Introduction

Net zero will be the law of the land in the major economies sooner rather than later, where this isn't already the case.1

Waiting to put net zero arrangements in place is putting capital at risk and increasing the chances of being caught out by sharp policy adjustments in key markets.2

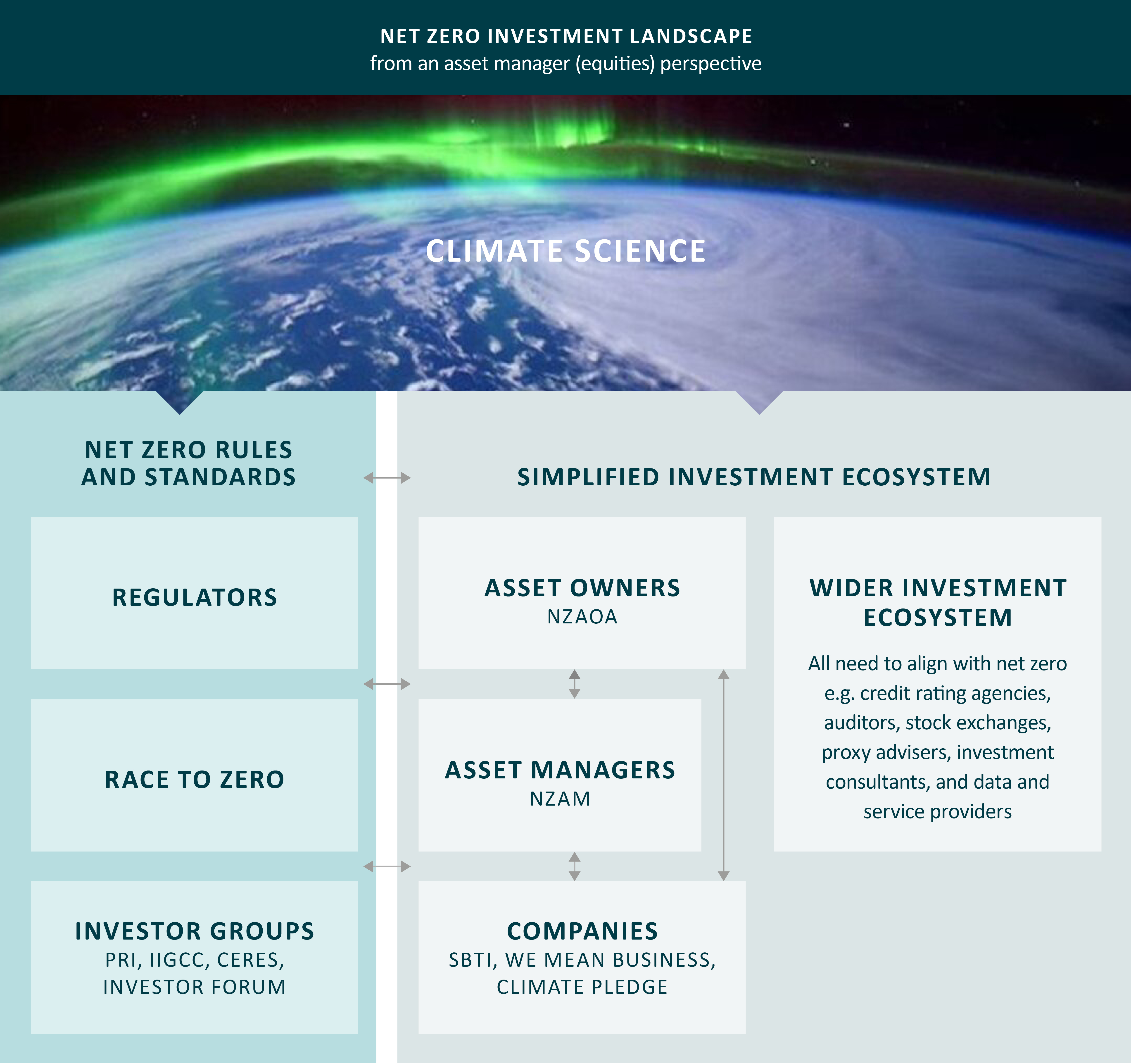

Asset owners are already working together on net zero with the support of the Net Zero Asset Owner Alliance (NZAOA) and the Paris Aligned Investment Initiative.3 Many companies are also signing up to net zero goals and over one thousand have joined the Science Based Targets initiative (SBTs are broadly consistent with net zero by 2050, if they follow the 1.5 degree methodology).4

Until now, a net zero club of asset managers has been notable by its absence, despite the best efforts of investor groupings including Principles for Responsible Investment (PRI), Institutional Investors Group on Climate Change (IIGCC) and Ceres. We believe closing the asset manager gap is essential. In the great majority of cases it is managers that make capital allocation to specific companies or other kinds of assets. Managers with significant investment positions and capital allocation responsibility are also uniquely well placed to effect change through engagement with companies.

In July 2020, Generation committed to align our investment portfolios with net zero emissions by 2040. We made this commitment to our clients because leadership on the climate crisis is necessary and we believe that managing climate risk and opportunity is inseparable from our fiduciary responsibility.

In the months following our own commitment, we worked with peers and partners, in particular the IIGCC, to establish a new Net Zero Asset Managers initiative (NZAM) – a coalition of like-minded managers committed to investing in line with net zero emissions by mid-century.

At launch in December 2020, the initiative had 30 founding signatories from around the world, with a combined $9 trillion of assets under management, recruited as a result of the work of IIGCC and Ceres with their members and the support of the High-Level Climate Champions for Climate Action.5

The investment ecosystem

As we describe in this piece, organisations across the worlds of business and investment will need to commit to net zero and, to the extent possible, to align their methodologies and approaches.

NZAM signatories have made specific commitments for their own investments, and will work closely with their asset owner clients in this process. Signatories commit to engage companies on net zero, but also to push for net zero commitments and aligned actions across the wider investment ecosystem.

Time for leadership

So why has it taken some time for asset managers to make this step?

The most commonly cited challenge is that client mandates limit the room for manoeuvre. For any investment strategy, the mandate agreed with clients sets important boundaries and objectives on how capital can be allocated. There is also the broader question: since we manage money on behalf of clients, should managers be taking the lead on setting strategic goals?

The lack of a common, agreed framework has also been a barrier to net zero goals. There has been a flurry of activity in recent months to establish high quality methodologies. Many of the key organisations in this effort participated in the working meetings for the initiative.

Setting ambition at 1.5 degrees also sharpens the focus of investors and clients – just as it does for companies. The extent and speed of action required raises challenging questions including the much discussed balance between engagement or divestment. For managers with a broad capital allocation across sectors and geographies, it is unquestionably challenging to commit to a goal that requires such sweeping changes.

For all these reasons, taking the plunge on net zero is uncomfortable, even for managers that are intellectually deeply committed to climate action. Yet given the systemic risks, we believe that it is only by showing leadership and catalyzing change from within the investment system that we can reach an acceptable outcome – from an investment performance perspective, and from a planetary safety perspective.

The framework

The framework for NZAM reflects both the necessity and urgency of climate action as well as the specific nature of asset management.

The full commitment and question and answer document are available here. We touch on some of the key elements of the framework in this section.

Headline commitment

NZAM initiative members commit to support investing aligned with net zero emissions by 2050 or sooner. Specifically, each organisation commits to:

-

Work in partnership with asset owner clients on decarbonisation goals, consistent with an ambition to reach net zero emissions by 2050 or sooner across all assets under management (‘AUM’)

-

Set an interim target for the proportion of assets to be managed in line with the attainment of net zero emissions by 2050 or sooner

-

Review their short-term target at least every five years, with a view to ratcheting up the proportion of AUM covered until 100% of assets are included

We spent much time discussing the proportion of assets that should be included. Generation has committed to net zero across all its investment strategies. Setting the bar at 100% would however have precluded membership from larger managers we need to drive a broader change in the ecosystem. In the end, we agreed that all managers would commit to the goal of net zero by 2050, but some managers would specify a proportion of assets they are managing in line with net zero. There is then a ratchet mechanism to review, disclose and hopefully increase the share of assets they manage in line with net zero as public policy, investment regulation, investment possibilities and client mandates change over time.

Managing to net zero

There are five supporting commitments that clarify how assets will be managed in line with net zero. Managers each to commit to:

-

Set interim targets for 2030, consistent with a fair share of the 50% global reduction in CO2 identified as a requirement in the IPCC special report on global warming of 1.5°C

-

Take account of portfolio Scope 1 & 2 emissions and, to the extent possible, material portfolio Scope 3 emissions

-

Prioritise the achievement of real economy emissions reductions within the sectors and companies in which they invest

-

If using offsets, invest in long-term carbon removal, where there are no technologically and/or financially viable alternatives to eliminate emissions

-

As required, create investment products aligned with net zero emissions by 2050 and facilitate increased investment in climate solutions

Of these areas, it is worth noting some of the debates we had as a group. No managers suggested that Scope 3 emissions should be excluded, but limited data availability for emissions in the value chain makes this a challenging area. Offsets and carbon removal deserves careful consideration too. High quality carbon removal (such as carbon stored in soil or trees, or direct air capture technologies) is likely to play a role in meeting corporate and investor net zero commitments. We therefore do want to see it scale, but it must not come at the cost of slower action on mitigation of emissions by companies.

Another theme for discussion was whether new investment products should be specified as a commitment, or if this is unnecessary as it logically flows from the commitment. Some managers feel it is important to be clear about the need for new net zero strategies and for an evolution in existing strategies. The group has therefore committed to create new investment products as required.

Enabling change in the investment ecosystems

Some of the most illumining discussions at our meetings were on the role of asset managers within the investment ecosystem. We hope the NZAM initiative can help to drive a system-level change – becoming what we would call ‘system positive’.

This is reflected in five additional commitments signatories make. For all members, these five commitments apply across the board (that is, they are not limited to the portion of assets currently being managed in line with net zero).

We think this is a comprehensive and potent set of commitments. It includes, for instance, providing asset owner clients with information and analytics on net zero investing and climate risk and opportunity. Crucially, it embraces an active stewardship and engagement strategy, consistent with an ambition for all assets under management to achieve net zero emissions by 2050 or sooner, with a clear escalation and voting policy. Furthermore any relevant direct and indirect policy advocacy undertaken by asset manager signatories will be supportive of achieving global net zero emissions by 2050 or sooner.

There is also an explicit focus on catalysing a system level change. Specifically, managers commit to engage with actors key to the investment system, to ensure that products and services available to investors are consistent with the aim of achieving global net zero emissions by 2050 or sooner – including credit rating agencies, auditors, stock exchanges, proxy advisers, investment consultants, and data and service providers.

Finally, signatories acknowledge the importance of consistent, transparent and high quality disclosure. Each member will publish Task Force on Climate-related Financial Disclosures (TCFD) aligned disclosures annually, including a climate action plan. These will be reviewed by the Investor Agenda via its partner organisations to ensure the approach applied is based on a robust methodology, consistent with the UN Race to Zero criteria,6 and action is being taken in line with all commitments.

Challenges

Key challenges for the next phase of net zero investing.

Maintaining the integrity of net zero commitments is crucial for the climate – and for the business case for net zero investing. As investors move onto a net zero path, they will need to consider seven key challenges.

Integration with the investment process

Tracking to net zero impacts investment both through capital allocation choices and engagement. Building the right processes to do this over time in line with credible interim net zero goals is key. Engagement resourcing, breadth and forcefulness must match the scale of the task. Reporting on progress over time with transparency of methodologies and assumptions is crucial to build confidence and momentum.

Value chain

Some of the most important and exciting efforts to decarbonise involve companies working with upstream suppliers or customers – for instance to use 100% renewable energy, electric vehicles or zero carbon materials. But today, disclosure of value chain (Scope 3) emissions is poor. This should be a priority for investor engagement.

Offsets and Carbon removals

We believe that companies relying on a large share of offsets to meet net zero targets will come under intense scrutiny. Some long term carbon removals may be needed to balance the last remaining chunk of greenhouse gas emissions by mid-century, but rules and standards are still emerging. Removals should be used only where there are no alternatives to eliminating emissions. Reporting separately on decarbonisation and removal pathways should become the norm.7 Net zero commitments should focus on portfolio Scope 1, 2 and 3 greenhouse gas emissions, not avoided emissions.8

Systems in transition

We believe ‘system positive’ companies have an impact through their products and services and how they shape the industrial ecosystem. Investing in some system positive companies may increase portfolio emissions over the short term. Over time, such companies will accelerate the emergence of a net zero economy and help make net zero aligned investing possible.

Disruptive change

The path to net zero will be a story of disruptive change and S-curves in zero carbon goods and services. Capital allocation to deep decarbonisation initiatives can take time to bear fruit. The models and pathways typically used today in net zero assessments struggle to capture these dynamics and underestimate the potential for deep decarbonisation. We hope to see many companies reach net zero emissions long before mid-century.

Hidden risks

Some net zero scenarios lean heavily on ‘technologies’ such as biomass energy to carbon capture and storage which have unsustainable land use implications. If you remove these, the path to net zero appears steeper. Slower than expected short term progress on emissions would also lead to a requirement for steeper cuts in the coming years. Cutting emissions early is crucial. Interrogating a range of scenarios, as TCFD recommends, is also part of the solution.

Evolving science

Scenarios are subject to change as the science of climate change evolves. For instance, estimates of the carbon budget for 1.5 degrees continue to be refined.9 Recent analysis has also pointed to an increased non-CO2 warming effect from aviation.10 Net zero investing must be agile enough to incorporate these advances at global and sectoral level. Innovation in ‘climate services’ could help bridge the gap between net zero investor goals and climate research.11

Conclusion

We hope that by launching at this time, we can help to mobilise climate action in the run up to COP26.

There is an open door for other asset managers to join the Net Zero Asset Managers initiative and we believe the initiative can and will grow significantly. We believe that momentum on net zero investing is at a tipping point. Notably, the world’s largest asset manager, BlackRock, announced its commitment to net zero in its January 2021 client letter.12

We have designed NZAM to be an agile and fast evolving body, but clearly it will need a strong governance regime and secretariat. We are delighted that NZAM is supported by the Investor Agenda, and that its designated partners include the PRI, IIGCC, Ceres and the other regional investor groups on climate change, as well as CDP. To streamline disclosure, the intention is to seek to build on existing reporting frameworks such as PRI’s annual reporting.

UN Climate Champions have been important supporters and co-conveners of NZAM from the beginning, including those on secondment from PRI and Legal & General Investment Management. The champions will play a key role in raising further awareness in the investment community and building bridges between this initiative and the many other strands of climate action in the finance sector and beyond in the run up to COP26. We are delighted that COP26 President, Alok Sharma, and the Prime Minister's Finance Advisor for COP26, Mark Carney, have already issued a written call to CEOs of global private financial institutions to sign up to the Race to Zero ahead of COP26, including through NZAM.

Establishing this ambitious framework is a vital step for the investment sector, but the real work starts now. All NZAM signatories will incorporate the framework into their investment processes, as we drive towards an investment sector truly aligned with a 1.5 degree pathway. At Generation, we look forward to working closely with our clients, asset manager partners, companies and other stakeholders on this critical journey.

-

For the latest net zero legislative and policy status of countries see the Energy & Climate Intelligence Unit tracker.

-

The Principles for Responsible Investment (PRI) organisation calls this risk the ‘Inevitable Policy Response’. See PRI overview.

-

See this link for the initiative’s Net Zero Investment Framework

-

SBTi’s draft net zero criteria document discusses SBTs as an interim step to net zero and some of the methodological challenges.

-

The Climate Champions website has more information.

-

Race to Zero aggregates net zero commitments from a range of leading initiatives across the climate action community. It is led by the High-Level Climate Champions for Climate Action – Nigel Topping and Gonzalo Muñoz. See the website for details of the minimum criteria for participation.

-

See McLaren (2019) article for Carbon Brief on the case for separating out negative emissions targets.

-

See this paper by the Science Based Targets Initiative.

-

Matthews et al. (2021), ‘An integrated approach to quantifying uncertainties in the remaining carbon budget’, article in Nat aure Communications Earth and Environment.

-

Lee et al. (2021), ‘The contribution of global aviation to anthropogenic climate forcing for 2000 to 2018’, article in Atmospheric Environment.

-

Fiedler et al. (2021). ‘Business risk and the emergence of climate analytics’, article in Nature Climate Change.

-

The January 2021 Blackrock client letter is available here.

IMPORTANT INFORMATION

The ‘Insights 04: Race to Zero' is a report prepared by Generation Investment Management LLP (“Generation”) for discussion purposes only. It reflects the views of Generation as at March 2021. It is not to be reproduced or copied or made available to others without the consent of Generation. The information presented herein is intended to reflect Generation’s present thoughts on net zero and related topics and should not be construed as investment research, advice or the making of any recommendation in respect of any particular company. It is not marketing material or a financial promotion. Certain companies may be referenced as illustrative of a particular field of economic endeavour and will not have been subject to Generation’s investment process. References to any companies must not be construed as a recommendation to buy or sell securities of such companies. To the extent such companies are investments undertaken by Generation, they will form part of a broader portfolio of companies and are discussed solely to be illustrative of Generation’s broader investment thesis. There is no warranty investment in these companies have been profitable or will be profitable.

While the data is from sources Generation believes to be reliable, Generation makes no representation as to the completeness or accuracy of the data. We shall not be responsible for amending, correcting, or updating any information or opinions contained herein, and we accept no liability for loss arising from the use of the material.