is not a financial promotion. Generation IM is the parent entity of Generation Investment Management US LLP ("Generation US"), an investment adviser registered with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser with the SEC does not imply a certain level of skill or training. Generation IM and Generation US may only transact business in any state, country, or province if they first are registered, or excluded or exempted from registration, under applicable laws of that state, country, or province. In particular, Generation IM does not conduct business in the United States and persons in the United States should engage with Generation US only. Generation IM and Generation US are collectively referred to above as “Generation”.

If you have any questions relating to this report, please contact Generation Client Service at Generation Investment Management LLP, 20 Air Street, London W1B 5AN. Email: [email protected] Tel: + 44 (0) 207 534 4700.