Our base case finds that the integration of efficient logistics and warehousing gives ecommerce the advantage.

17 MARCH 2020

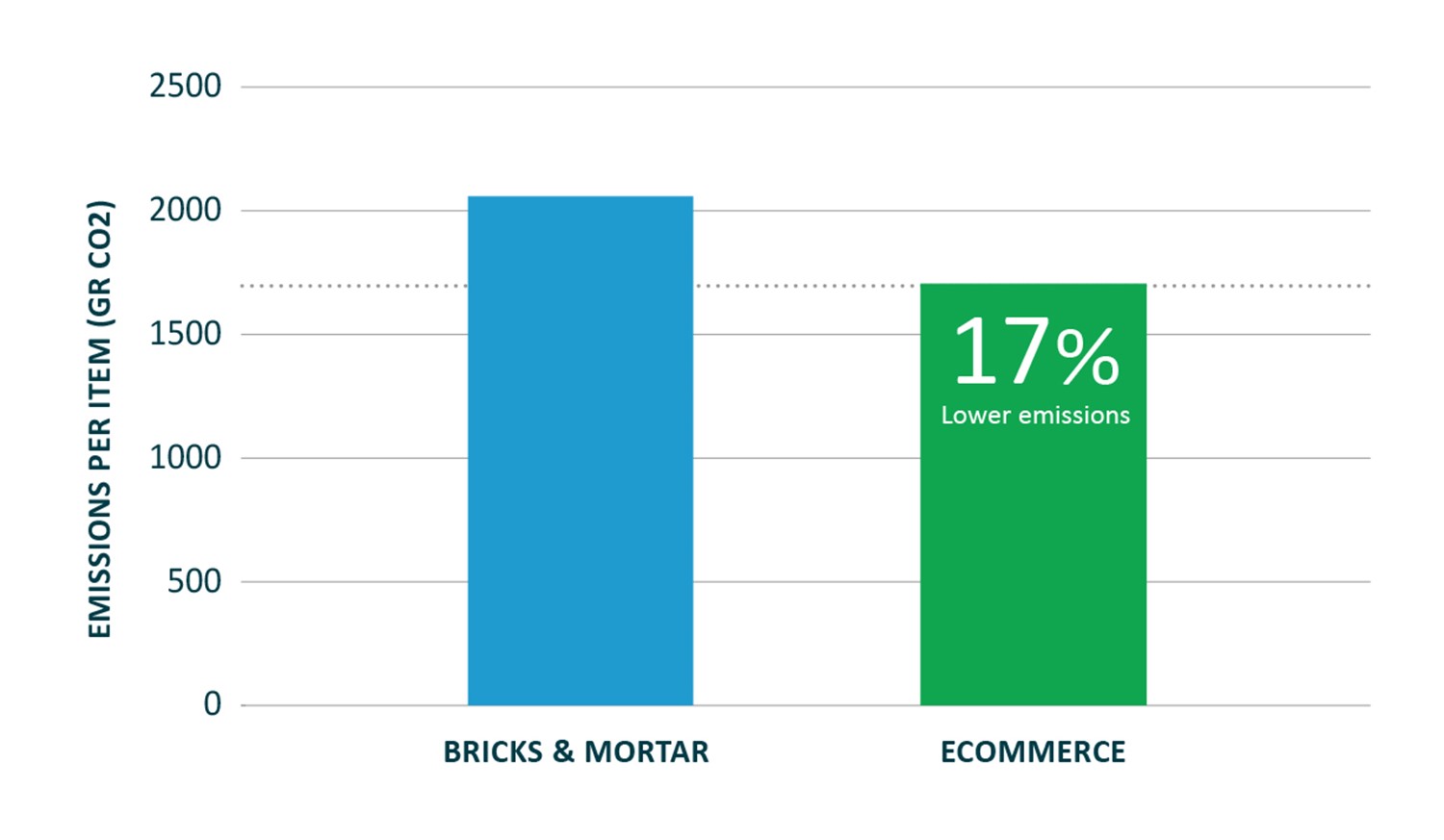

- Online shopping at large retailers in the United States is 17% more carbon-efficient than visiting traditional stores.

- Underpinning this are important assumptions such as the scale of the operation, the number of items purchased, return rates and single use packaging. Consumer behaviour is key.

- All retailers need to be on a path to net zero emissions. Ecommerce companies look well placed to make this transition due to their greater control over the logistics chain.

- Ecommerce companies should use their technology and data capability to enable sustainable patterns of consumption.

Introduction

Ever worry that those packages dropping through your letter box are increasing your carbon footprint?

In this Generation Insights piece, we find that online shopping at large retailers in the United States is actually more carbon-efficient than visiting traditional stores. Online retail is also well placed to transition rapidly to net-zero emissions.

Emissions footprints

Greenhouse gas (GHG) emissions for ecommerce are 17% lower than bricks and mortar retail in a base case scenario.

This is according to a new modelling tool developed for Generation Investment Management LLP by leading experts in the field.12 Grounded in detailed assumptions about energy consumption and GHG emissions in the supply chain, the tool compares the footprint of an item sold by traditional retailers with one delivered via ecommerce.

We focus this piece on the United States, the market where we currently have the most reliable set of estimates. In the future, we will use the tool to explore other geographies, starting with China.

GHG Footprint: ECommerce vs Bricks and Mortar

Source: Generation IM

ECommerce

As long-term investors, we continually seek to understand the impacts that companies have.

These impacts arise from a combination of what they do, and how they do it. For a long time, our thesis has been that ecommerce delivers significant energy and emissions savings – alongside convenience for the consumer.

10% Ecommerce - share of all retail sales in the US in 2018

With ecommerce on the rise around the world, we thought it was time to revisit our assumptions. Globally, sales have grown from $2 to $3.5 trillion from 2016 to 2019.3 In the US, ecommerce grew from less than 1% of retail sales in 2000 to 10% in 2018.4 In addition to this, many traditional retailers are adopting an ‘omnichannel’ approach – where customers can order items to collect in-store or choose home delivery.5

When we looked around, we could not find an off-the-shelf assessment tool that could do the job. We decided to build one from scratch, drawing on existing research and the views of industry experts.

Unboxing the data

To understand the GHG emissions associated with an item reaching the consumer, you need to consider the whole logistics chain.

Base case results

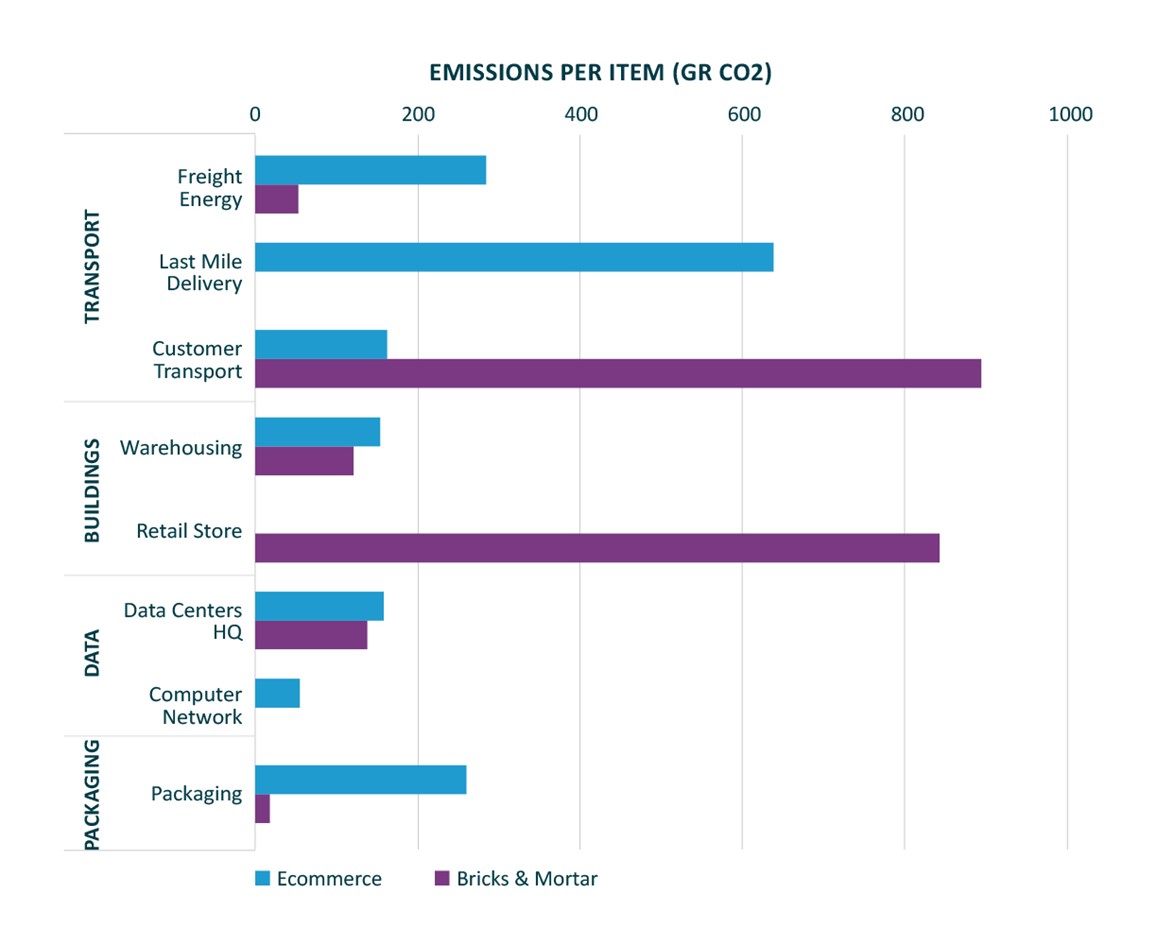

In the chart, we break out the GHG footprint results from the new tool into four areas. Blue bars show results for ecommerce. Purple bars are bricks and mortar retail. These four areas are as follows:

1. Transport

This includes long distance freight, last mile delivery (for ecommerce), and customer travel (to bricks and mortar stores).

2. Buildings

This includes warehouses (which are used for both ecommerce and bricks and mortar retail) as well as physical stores.

3. Data/HQ

This covers electricity use associated with the use of data centres and computing and headquarter operations.

4. Packaging

These are the GHG emissions associated with manufacturing the packaging material.

Source: Generation IM

Transport

Within transport, there is an important trade-off between last mile delivery for ecommerce, and customer transport to brick and mortar stores.

As you can see in the chart, however, the two categories largely cancel each other out in our base case. Ecommerce comes out around 140gCO2/unit above bricks and mortar for transport overall.

Instead, the key differentiating factor is the higher energy demand at bricks and mortar stores – for lighting, heating and cooling. Ecommerce uses more energy than bricks and mortar for warehousing, but only by a relatively small amount. This leaves ecommerce with an 800gCO2 lower emissions footprint from buildings overall. This more than outweighs the higher emissions for ecommerce in transport, data use and packaging.

Importantly, it is not so much these individual steps in the logistics chain, but rather the overall system efficiency that matters. In other words, in our base case the integration of efficient logistics and warehousing gives ecommerce the advantage – even when compared with highly efficient bricks and mortar operations.

Key factors

While the overall balance is in favour of ecommerce in our base case, it is easy to imagine how, with a few changes to the assumptions, the scales could tip in the other direction.

Underlying our results are a number of assumptions, all based on available survey data, previous research or expert knowledge of the sector. Some of the key assumptions include: the number of items purchased in one visit; the share of items returned to the store by customers; and the amount of packaging used. For bricks and mortar, we also need to consider the distance that shoppers drive to the store (and how many stores they visit in a single trip).

We unpack some of these key factors in the sections below.

Scale

1. Scale and time

It’s important to realise that our base case focuses on the largest-scale retail players.

The assumptions are based on estimates of real-world performance for major traditional retailers (such as Target and Walmart) as well as large ecommerce companies (which, given its prominence, are particularly based on Amazon).

In our model, ecommerce achieves this advantage through the efficiencies achieved at global scale. In fact, when we model a smaller scale ecommerce company, it comes out slightly more emissions-intensive than our base case for bricks and mortar – due in large part to less efficient last mile delivery.

Another key issue is timing. Rapid deliveries – known as ‘rush shipments’ – tend to increase energy use per item. To get to the consumer at short notice, some products may need to be transported by air – and at the other end of the chain, last-mile delivery vehicles can be driving around half-empty.

On the other hand, companies with global logistics operations are building local fulfillment centres where goods await future orders. The flexibility in their distribution systems can – at least in in theory – achieve next day deliveries without the need for air freight and with energy-efficient last mile delivery.

Ecommerce achieves this advantage through the efficiencies achieved at global scale.

2. Best behaviour

Our model suggests that shopping online is typically more GHG-efficient than shopping at bricks and mortar stores. But there are all sorts of contextual factors that determine the footprint of a single ‘shopping instance’ – whether on or offline.

Indeed, we believe many of these factors represent meaningful opportunities to cut emissions through changes in behaviour.

Basket size – how many items you buy in a single visit to a physical or online store – has a big effect. In our base case the physical retail basket contains 2.5 items and online has 1.2 items. If you increase the physical basket size to five items, a tipping point occurs – bricks and mortar becomes less ‘emissions intensive’ than online delivery.6 That’s because the per-item emissions from customer travel are spread across multiple items.7

The distance travelled by bricks and mortar shoppers also matters. Drive a few kilometres to a local store and you are certainly not helping your retail GHG footprint. On the flip side, if you take public transport or walk to the local shops, your footprint is probably lower than if you bought those items online. Unfortunately, this is relatively uncommon in the United States.

Of course, you can also visit more than one shop in a single trip. This issue of ‘trip chaining’ is quite tricky to capture. Recent surveys conducted by UC Davis indicate that chaining cuts the typical ‘distance travelled’ per unit-purchase by two thirds. This is reflected in our base case.

The rate of returns from online shopping has an effect in our model, but it’s not as much as you might think. We assume a 20% return rate for ecommerce in the base case.8 Although there is some additional energy spent on ‘reverse logistics’ (collecting items from the customer), it’s not a dead loss – many of those items go back to the warehouse or store ready to be re-sold.

That said, it appears that returns are an increasing problem for many e-retailers, especially in categories like clothing where the fit, colour and texture of items is often hard to gauge in advance. This could quickly become a bigger problem for the GHG footprint if logistics need to be expanded or if many items are destroyed.

To recap, you – as a consumer – have meaningful opportunities to minimise your GHG footprint by being patient with delivery, avoiding multiple shopping trips to bricks and mortar stores and returning items only where necessary. At the same time, retailers can do more to make these choices attractive – for instance, via price signals and delivery times.

This will often be a win-win. One ecommerce retailer is adjusting prices to reward customers when they choose items that can be shipped together, cutting the cost and emissions associated with transport.

Online supermarkets

The scenarios we present in this piece assume the purchased items are non-food, non-perishable products.

These tend to be purchased in small basket sizes. They are also items where customers are keen on rapid delivery, which can make it hard to optimise logistics.

Online food shopping is taking on a very different shape. The typical basket size for Ocado, an online food supermarket and technology company, is around fifty items in the UK. Customers are willing to book slots several days in advance, allowing the company to fill up vans and optimise routes.

Energy use in buildings is an even more important factor for food retail. Large, central, highly- automated warehouses offer significant efficiency gains over physical stores. In addition to lowering electricity use, warehouses are better placed to avoid leakage of refrigerants, which are potent greenhouse gases.

Shifting online should also help tackle the huge challenge of food waste. Food spends less time in the supply chain before reaching the consumer. It is also easier to maintain a continuous cold chain, keeping products fresh for longer. In combination, this means customers have more time before products reach their use-by date.

It is less clear that the shift online is helping to solve the single use packaging associated with supermarket shopping. Ocado has said that tackling this is a priority.9In the UK alone, ten supermarkets are placing over 800,000 tonnes of single use plastic on the market every year, as well as over a billion single-use plastic bags.10

Heaven and hell

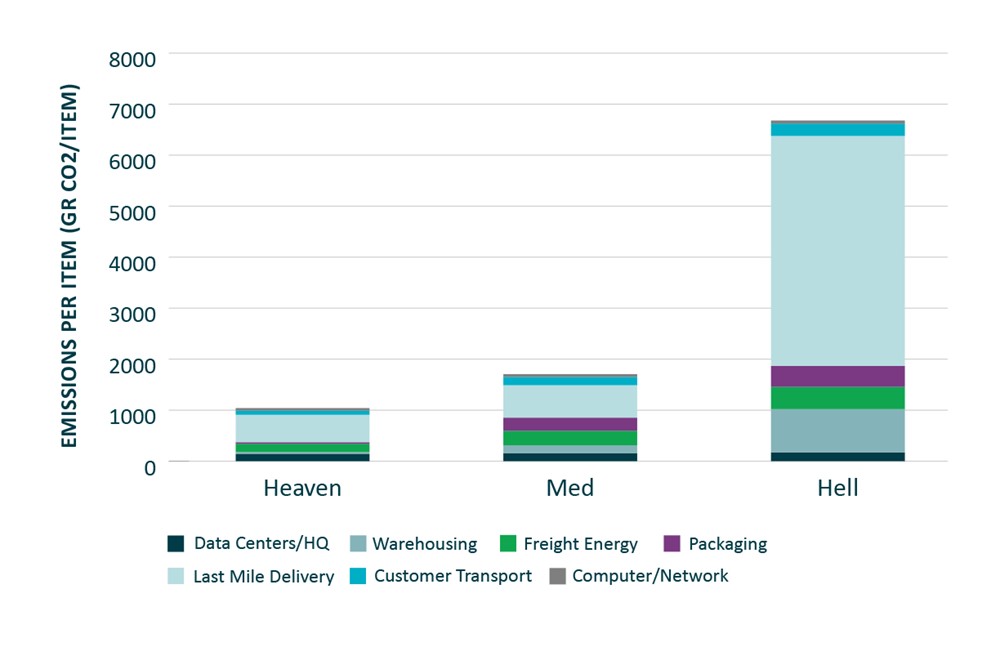

In addition to our base case, we explored two scenarios: ‘ecommerce heaven’ and ‘ecommerce hell’.11

Ecommerce heaven

The heaven scenario reflects all our most optimistic assumptions about ecommerce today, while the hell scenario reflects all the most negative. These results give an idea of the range of possible outcomes as ecommerce continues to scale in the coming months and years. In the heaven case, emissions are cut to 1000gCO2/item, down from around 1700gCO2/item in our base case. At this level, the emissions would be around 50% of those for bricks and mortar in our base case. The improvement is largely achieved via introducing electric vehicles for last mile delivery, decarbonising data centres with renewable energy and avoiding single-use packaging.

Ecommerce hell

In the ‘hell’ scenario, emissions for ecommerce more than triple compared with the base case. Moreover, they are about 3.3x higher than bricks and mortar. Most of the increase is down to inefficient last mile delivery. In this scenario, we assume longer delivery routes (160km, up from 100km in the base case) and fewer packages delivered on each route (from 120 to 30). This is a proxy for the potential negative impact of rush shipments. The hell scenario also assumes that energy needs in fulfilment centres are about 3x higher than in the base case. This accounts for the increase in the warehousing category. This serves as a warning that we cannot assume that all ecommerce companies are, or will be, better from a GHG footprint perspective.

Ecommerce Heaven and Hell scenarios

Net zero

Towards net zero

The relative performance of ecommerce and bricks and mortar retail today clearly matters, but the sector’s transition to net zero emissions, in line with the Paris Agreement, matters even more. For this, we need to consider whether the shift to ecommerce will help or hinder retail’s efforts to decarbonise.

1. Transition levers

Ecommerce companies have more control over transport-related emissions.

Via their procurement choices, they can ensure a rapid switch to electric vehicles for last mile deliveries – this alone wouldmove them much closer to the ‘ecommerce heaven’ scenario. Battery powered vehicles and hydrogen are likely to provide further opportunities for longer distance freight in the coming years.

In contrast, high street retailers have very limited tools to influence consumer transport choices.

Ecommerce companies also have more leverage over emissions associated with buildings. A traditional store designed to make shopping easy for the consumer is unlikely to ever be as efficient as a custom-built warehouse. Warehouses will likely get more efficient still, as automation takes over a growing range of tasks. In any case, bricks and mortar logistics chains also require warehousing (you can see this in our base case results in Figure 1).

This is also a numbers game. Amazon has 200 buildings in the US, including around 100 operational sites.12It’s possible to tackle emissions from electricity use at these sites through a relatively small number of renewable projects or purchasing contracts. In contrast, Target has around 1800 physical stores in the US. Meanwhile, there are over 8,000 large-scaleshopping malls.13

In two categories where ecommerce appears to have higher emissions, there are significant opportunities for near term decarbonisation. Data processing and computing centres can be supplied by renewable energy. Indeed, many technology companies already have commitments in this area. For packaging, all retailers are under pressure to cut out all unnecessary single-use materials, especially plastics.

2. Supply chains

This piece focuses on the journey of a product from original seller to customer.

But it’s worth bearing in mind that the emissions embedded in the actual products sold are usually several times larger than the associated emissions from this journey. For electronic and electric items, this also applies to the emissions footprint of theproducts when they are used.

How best to drive down these supply chain emissions (known as ‘scope 3’) is determined by the business model. Stores that make direct purchasing decisions have significant leverage over manufacturers of those products, whether they are sellingonline or in physical stores.

Major retailers have acknowledged this. Target, for instance, has a commitment that 80 percent of its suppliers will set ‘science-based targets’ by 2023 (see the box below for more examples). Walmart is working with suppliers to avoid 1 billiontonnes of CO2 emissions by 2030.14It has also created a sustainability index for its 2,800 suppliers.15Omnichannel retailers, and ecommerce companies that source the products that they sell, can take a similar approach.

The opportunity comes in a different form for ecommerce marketplaces, which are not making direct procurement choices to the same extent. They can, for instance, ensure that near-zero emissions products move to the top of search results.They can also impose minimum standards or clearly label the environmental footprint. We think this is a largely untapped opportunity, and it will be a key focus for our engagement with ecommerce marketplace companies.

Retailers commitments to climate action

Some of the largest players in retail have made ambitious commitments on climate action.

Walmart, for instance, will source 50% of its energy needs from renewables by 2025. It is now the largest onsite green power generator in the US.16Target will source 100% of electricity from renewables by 2030.17 Best Buy aims to be carbon neutral by 2050.18 In the UK, supermarkets Tesco and Sainsbury’s have net zero targets (by 2050 and 2040 respectively).19 Landsec plans to be net zero by 2030.20 Retailers that are part of the Science Based Targets initiative 21are presented in the chart below. ‘Committed’ means they have joined the initiative. ‘Targets set’ means they have gone through a verified process to set a short-to-medium-term emissions-reduction goal in line with the Paris Agreement.

Retail: Companies with science based targets

Source: Science Based Targets initiative. In 2019, Amazon not only disclosed greenhouse gas emissions data for the first time but also set a net-zero emissions target for 2040 (see reference 22). In the same announcement, Amazon provided more details on its plans for renewable energy and electric vehicle adoption. We have had conversations with the company for many years on this topic.

What we buy

Is ecommerce changing what we buy and how much we buy?

If so, this could upend all of our calculations above, which are based on emissions per item sold. It’s an important limitation in our model.

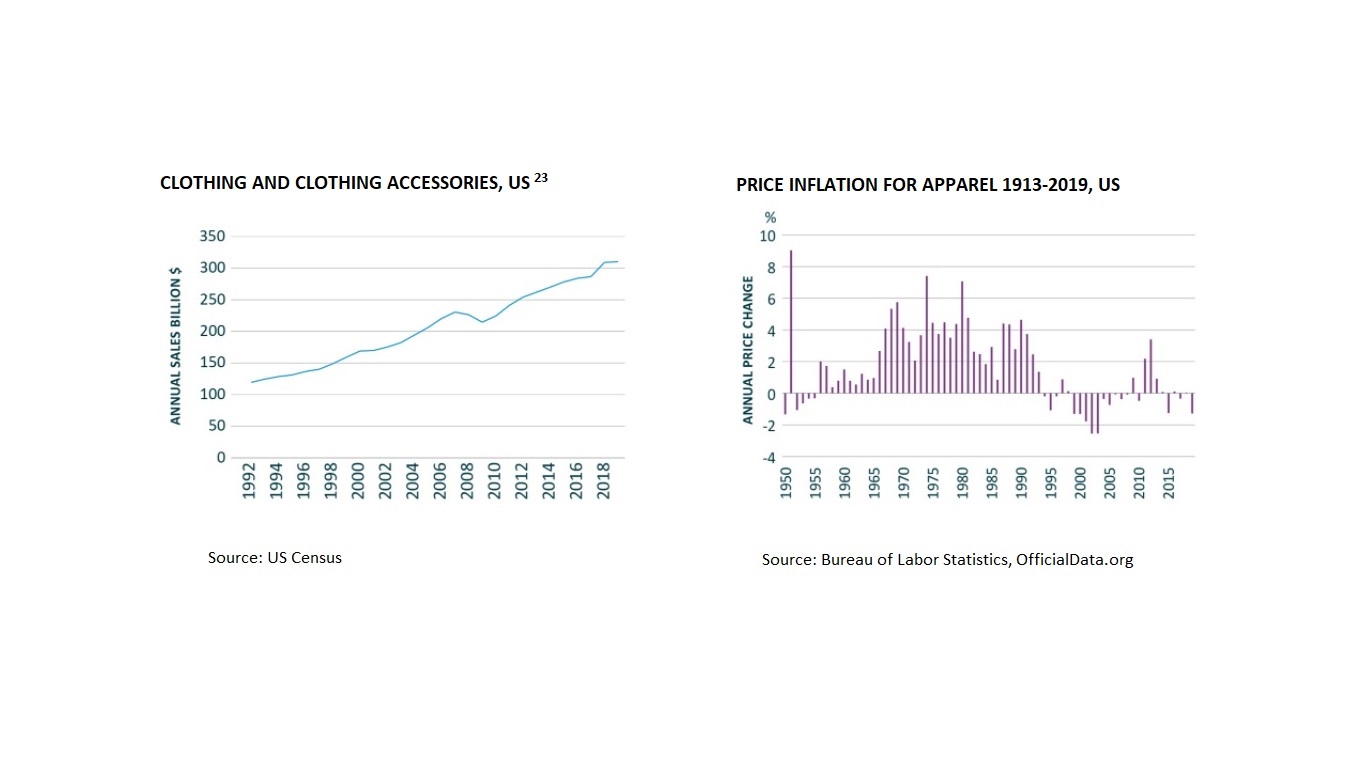

It’s difficult to tease out the impact of ecommerce on consumer behaviour because of wider trends in the economy in recent years, especially since ecommerce has only recently taken a meaningful share of retail sales. Let’s take apparel, one of the most important product categories from an environmental impact perspective.

The rise of ecommerce appears to have made little difference to the long-term trend for consumer spending on clothing (left chart, not inflation adjusted). Moreover, globalisation, rather than ecommerce, is the explanation for lower clothes prices in recent decades.

On the right hand side you can see the impact of the World Trade Organisation coming into being in 1995 (and China joining in 2001).

What we buy

17 bn units of clothing are sold each year in the US.22 It is very possible that ecommerce is leading to a shift in consumer choices or in the volume of sales, but it’s hard to find it in the data.

This is not to say that spending is at sustainable levels. The average US consumer buys one mid-priced item of clothing a week. 17 billion units of clothing are sold each year in the US.24 The volume of clothes that the US throws away has nearly doubled in the past 20 years to around 14 million tonnes.25

Perhaps the more important question is: how should all retailers work with their customers to dramatically lower their environmental footprint?

A decade ago, Tesco, the UK Supermarket, tried to add a carbon footprint label to all its products. That pioneering initiative was abandoned in the face of methodological challenges.26 But we are now in a very different world when it comes to collecting and analysing data. Moreover, consumer appetite is greater than ever. In 2019, Carbon Trust found that 2 in 3 shoppers want to see a carbon footprint label.27

Ecommerce companies are especially well placed to unlock accurate accounting of environmental impact, given their innovative capacity in data and technology. We’d like to see companies do much more to highlight the emissions, water and land footprint of individual products. We’d also like them to promote circular materials and products over single use or short-lived items.

Ultimately, they should be working in lockstep with consumers to enable sustainable consumption and healthy lifestyle choices.

Conclusion

Online shopping has a lower carbon footprint today – but as we have seen, there are a lot of elements to this story.

What does this tell us about how to prioritise our engagement with companies?

First, we want to see concrete steps taken to ensure a rapid transition to net zero emissions. Switching to electric vehicles for last mile delivery should be a priority for ecommerce companies, along with powering data centres with renewable energy and cutting out single use packaging.

Second, the final frontier for all retailers is enabling sustainable consumption patterns. Given their capabilities in technology and data, ecommerce companies are only scratching the surface of what could be done with better environmental accounting.

Third, we need to see enhanced disclosure of GHG data in the logistics chain. We have developed this tool with industry experts, but it could be considerably refined if information was available on a wide range of industry players.

In the meantime, customers can make a meaningful difference today through their purchasing behaviour. It’s best to avoid long drives to buy one or two items from a bricks and mortar store. When shopping online, it’s about avoiding urgent shipments and excessive returns. Perhaps most of all, it’s about what we choose to buy.

H. Scott Matthews. Professor, Civil and Environmental Engineering and Engineering & Public Policy. Carnegie Mellon University https://www.cmu.edu/cee/people/faculty/matthews.html

Miguel A. Jaller Martelo. Associate Professor and Co-Director, Sustainable Freight Research Center. UC Davis. faculty.engineering.ucdavis.edu/jaller

Jessica Young (2019), ‘Global ecommerce sales to reach nearly $3.46 trillion in 2019’. DigitalCommerce360. digitalcommerce360.com/article/global-ecommerce-sales

US Census Bureau, accessed February 2020. See timeseries in Quarterly E-Commerce Report section: census.gov/retail/index.html

We have also modelled the GHG footprint of omnichannel retail. For simplicity these are not presented. In our base case, total per unit GHG emissions for omnichannel are similar to traditional retail.

Jaller, M. and A. Pahwa (2020). Evaluating the Environmental Impacts of Online Shopping: A Behavioral and Transportation Approach. 'Journal of Transportation Research Part D: Transport and Environment' sciencedirect.com/journal/transportation-research-part-d-transport-and-environment/vol/80/suppl/C

Ecommerce can also find efficiencies by combining travel journeys of multiple items.

Returns from bricks and mortar are 10% in the base case.

BBC news (2019), ‘Can you really do a plastic-free food shop?’. Article on BBC website: bbc.co.uk/food/articles/plastic_free_food_shop

Environmental Investigation Agency and Greenpeace (2019). ‘Checking out on plastics: A survey of UK supermarkets’ plastic habits’. eia-international.org/wp-content/uploads/Checking-out-on-plastics.pdf

For simplicity, we are not presenting an equivalent ‘heaven and hell’ for bricks and mortar.

There are 110 operational sites in North America. See Amazon website: aboutamazon.com/amazon-fulfillment/our-fulfillment-centers Forest Shipping identifies 83 Amazon fulfillment centres in the US, with several more in planning. Forestshipping.com/amazon-fulfillment-usa

The methodology used for ‘major shopping centres’ is available from ESRI: downloads.esri.com/esri_content_doc/dbl/us/2018_Directory_of_Major_Malls_Data_Methodology.pdf

See Walmart website: corporate.walmart.com/newsroom/2019/05/08/walmart-on-track-to-reduce-1-billion-metric-tons-of-emissions-from-global-supply-chains-by-2030

Nick Winkler (2020), ‘What Is the Future of Ecommerce? 10 Insights on the Evolution of an Industry’. shopify.com/enterprise/the-future-of-ecommerce#6

See Walmart website :corporate.walmart.com/our-story/our-business

See Target website: corporate.target.com/article/2019/06/renewable-electricity

See Bestbuy website: corporate.bestbuy.com/sustainability

BBC news (2020), ‘Sainsbury's pledges £1bn to cut emissions to zero by 2040’. Article on BBC website. bbc.co.uk/news/business-51263991

Hugh Radojev (2019). ‘Landsec pledges to be net zero carbon business by 2030’. Retail Week. retail-week.com/stores/landsec-pledges-to-be-net-zero-carbon-business-by-2030/7033430.article?authent=1

See the Science Based Targets initiative website. sciencebasedtargets.org

See Amazon website: sustainability.aboutamazon.com/carbon-footprint

US Census Bureau historical data is based on bricks and mortar stores. These numbers reflect supplemental data provided by the Bureau for ecommerce sales of clothing and clothing accessories for the past 2 years. For previous years back to 2000, the adjustment to incorporate ecommerce is based on data provided by the Bureau for share of ecommerce for all retail.

Common Objective (2018). Volume and Consumption: How Much Does The World Buy? commonobjective.co/article/volume-and-consumption-how-much-does-the-world-buy

US EPA. ‘Facts and Figures about Materials, Waste and Recycling’. epa.gov/facts-and-figures-about-materials-waste-and-recycling/textiles-material-specific-data

Tesco worked with the Carbon Trust on this initiative.

See Carbon Trust website: carbontrust.com/news-and-events/news/research-reveals-consumer-demand-for-climate-change-labelling

Important information

The ‘Insights 02: The Carbon Footprint of Retail: ecommerce vs bricks & mortar' is a report prepared by Generation Investment Management LLP (“Generation”) for discussion purposes only. It reflects the views of Generation as at March 2020. It is not to be reproduced or copied or made available to others without the consent of Generation. The information presented herein is intended to reflect Generation’s present thoughts on ecommerce data and should not be construed as investment research, advice or the making of any recommendation. It is not marketing material or a financial promotion. References to any companies must not be construed as a recommendation to buy securities of such companies.

While the data is from sources Generation believes to be reliable, Generation makes no representation as to the completeness or accuracy of the data. We shall not be responsible for amending, correcting, or updating any information or opinions contained herein, and we accept no liability for loss arising from the use of the material.