Note: This year’s Senior Partner Letter takes the form of prepared remarks, delivered at the firm’s Global Client Conference on 19 March 2024 by Generation Investment Management Senior Partner David Blood.

Welcome

Welcome, everyone. Twenty years. We are deeply grateful to you, our clients and partners, for your trust, advice and engagement, and for joining us on our collective journey to a sustainable society.

My remarks this morning will be in two parts. The first will remind you of our founding principles and mission, identify the key messages we hope you will take away over the next two days, and explain why we named the firm Generation. Part two will be a high-level review of our first 20 years and more importantly our focus for the next decade. I might even challenge us all to take action.

This Generation

Today, when we talk about the firm or Generation we mean Generation Investment Management, Just Climate and the Generation Foundation. There were 16 of us at the beginning. One of our first tasks was to agree on our mission, core values and founding principles. Our founding principles remain intact today:

- Generation is a mission-led, research-driven sustainable investment manager.

- We aspire to be outstanding investors. We pursue sustainable investment excellence as a way to demonstrate that sustainable investing is best practice.

- We seek long-term client relationships that enable us to pursue our mission by ensuring our interests are fully aligned with those of our clients.

- We are an independent, broadly owned and managed private partnership of values-aligned professionals.

There are six points about Generation we hope to bring to life over the next two days:

- Mission matters.

- Strong investment performance for our clients is our licence to operate. It also gives us a more powerful advocacy voice.

- We are proud of our team and how we work together.

- We are research driven. We use sustainability as a framework to identify risk and opportunities. We believe this approach reveals important differentiated insights, across both public and private markets. Sustainability research across markets is a competitive advantage.

- Our alignment with clients on both sustainability and timeframe is particularly important to us.

- Our leadership team, including the founders, is deeply committed for the long term.

20 years

Twenty years ago we began with the dual mission to deliver long-term, attractive, risk adjusted investment results and to increase the adoption of sustainable investing in the wider market. We wanted to use our investing skills to prove the business case for sustainable investing. And, we aspired to help finance and capital markets tackle the global sustainability challenges. We believed and continue to believe finance can be a force for good.

If we learned anything over the last 20 years, it is mission matters. It is our guiding light and has remained the same since we got started. We believe purpose is a competitive advantage.

Over the years many folks have asked about why we are called Generation. Our name, Generation, signifies many things to us.

We were initially inspired by the 1987 Common Future report which placed environmental issues firmly on the political agenda, and defined ‘sustainable’ as: ‘to meet the needs of the present without compromising the ability of future generations to meet their needs.’ Our name reminds us of the future generations we are serving in our alignment with clients and our long-term investment mindset. In addition, it affirms our commitment to developing a firm that long survives its founders.

We were initially inspired by the 1987 Common Future report which placed environmental issues firmly on the political agenda, and defined ‘sustainable’ as: ‘to meet the needs of the present without compromising the ability of future generations to meet their needs.’ Our name reminds us of the future generations we are serving in our alignment with clients and our long-term investment mindset. In addition, it affirms our commitment to developing a firm that long survives its founders.

We also strive to generate strong investment performance for our clients.1 This provides the fundamental proof point that allows us to exist.

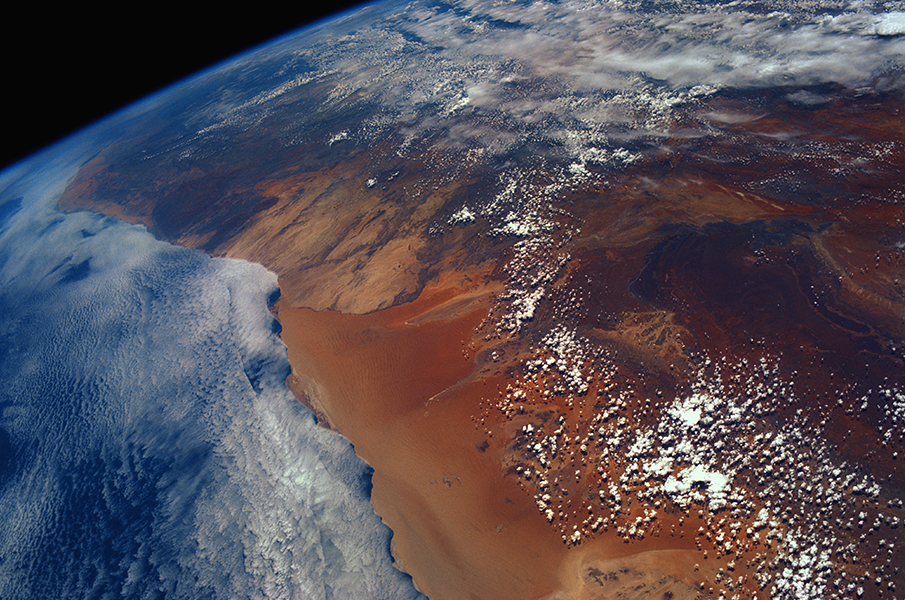

And critically, we recognise we are the last generation that has the opportunity, resources and, indeed, obligation, to do everything we can do to bend the emissions curve and transition to a sustainable world.

Looking back, we see in many ways we’ve achieved more than we could have hoped. We’ve worked with many others and together have helped sustainable investing to evolve from a niche strategy to a mainstream approach.

We are very uncomfortable tooting our own horn but with your forbearance we would like to take a moment to recognise some of our work in developing the field of sustainable investing since we started the firm.

We and others began with awareness building of the risks and opportunities in sustainability and the materiality of environmental and social impacts along with governance approaches. We went on to support efforts to standardise metrics and reporting frameworks, working with initiatives such as the Sustainability Accounting Standards Board and the Task Force on Climate-related Financial Disclosures.

Through Generation Foundation’s partnership with the United Nations Environment Programme Finance Initiative, we’ve considered the legal framework that governs fiduciary duty and investment decision-making. Today, we are helping at a jurisdictional level to spread the recognition that fiduciaries can and must consider sustainability factors, including impact, as part of their legal duty.

At an enterprise level, we’ve supported the B Corp movement (we are a B Corp ourselves) and the Impact Management Project. As engagement and shareholder activism have become important tools for investors to influence corporate behaviour, we’ve advocated for science-based targets for climate and, starting recently, for nature. We have also helped to establish with our peers the Net Zero Asset Managers initiative and Glasgow Financial Alliance for Net Zero.

Throughout all this, we’ve continued to share and deepen our understanding of sustainable investing – most recently, on climate-led investing with Just Climate.

Sustainable investing: what we have learned

While our collective progress in developing sustainable investing has been rewarding, there are challenges too.

Sustainable investing is three things at the same time: difficult, essential and not enough.

Sustainable investing is hard and it is not always win-win; there are often trade-offs. There are also data challenges to standardised measurement and integrated reporting. Addressing this is a critical priority to inform better decision-making and make trade-offs clear.

We have come to recognise to deliver a world in which prosperity is shared broadly, in a society that achieves well-being for all, protects nature and preserves a habitable climate we must drive the growth of sustainable investing and expand what capital values.

But sustainable investing is not enough. We see that while more capital than ever is flowing into sustainable investing, the world is still failing to achieve each and every one of the UN’s 17 Sustainable Development Goals, which seek to harmonise economic growth, social inclusion and environmental protection.

And so despite progress, we clearly need to do something different. We need transformational change across all aspects of our economies from industry to finance to public policy.

In every area we need to challenge conventional thinking, take appropriate risks and face up to the tough decisions that will take us where we need to go.

With change in mind, in 2021 we committed to working with others on five societal goals:

- A global price on carbon;

- A Just and Inclusive Transition, with workers empowered through a living wage;

- Commitments to a 2050 or sooner net-zero target with robust portfolio alignment reporting;

- Deforestation free supply chains; and

- Capital allocation frameworks to measure risk and return, and impact adopted as best practice.

This critical decade: our commitment

We remain inspired by these objectives, but by setting some of these goals beyond our firm and even our industry’s reach, we realised in a way we could be perceived as letting ourselves off the hook. We absolutely want to be 100% on the hook for our mission, for our clients and for future generations’ right to a sustainable world. Therefore, our intention for the remainder of this critical decade is to double down on our mission through objectives that are aligned with our business. We believe we have delivered and will continue to deliver strong risk adjusted investment results and impact. However, it is the second part of our mission, the widespread adoption of sustainable investing, which is more rigorous and expands what capital values, that is key to achieving the transformation required in finance.1

Before I share what we will do, let me start with what we will not do: we are not conceding the definition of sustainable investing to politically motivated detractors. We will not shy away from our identity. We are proud to be a sustainable investment firm. It is all we do, and all we will ever do. We are not running from equity, diversity and inclusion because some find it convenient to divide. And, we are not overlooking communities in the Southern Hemisphere who hold many of the answers to these challenges but whose voices are so often excluded from the debate.

So, what are we committed to doing?

We are certain our advocacy voice is strengthened by our investment results. Similarly, our position as a sustainability leader is dependent on our commitment to innovating and driving sustainability ambition and best practice.

To this end, we recently reaffirmed and strengthened the commitment to our mission and core values in our partnership agreement. We will also ensure all our colleagues are connected to and can deliver on the mission.

To fulfil our mission and our duties as investors, we will:

- Continue to allocate capital to deliver both long-term, attractive, risk-adjusted investment returns and positive impact;1

- Engage with our companies to: scale their businesses that provide solutions to the world’s most pressing challenges, but also shine a light on where action is needed to make their impacts on people, the planet and the economy fall within planetary boundaries and meet societal needs;

- ‘Walk the talk’ and strive to model what a truly sustainable business looks like, in terms of how we run our firm; and

- Help create the enabling conditions for investors and capital to achieve sustainability outcomes and impact. The Generation Foundation will continue its market-building efforts, and collectively we will explore new opportunities to invest in transformational business models, sustainable solutions and systems change.

We will measure and report on our progress. By all means, please keep us very much on the hook.

What should capital allocators do?

The artist Michelangelo is purported to have warned: “The greater danger for most of us lies not in setting our aim too high and falling short; but in setting our aim too low, and achieving our mark.”

As we reflect on our first 20 years and the next ten, we are determined to create the sustainable future we want and need. We must all ask the hard questions about how the financial system (and we as actors in it) must change to address the urgency of the Just Transition to a net-zero world. We believe the very nature of capital markets is to respond to, and provide a means for, society’s ambitions. We will not attain a sustainable economy unless the stewards of capital consciously allocate the funds to help create it. It is important to remember finance is not a static concept. It evolves.

Let’s all be clear, a pensioner living in a 3.0°C hotter world, with degraded eco-systems and significant economic inequality, will not enjoy the fruits of their retirement. Acting on the sustainability crisis is our fiduciary duty.

Our aim is to use sustainable investing to drive the transformation of our economies.

You will remember, at the outset, I said I might challenge us to action. Well, here are actions that we at Generation hope you, our partners on this journey, will take:

- First, acknowledge it is part of your fiduciary duty to assess sustainability impact, both positive and negative.

- Make impact an objective, and use it as a source of return.

- Set your parameters and actively engage with your investments.

- Commit to capacity building, including helping address data and reporting challenges.

- Consider policy as a tool in your toolbox – we need nothing short of sweeping revision of public policy throughout the world.

- Collaborate – by influencing peers and sharing research, ideas and resources. The sustainability challenges are too great. We must work together to solve them.

Future generations

In closing, the English-American activist and philosopher Thomas Paine said: “If there must be trouble let it be in my day, that my child may have peace.” We are all very lucky to be alive today in an incredible moment of change. In the history of humanity, rarely has the impact on future generations been so dependent on a single decade of decision-making. In facing our responsibility, we are fortunate to have each other’s support. With your partnership, we are determined to do everything we can to meet this challenge. We are the generation that has both the resources and the obligation to transition to a sustainable world. With your help we can – and will – prevail. Thank you.

David Blood, Senior Partner, on behalf of the Partners and employees of Generation Investment Management, Just Climate and the Generation Foundation

- Generation seeks to deliver attractive returns and positive impact, but there can be no guarantee this goal will be achieved.