Integrating sustainability into our investment work

As Generation Investment Management celebrates its 15th anniversary, we are looking to share more about our investment work with other stakeholders committed to a sustainable future.

In the coming months, we will share insights into how we integrate sustainability into our investment work. We will also highlight where we believe the bar needs to be raised across our sector and beyond, in light of the urgency of our global environmental and social crises.

The first of our insight pieces focuses on the Future of Environmental, Social and Governance (ESG) Data. Written by Felix Preston, Director of Sustainability Insights at Generation, the piece examines what can be done to improve the quality, consistency and usage of data that underpins companies’ ESG reporting and asset owners’ investment decisions.

5 DECEMBER 2019

- ESG data underpins the fast-evolving landscape of sustainable investment. It helps guide the allocation of trillions of dollars of ‘ESG aware’ investment capital.

- Investors ignore the limitations of today’s ESG data at their own peril. We believe placing ESG data in context is key to making sound investment choices.

- The coming revolution in ESG data will be forward looking and tied to real-world impact – tracking towards science-based targets and an inclusive economy – and testing if management is transition-ready.

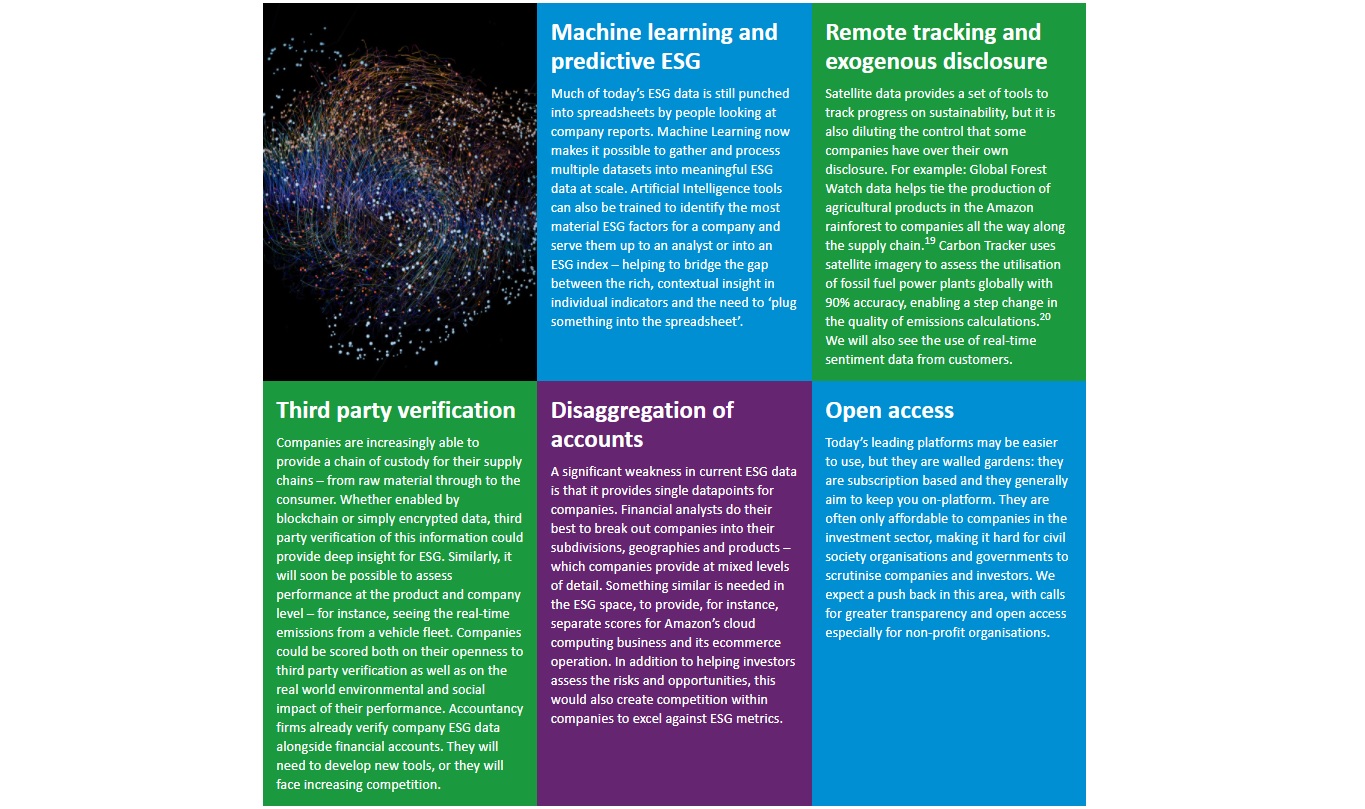

- We identify five enablers of the coming revolution in ESG data: 1. Machine learning and predictive ESG 2. Remote sensing and exogenous disclosure 3. Third party verification 4. Disaggregation by business unit and 5. Open access.

ESG Data

ESG data underpins the fast-evolving landscape of sustainable investment.

It already helps guide the allocation of trillions of dollars of ‘ESG aware’ investment capital, with trillions more expected to come as the use of this data spreads throughout the financial sector.1 Yet today’s ESG data has real limitations. The risk is that it puts the spotlight on what is available, rather than what is most important.

At Generation, our investment philosophy blends traditional financial and ESG data, a raft of contextual information and team debate that challenges and refines our thinking over time. At the same time, we can see the growing demand for simple ESG data that can be easily plugged into financial models at scale. We believe that bridging the gap between the value of rich contextual information and the need to ‘plug values into the spreadsheet’ is where ESG data needs to go.

Our belief in the need for a new generation of ESG data is tied to a high ambition future for sustainability – a future where high-quality companies are aligned with planetary and societal needs. As the economist Michael Porter argues, high quality investing means allocating capital to companies that deliver shared value, rather than ones that do well in incremental metrics.2 Ultimately, ESG data is a means to an end.

In this piece we look at how ESG data is set to transform. We discuss the need to use time series data and forward-looking disclosure, rather than snapshots. We highlight the need to assess what companies do, as well as how they behave. We also see many opportunities to harness the digital revolution to connect ESG data with the real-world impact of companies and the products and services they provide.

Incremental improvement

Today, the discussion about ESG data focuses on useful but incremental improvements.

Some of the most significant include filling in gaps in the data, adding new metrics and improving consistency – all of which aids comparability across companies.

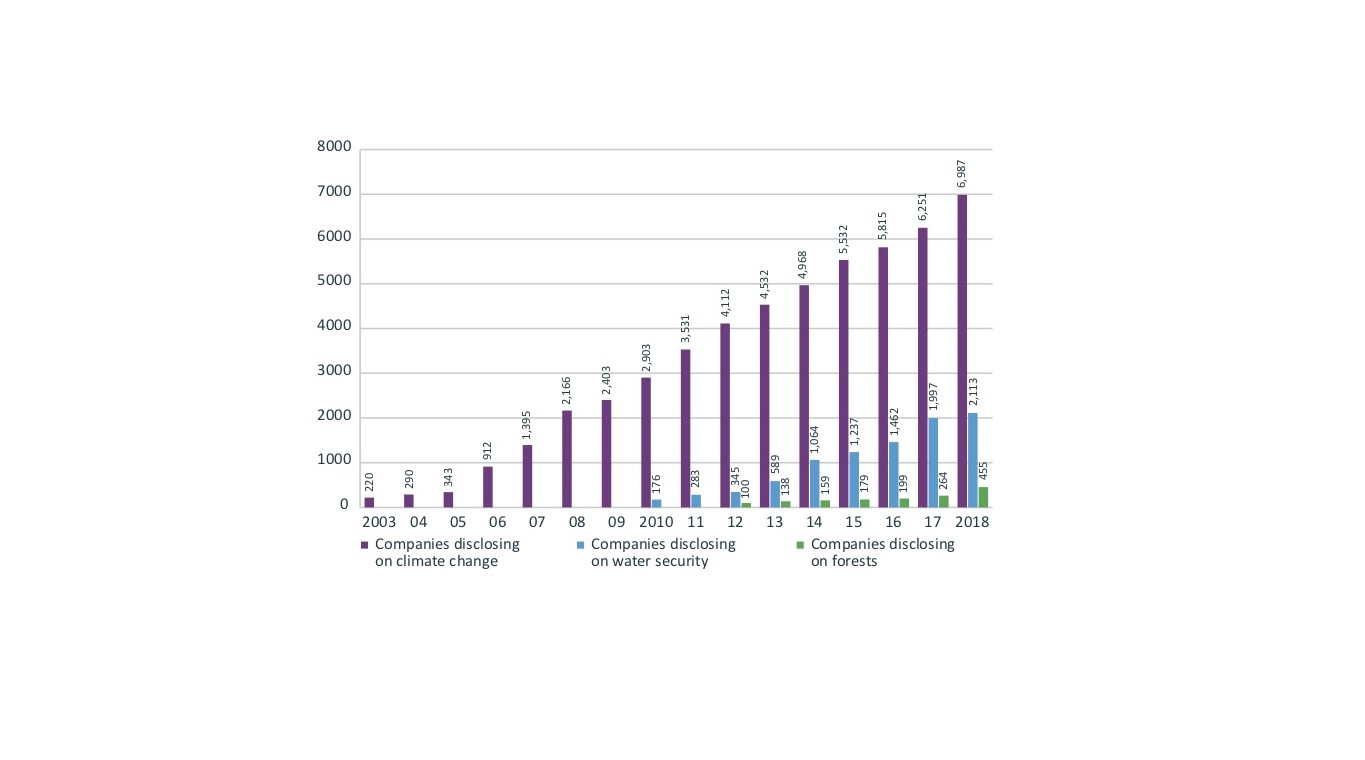

When Generation was founded in 2004 about 300 companies reported annual greenhouse gas data to CDP (formerly the Carbon Disclosure Project), and most were based in Europe. This has now climbed to 7,000 companies from around the world.3 There is growing information on environmental and social risks in company supply chains. The quality of data on governance indicators is improving as their scope widens. Data is also available on breaches of environmental regulation, allegations of corruption and other red flags.

Companies disclosing to CDP since 2003

Disclosure of climate-related data to CDP has improved in recent years. Source: CDP (See reference 4)

ESG DATA IN NEED OF TRANSFORMATION

Even so, the reality is that coverage remains patchy.

Data are only currently available for some metrics, for some firms in some geographies. Indicators for social issues are relatively weak, at a time when societal challenges have never been higher on the agenda. The risk is that ESG data put a spotlight on what is available, rather than what is most important.

Meanwhile, sustainability discussions focus on the need for transformation and unprecedented shifts in the way that companies operate. We think there is a disconnect here. If it is to help guide transformations underway in the economy and society, ESG data will itself need to undergo a transformation.

Mixing up scores

ESG metrics are imperfect proxies for the environmental and social impact of companies and how they are governed.

Take the Climate Crisis. Last year’s greenhouse gas emissions data for a company’s operations is a commonly used metric.

A more complete picture of how the company is doing would depend on understanding its supply chains, interactions with customers, opportunities to innovate and more. Climate is of course only one critical sustainability issue that investors need to consider.

Many data providers have responded to this complex picture by providing ever more sophisticated combinations of metrics to assess sustainability. Yet they do not agree on which factors are most important.

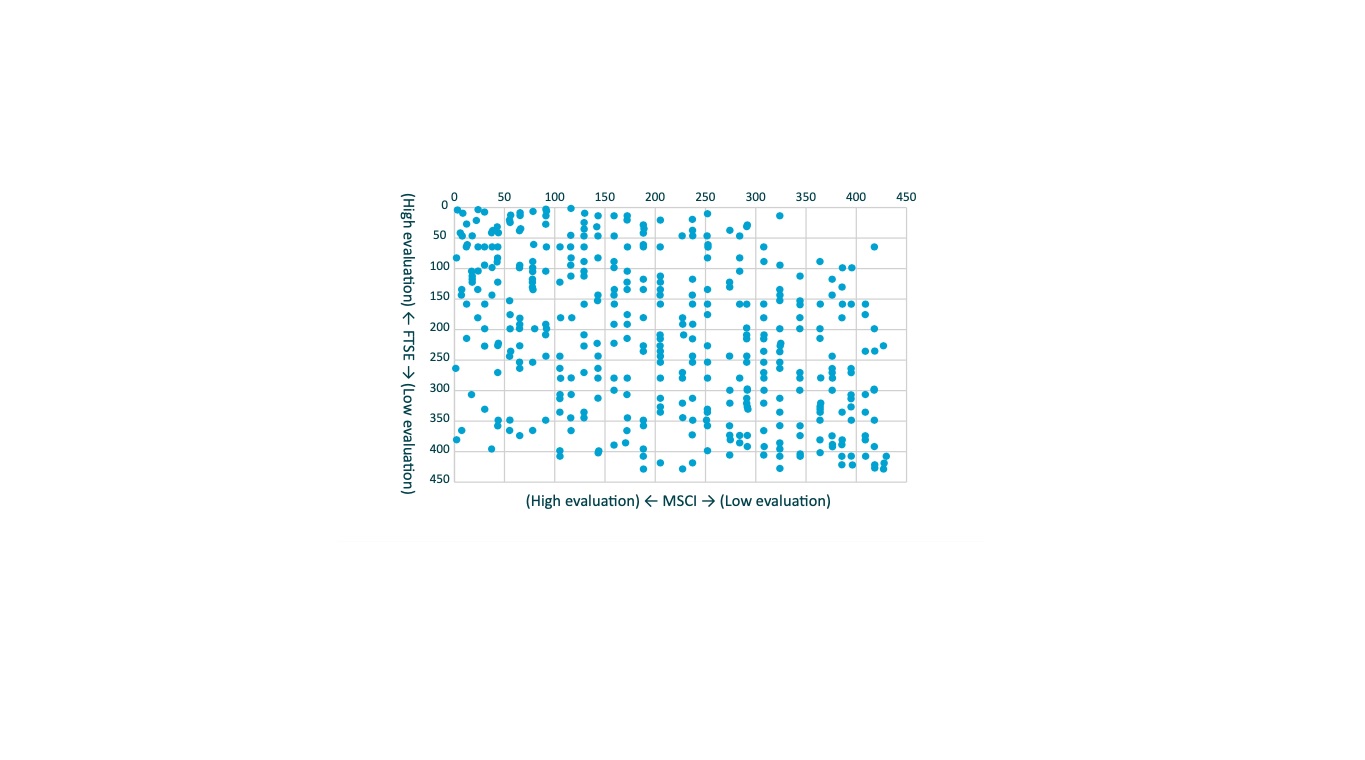

Comparison of ESG scores from FTSE and MSCI

Low correlation of ESG scores for Japanese equities given by two data providers. Source: GPIF (2017) - (See reference 5)

Dashboard Approach

At Generation, we prefer to take a ‘dashboard’ approach.

Looking at the raw data for a variety of metrics rather than aggregate scores – when we look at a company or sector.6 This is also how we present our integrated reporting to clients at the portfolio level. We doubt that aggregate scores are a more reliable means of allocating capital at scale.

Indeed, composite ESG scores risk creating further distance between an investor’s understanding of a company and its real-world impact. As the Financial Times put it, it can create ‘a false sense of confidence among investors who don’t really understand what lies behind the numbers — and therefore don’t really understand what they’re buying’.7 The equivalent in financial analysis would be to evaluate the quality of a company by looking only at its balance sheet.

ESG data today is also better suited to highlighting the worst performing companies. This situation has arisen because a common use of ESG data is ‘negative screening’ – excluding firms or entire sectors from investment portfolios, often on ethical or religious grounds (for example, tobacco, alcohol, munitions, and gaming).8 Another common use case is limiting exposure to poor labour conditions, corruption or other issues in the supply chain. In contrast, there is much less data available to help identify positive opportunities for sustainable investment.

A race is underway to provide a ‘single point of truth’ platform for ESG data. MSCI and Bloomberg, for example, now provide thousands of metrics and scores, either within their platforms or over an Application Programming Interface (APIs allow two pieces of software to communicate directly).

The demand for these tools is spreading into all parts of the financial sector. They are used by equity funds, fixed income managers, insurance companies and retail platforms, among others. We believe a rising number of investment firms already use the data in some form, and within these firms its use is spreading into new departments.

The consolidation of the ESG data universe is a sign of it maturing. For companies that pay for access, there are meaningful benefits arising from standardisation. However, ESG data suppliers appear to be creating ‘walled gardens’ – platforms only available to subscribers – and there is a risk of an asymmetry of information developing.

ESG data should be made available to non-industry players at affordable prices, to ensure proper scrutiny of companies and investors by civil society, academics, regulators and the media. There is a strong case for the most important data being made available for free – whether through existing financial reporting processes or some other mechanism.

THE WHAT AND THE HOW

In our own investment work, the ‘what’ usually comes before the ‘how’.

We are interested in companies consistent with a healthy, clean, fair and safe society. We would not be interested in investing in an oil company with the highest environmental standards.

In contrast, ESG data is currently much better at telling us how a business operates, rather than about what it does. By ‘what’, we mean that companies produce goods and services aligned with the society we want. By ‘how’, we mean that companies conduct their business in a long term, responsible way, with regard to all stakeholders.

This leads to ESG ratings which are often hard to reconcile with the need to tackle our climate and ecological crises. It is not uncommon to find companies like Phillip Morris and Exxon Mobil in ESG equity funds. One European manager's Sustainable Emerging Leaders fund has Russian oil company Lukoil as a top-ten holding. Citigroup found that in the top-rated ESG tier of one Index, about 10% of the bonds were issued by companies that produce fossil fuels.10

The ‘how’ is also important, but opportunities in a sustainable future are more meaningful when we consider the ‘what’.

For instance, consider an insulation manufacturer that provides essential materials for energy efficient buildings. Or a company that provides enzymes and chemicals that enable low energy processes and products to be created. Or one that produces the semi-conductors that power smart devices. When we look at healthcare companies, the impact of their products and affordability are our focus. Some of these companies will have an emissions footprint which affect their ESG scores. The societal benefit of the goods and services they provide is generally missed.

TOWARDS BETTER DISCLOSURE

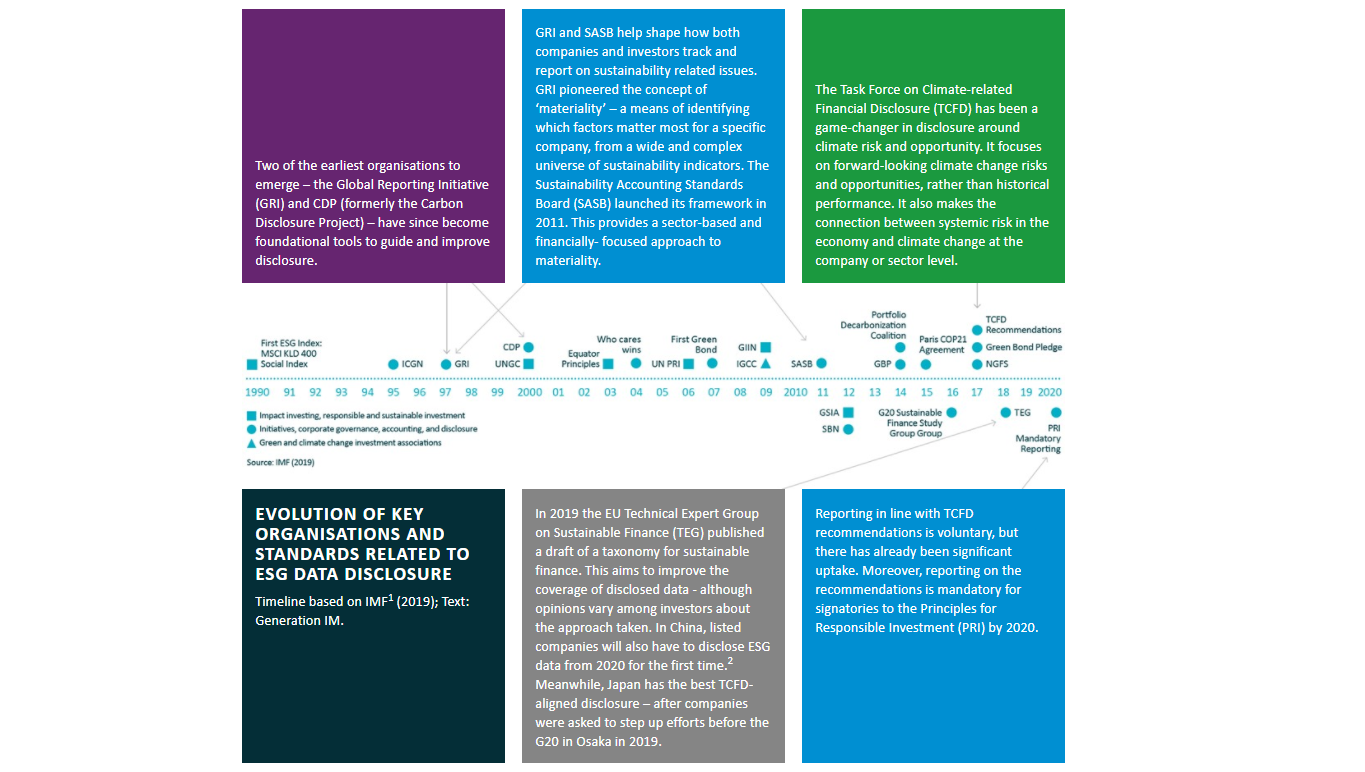

We have come a long way since the first sustained efforts to standardise and increase disclosure were launched at the turn of the century.

Two of the earliest organisations to emerge – the Global Reporting Initiative (GRI) and CDP – have become foundational tools to guide and improve disclosure.

In parallel, a growing number of jurisdictions are taking steps towards mandatory disclosure. This is motivated by some of the same concerns expressed by investors – as the IMF put it, policy makers have a role to play because ‘ESG-related disclosure remains fragmented and sparse, partly due to associated costs, the often voluntary nature of disclosure, and lack of standardization’.

Overall, we are supportive of these evolving frameworks. We engage in their development, and we also use them in our own work. There is no doubt however, that assessments based on these frameworks heavily depend on the available ESG data.

International Monetary Fund (2019). Sustainable Finance: Looking farther. Chapter 6 in Global Financial Stability Report.

Report by the PRI, The Generation Foundation and SynTao Green Finance (2018), ‘ESG data in China: Recommendations for primary ESG indicators’

The next wave of ESG data

We believe the next revolution in ESG data will have three characteristics.

1. Future-focused

ESG data should be focused on ‘the future we want’, to use the language of the UN Sustainable Development Goals.

Assessing whether a company is on a path that is consistent with our transition to a sustainable world is even more important than its current environmental and social impact.13

Globally, over 700 companies have now either committed to setting a ‘net-zero’ target or a science-based target, which set the decarbonisation pathway a company needs to follow to remain in line with the Paris Agreement.14 200 have committed to use 100% renewable energy by a specified year.15 There is an opportunity to use the wealth of energy and emissions data now available from providers like CDP to track performance against these targets, rather than against industry peers.

Under TCFD, companies are asked to disclose ‘forward-looking’ information. To test their resilience to climate change, some companies take their greenhouse gas emissions today and see how they would be affected by a higher carbon price, and what measures they could take to adapt. ‘Green patent portfolios’ are also used as a proxy for innovative capacity – i.e., these provide some indication of products that the company is developing for a low carbon world. These are only first steps, but they could develop into a toolset for assessing transition.

Climate change may have obvious time-bound requirements, but forward-looking disclosure is not only relevant to environmental issues. We believe companies should be assessed against their progress on social indicators too. For instance, once more data is available it will be possible to track progress towards closing the gender pay gap.

2. Real-world impact

Today’s ESG data provide only a limited window into real-world impact.

One practical opportunity exists around the use of highly granular data collection or modelling. The FTSE European Public Real Estate Association (EPRA) Nareit Green Indexes, for example, apply sustainability performance as ‘tilts’ to adjust the weights of constituents in the underlying index. They claim to maintain a similar returns profile to the parent index. At the same time, green certification increases by 63% while carbon emissions per dollar of revenue drop by 40%.16

Better data is also now available on how physical and economic shocks affect companies. Historically, it has been difficult to assess the risks companies face from extreme weather events. Information is now available at much finer spatial resolution, making it possible to allocate risk to specific infrastructure, supply chains and business locations. Economic impacts arising from climate change are being translated to the company level through the use of vectors such as commodity price increases, physical supply interruptions or land use valuations.17

We believe approaches like this which more tightly couple companies to real-world impacts (and real-world impacts on the companies) will also go some distance towards capturing what a company does, and the benefits it provides to the economy and broader society.

3. Management in transition

As long-term investors, we want to know that companies have the capacity and intent to set a clear strategic direction and navigate turbulent waters.

Today, it is possible for a company to get strong ESG scores by incrementally improving environmental performance to a level at least as good as its peers. These valuable steps forward can often be achieved without altering the company’s business model or product offering.

Yet companies now face much tougher environmental constraints and societal expectations that threaten their license to operate. We need better data around setting and implementing ambitious targets. We also need metrics to assess the capacity of the management team to implement profound changes to the business and enhance preparedness for future disruption.

The challenges are manifold and interlinked. Are management, for instance, well placed to manage a complex transition in line with the Paris Agreement, switch to regenerative agricultural production methods, and remove plastics from their supply chain? Does the company pay its fair share of tax? Some of the most fundamental questions being asked of companies are around a shift away from unsustainable patterns of consumption.18 Is management articulating how it will act to reduce raw material consumption and shift to a more circular economy?

Tackling our sustainability crises also requires collaboration, advocacy and purpose. We should be looking for evidence that management teams are forging alliances with their suppliers to drive sustainability along the value chain, as well as pushing for ambitious minimum standards in industry bodies. Participation in high ambition initiatives and voting records could provide insight here. We should be tracking whether their lobbying activities are in line with their high ambition public statements on sustainability.

To fully assess management quality in transition, investors need sustainability goals to be as clear as financial management targets. This includes better data on whether ambitious targets have been set and are being implemented. Whether senior executives are incentivised in line with these targets would be another useful indicator. At the same time, we believe better data would complement rather than replace the need for deep, ongoing engagement with management.

Five enabling innovations

The digitisation of the economy has opened up many new possibilities for collecting and processing ESG data. We set out five enablers of better ESG data below, along with examples of progress already being made.

Conclusions

Investors ignore the limitations of ESG data at their own peril.

Understanding data gaps and the need to place ESG data in context is the key to making sound investment choices aligned with long term sustainability.

The integration of sustainability within the investment process lies at the heart of Generation’s own approach. For our work – and for the wider investment sector – the question is how to close the gap between the growing array of rich contextual information available and what can be represented as company-level ESG data ready for use in decision making.

For firms collectively allocating trillions of dollars across every sector in the economy, the desire for a single-point-of-truth platform for ESG is irresistible. Ensuring the underlying data provide better proxies for the impact of both what companies do and how they operate is therefore an urgent task.

The next wave of ESG data is already emerging, enabled by digital innovation, new sources of disclosure and novel forms of third-party verification. We believe it will be more focused on the future – tracking towards science-based targets and an inclusive economy – and assessing whether management teams are on the front foot in the transition to sustainability.

We look forward to working with other stakeholders – data providers, investors, policy makers and civil society – to help build the next generation of analytical tools that will guide the trillions of dollars managed under the banner of ESG.

For instance, there is $17.5 trillion of assets in ‘ESG integration’. See Global Sustainable Investment Alliance (2019), ‘2018 Global Sustainable Investment Review’ www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf

Porter, M., Serafeim, G. and Kramer, M (2019). ‘Where ESG Fails’. Institutional Investor www.institutionalinvestor.com/article/b1hm5ghqtxj9s7/Where-ESG-Fails

CDP (2019), ‘Global Climate Change Analysis 2018’. www.cdp.net/en/research/global-reports/global-climate-change-report-2018

For details see CDP website. www.cdp.net/en/companies/companies-scores

GPIF (2017). ‘GPIF Selected ESG Indices’. Government Pension Investment Fund of Japan. Chart shows ESG scores for Japanese equities. www.gpif.go.jp/en/investment/pdf/ESG_indices_selected.pdf

A recent Goldman Sachs piece came to a similar conclusion on a benchmarking approach. See ‘GS SUSTAIN: Chart of the Week: Wrestling with ratings’.

Allen, K (2018), 'Lies, damned lies and ESG rating methodologies'. Financial Times. http://ftalphaville.ft.com/2018/12/06/1544076001000/Lies--damned-lies-and-ESG-rating-methodologies/

International Monetary Fund (2019). Sustainable Finance: Looking farther. Chapter 6 in Global Financial Stability Report. www.imf.org/en/Publications/GFSR/Issues/2019/10/01/global-financial-stability-report-october-2019#Chapter6

Neuman, B. (2019) ‘Credit rating agencies join battle for ESG supremacy’. Article in Financial Times on 17.09.19. https://www.ft.com/content/59f60306-d671-11e9-8367-807ebd53ab77

Benstead, S (2019). ‘Sin stock shock? Why ESG funds hold controversial companies’ https://citywireselector.com/news/sin-stock-shock-why-esg-funds-hold-controversial-companies/a1257972

International Monetary Fund (2019). Sustainable Finance: Looking farther. Chapter 6 in Global Financial Stability Report. www.imf.org/en/Publications/GFSR/Issues/2019/10/01/global-financial-stability-report-october-2019#Chapter6

Report by the PRI, The Generation Foundation and SynTao Green Finance (2018), ‘ESG data in China: Recommendations for primary ESG indicators’ https://www.unpri.org/download?ac=6500

Pinchot, A and Christianson, G (2019). ‘What investors want from sustainability data’. World Resources Institute. https://wriorg.s3.amazonaws.com/s3fs-public/wri-commentary-what-investors-want-sustainability-data.pdf

See the We Mean Business website www.wemeanbusinesscoalition.org/

See the RE 100 website http://there100.org/re100

16 FTSE Russell (2018). ‘FTSE Russell launches new green real estate indexes’. Press release. https://content.ftserussell.com/sites/default/files/press-archive/ftse_epra_nareit_green_indexes_04dec18.pdf?_ga=2.227170521.533520990.1572614070-445065341.1572614070

See the work of the Impact Lab in this area http://www.impactlab.org/

Lee, B (2017). ‘Are we on the cusp of a demand revolution?’ Hoffmann Centre for a Sustainable Resource Economy’. Chatham House https://hoffmanncentre.chathamhouse.org/article/are-we-on-the-cusp-of-a-demand-revolution/

Global Forest Watch (2016), ‘Linking products to places: the initiatives working to end deforestation’. https://blog.globalforestwatch.org/commodities/linking-products-to-places-the-initiatives-working-to-end-deforestation. Stockholm Environment Initiative (SEI) also has a relevant initiative in this area called ‘Transparent supply chains forsustainable economies (Trase)’. See https://www.sei.org/projects-and-tools/tools/trase/

Carbon Tracker (2018). ‘Nowhere to hide: Using satellite imagery to estimate the utilisation of fossil fuel power plants’ https://www.carbontracker.org/reports/nowhere-to-hide/

IMPORTANT INFORMATION

The ‘Future of ESG Data’ is a report prepared by Generation Investment Management LLP (“Generation”) for discussion purposes only. It reflects the views of Generation as at December 2019. It is not to be reproduced or copied or made available to others without the consent of Generation. The information presented herein is intended to reflect Generation’s present thoughts on ESG data and should not be construed as investment research, advice or the making of any recommendation. It is not marketing material or a financial promotion. References to any companies must not be construed as a recommendation to buy securities of such companies.

While the data is from sources Generation believes to be reliable, Generation makes no representation as to the completeness or accuracy of the data. We shall not be responsible for amending, correcting, or updating any information or opinions contained herein, and we accept no liability for loss arising from the use of the material.