Climate change is a threat to human well-being and planetary health. There is a rapidly closing window of opportunity to secure a liveable and sustainable future for all … The choices and actions implemented in this decade will have impacts now and for thousands of years.1

In aggregate, global action on climate remains far short of what is required to limit global temperature rise to 1.5°C, the aspirational goal of the Paris Agreement. Indeed, it is now obvious that we are collectively failing on achieving every single one of the 17 UN Sustainable Development Goals (SDGs) – especially Climate and Poverty/Inequality.2

It is clear we will not attain a sustainable economy unless the stewards of capital consciously allocate the funds to help create it. To achieve a sustainable world in which prosperity is shared broadly, where all people have the opportunity to lead fulfilling lives and where society protects nature and preserves a habitable climate we will need to expand what capital markets value.

It’s important to remember, finance is not a static concept. It evolves. For example, in the 1970s the notion of being paid for taking risk developed launching the venture capital and high yield markets.3 Today, if the investment industry is to deliver against our net-zero commitments, or indeed any other of the SDGs, we need to seriously reconsider how and where our capital and engagement efforts are allocated.

Climate-led investing as a capital allocation imperative

The opportunity: the International Energy Agency estimates the world will need to mobilise nearly $5 trillion per year by the 2030s to decarbonise the world economy.4

The transition to net zero will be the most significant shift in our lifetimes, indeed possibly in history. It will be a “dramatic overhaul of every aspect of our lives: from what we eat to how we travel, and what we wear, from where we live to the kind of jobs available and of course the energy sources that power it all.”5 The sheer magnitude of decarbonising the economy presents an opportunity for investors unlike any other chapter in the history of financial markets.

The good news is there is no shortage of available capital, and the flows of capital to climate solutions are increasing. There is encouraging growth in capital going towards certain segments such as the roll-out of renewables, as well as technology-driven, asset-light businesses that support a net-zero aligned economy. However, the different news is they are still not large enough, nor are they going everywhere they need to. Far too little capital goes to solutions that can decarbonise the harder-to-abate parts of the economy, such as steel and cement production, industrial heat, charging infrastructure for vehicle fleets, and land use. These sectors still cause over half of global emissions today.6

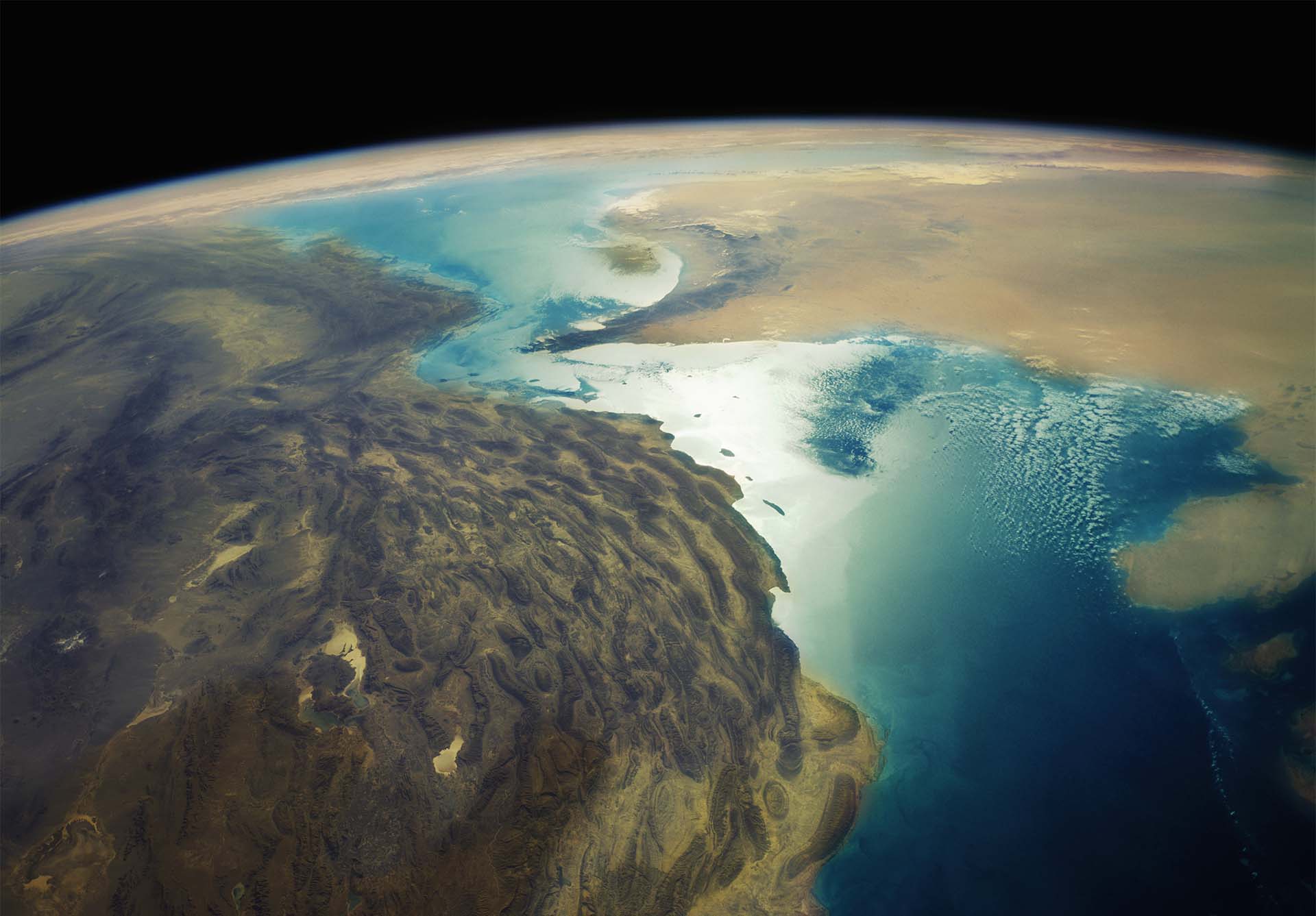

Investors must also consider geographic location of their net-zero investments as some of the widest gaps persist in areas with the greatest and timeliest impact potential, such as parts of Africa, South America and Southeast Asia. In addition, as we ‘transition in’ climate solutions that can radically reduce or remove greenhouse gas emissions and ‘transition out’ the legacy carbon-intensive business models, affected workers and communities that are hurt cannot be ignored. A singular focus on reducing greenhouse gas emissions will not secure the buy-in from society that is required to see us through this disruptive transition. We must ensure that the views of people most affected are considered in decision-making. Such consultation is critical for companies to build strong relationships with stakeholders, who in turn affect their performance and prospects, and ultimately financial value for investors.

There are no legal barriers in the way of net-zero action by investors.7

While the opportunity is clear, many investors still question whether sustainable investing is consistent with fiduciary duty. But, the Freshfields report titled “The Legal Framework for Impact” sponsored by the Generation Foundation in partnership with the PRI and UNEPFI, highlights that investors can invest for sustainability impact and in many cases it is their fiduciary duty to do so.

We are well aware financial return is generally regarded as the primary purpose of investment. However, as the Freshfields report shows, investors should consider sustainability impact when it can help achieve financial objectives. Climate-led investing is the perfect example.

Climate change is and will continue to have devastating impacts on people and nature. We believe investors who do not consider climate are putting capital at risk and not fulfilling their fiduciary duty. Moreover, investors have a responsibility to support a healthy economy and financial system. This means failing to incorporate sustainability impact into our risk and return framework can breach our responsibilities to our clients. A pensioner living in a 3°C hotter world, with degraded ecosystems and significant economic inequality will not enjoy the fruits of their retirement.

How we define climate-led investing.

Investors can better navigate a just transition to net zero by adopting a new framework for capital allocation. Climate-led investing starts by identifying the climate solutions with potential for highest impact defined as avoidance and/or removal of greenhouse gas emissions that are at scale, timely and consistent with a sustainable end state, including a pathway to a maximum of 1.5°C global warming and a just transition. Climate-led investing then seeks to allocate capital to climate solutions that can not only address these greenhouse gas emissions but also generate attractive risk-adjusted financial returns for investors.

Critically, climate-led investing must also be:

- Transformational – have the potential to scale and replicate globally to transform entire industries

- Catalytic – accelerate the deployment of capital into the most promising climate solutions

- Sustainable – ensure that climate solutions will operate within planetary boundaries and social norms

Team incentives must reward both climate impact and financial returns in order to embed climate-led investing in team culture and investment processes.

Conclusion

None of the decisions facing our industry, or any other industry for that matter, are easy. In every area, we need to challenge conventional thinking, take appropriate risks and face up to the tough decisions that will take us to where we need to go.

We are determined to create the sustainable future we want. We must ask the hard questions of ourselves and others about how the financial system (as actors in it) must change to address the urgency of the net-zero and just transitions. Remember, finance evolves. We believe the very nature of capital markets is to respond to, and provide a means for, society’s ambitions. Expanding what capital markets value to prioritise sustainability impact in capital allocation is essential to our ability to achieve our aspiration for people, climate and nature.

- Intergovernmental Panel on Climate Change Sixth Assessment Report, March 2023

- Climate Action 13, Nature (Sustainable use of ecosystems 14/15), and Inequality 10. Progress Chart on SDGs: https://unstats.un.org/sdgs/report/2022/Progress-Chart-2022.pdf

- Howard Marks “Sea Change”, December 2022

- International Energy Agency. https://www.iea.org/reports/world-energy-investment-2023/overview-and-key-findings

- The Transformation of Growth: How Sustainable Capitalism Can Drive a New Economic Order, Generation Foundation, June 2017.

- Working Group III contribution to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_TechnicalSummary.pdf

- Legal Framework for Impact. The analysis aimed to determine the extent to which legal frameworks enable investors to consider impact in their activities across 11 jurisdictions: the EU, Australia, Brazil, Canada, China, France, Japan, South Africa, the Netherlands, UK and the US.