We are also likely to see rapid shifts in market sentiment as investors begin to fully appreciate the scale of the challenge and get smarter at interrogating company climate action plans.11

3. Heading in the wrong direction

Companies that are decarbonising rapidly and helping to deliver zero carbon solutions do much more than manage risk well – they are better positioned for an enormous opportunity.

Think about what the most valuable companies look like in a net zero world. They are not the ones with a vague plan to decarbonise by 2050. They are innovating today to position themselves for the rapidly growing markets for sustainable goods and services.

While most of the conversation on climate naturally relates to the physical assets responsible for emissions, much of the value of companies today lies in their intangible assets – things like networks, platforms, know-how and intellectual property. This makes us wonder whether there is significant potential for intangible stranded assets – intangible assets that turn out to be incompatible or poorly aligned with net zero.

The big German car companies suffered a sharp fall in share price in 2015. While the proximate cause was the dieselgate scandal, the Paris climate negotiations had also put the spotlight on greenhouse gas emissions from vehicles. The intangible assets these companies had built to make high quality engines – specialist engineering teams, patents, a century of knowhow, and a brand built on engine performance – were suddenly in question. The value lost was much more than defunct manufacturing equipment, it was an impairment to these intangible assets. For companies that haven’t developed credible and bold strategies to transition to electric vehicles, it may be too late.

The bottom line is that not all climate action is equivalent, but the urgency applies to all companies in some form.12 It is sobering that despite the proliferation in climate-related announcements, nearly all systemically important companies for climate action are failing to take the near term action required, according to the recent net zero benchmarking exercise by Climate Action 100+.13

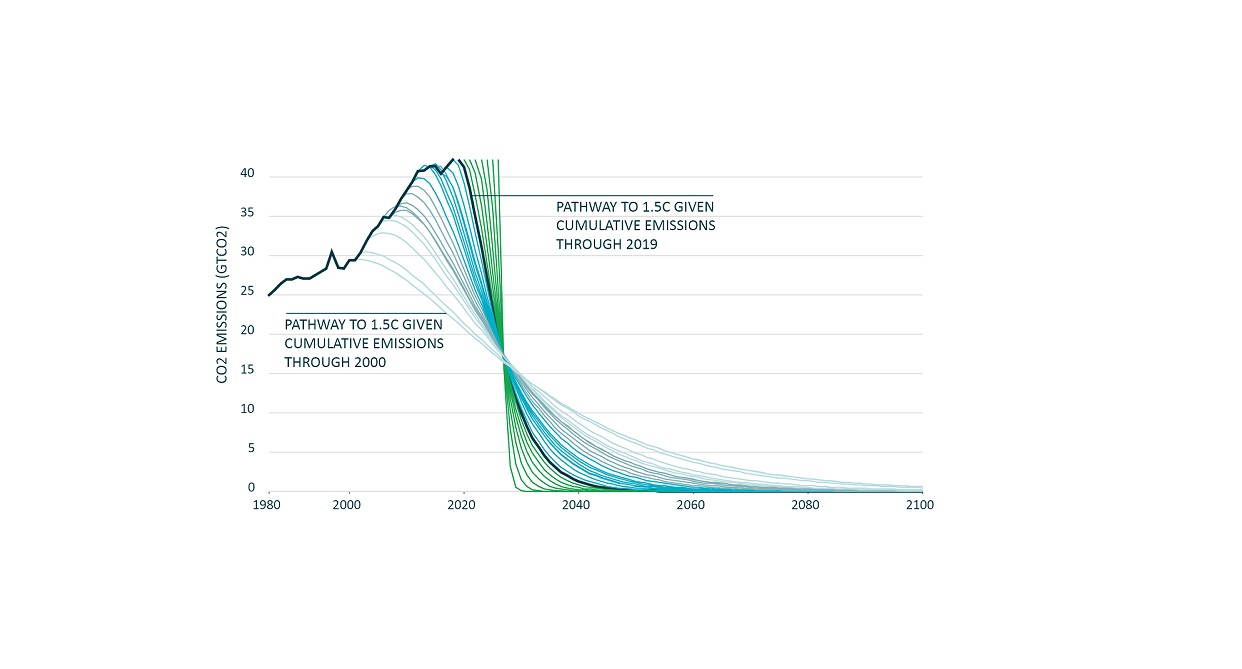

An astute investor should value climate action today more than a plan to cut it tomorrow. But she should also think deeply about how these dynamics could shape the future prospects of companies. Below, we explore the concept of the Time Value of Carbon from a few different perspectives, starting with our own investment process.