Introduction and Overview

2021 was a pivotal year for sustainability and its prominence on the global stage, as financial markets began to reckon with the severity of the climate crisis, global inequality, and the continued effects of COVID on communities, supply chains, inflation and global trade. While many pockets of the economy faced headwinds, we saw tailwinds from an increased and urgent demand for businesses offering solutions to address sustainability challenges.

This Sustainability and Impact report covers our third Growth Equity Sustainable Solutions Fund (SSF III), which closed with just over $1 billion of committed capital in 2019 and is now almost fully invested as of writing. We added five new companies in 2021 and the final two companies added in early 2022 will feature in next year’s report.

At Generation, we refer to sustainability as having two dimensions – what a company does and how a company operates. As such, we believe the best companies will be able to consistently capture and report on both the contribution of their products and their operations towards a net-zero, prosperous, healthy, fair and safe future. But measurement is not the end-game – the very best companies will also be using meaningful quantification of impact to regularly reflect on and improve their performance. In 2022, you can expect us to continue to support our companies on their journeys to best practice on both levels.

Growth Equity

Overview

Investment Strategy & Approach

Strategy

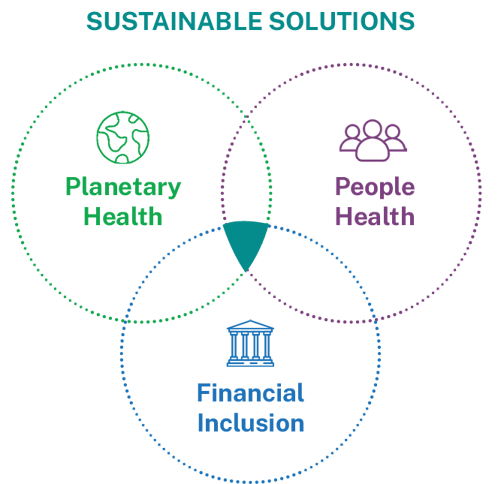

We invest in companies whose products, services and operations contribute to the global outcomes of planetary health, people health and financial inclusion.

We seek to back companies that drive clear impact across our three outcomes domains, as detailed in the table below. Using our systems thinking lens, we also understand that these outcomes are often interrelated, and we take this into account in our investment research and evaluation – planetary health influences people health and financial inclusion, and the other way around.

We believe this will be the defining decade for driving the transformational changes needed in climate and social action. Click on the video below to hear more from Lucia Rigo, Partner in Growth Equity.

Hear about The Defining Decade

Approach to Portfolio Impact and ESG Performance Measurement

We select at least one ‘North Star’ impact metric to measure each business’ contribution to the above goals, and report on outcomes mapped to the UN Sustainable Development Goals (SDGs), alongside core ESG performance metrics. For companies contributing to Financial Inclusion and People Health, we conduct social outcomes benchmarking using beneficiary surveys. For companies contributing to Planetary Health, we analyse their total environmental impact through Lifecycle Analysis (LCA). We also analyse our business’ overall contribution and risks to impact using the Impact Management Project (IMP) framework. Finally, using GHG emissions measured as part of our core ESG performance metrics, we have also begun to engage our portfolio in reporting aligned to the Task Force on Climate-related Financial Disclosures (TCFD) and in setting Science-Based Targets (SBT), in line with Generation’s commitment to align our portfolio to net zero by 2040 or sooner.

Planetary Health |

People Health |

Financial Inclusion |

Reporting Frameworks: |

|

| Impact Outcomes |

GHG Mitigation Pollution Avoidance Resource Efficiency |

Access Health Outcomes System Cost Efficiency |

Access Earnings Growth System Cost Efficiency |

|

| Impact Metrics |

|

|

|

|

| ESG Performance Metrics | Environmental, Social, and Governance (ESG) information captured across the portfolio |

|

||

Portfolio Results

Within our portfolio in 2021, we saw a significant step forward in disclosure and transparency on all fronts. We have deepened our focus on carbon accounting (including 100% disclosure of Scope 1, 2 and 3 emissions across our private portfolio for the second year)3 and are taking early steps to support companies with setting Science-Based Targets. Equity, diversity and inclusion (EDI) outcomes improved, with 42% of portfolio management teams identifying as female or non-binary and 40% as people of colour (POC). Importantly, we also tapped our extensive network for multiple Board searches, leading to a three percentage point increase in average Board gender diversity. Next year, we aim to scale the strong performance on diversity achieved by many of our portfolio companies (including three companies with >50% POC on the Board) to the entire portfolio.

Click on the logos below to read more about results from companies in the portfolio.

AlayaCare

What it Does

AlayaCare is a home care and home health care software provider, selling an all-in-one SaaS solution to over 500 agencies across Canada, the US and Australia. Its flagship platform offers clinical (e.g., plan of care) and non-clinical (e.g., scheduling, workforce management) modules to home care agency stakeholders including office workers, schedulers, caregivers and patient families.

System Positive Thesis & Solution

According to the US Centers for Medicare and Medicaid Services, home health care is 99% cheaper than acute hospital care and 84% cheaper than in a skilled nursing facility, generally more convenient, just as effective and can lead to better outcomes. Further, better optimisation of care provider routes can lead to reduced emissions. We believe that a more efficient and effective health system is one with greater home care, and growing the home care market requires easier-to-use, comprehensive care agency platforms. AlayaCare is leading this change.

Impact Insights

- What. Generation supported AlayaCare’s first beneficiary survey, finding that care providers reported improved access to shifts and decreased hospitalisation rates for clients.4

- How. In 2021 we helped AlayaCare launch its first sustainability KPI dashboard and GIM Chairman Al Gore delivered the virtual keynote for the Home Care 100 conference as AlayaCare’s guest, underscoring the importance of home care to a sustainable healthcare system.5 Additionally, the Board added its first female member, Marki Flannery, former healthcare executive.

Investment Detail

Year Invested

2021

Andela

What it Does

Andela is a marketplace for technologists, enabling talented individuals from Africa and elsewhere to find high-quality software engineering opportunities with vetted technology companies globally – “connecting brilliance with opportunity.” Andela attracts job-seekers with a unique combination of remote-first work, facilitated payments and a skill development programme, and its seamless approach to curating and onboarding remote teams attracts global enterprise clients.

System Positive Thesis & Solution

By upskilling and economically empowering software engineers across Africa and other geographies, Andela can increase access to work and the earnings of thousands of individuals.

Impact Insights

- What. Andela’s marketplace model excelled in 2021, turning a 4% growth in engineers trained into 49% revenue growth. In 2021 84% of engineers reported increased earnings due to Andela, a substantial improvement.

- How. In 2021 Generation helped Andela appoint Laurie Hodrick as an Independent Director with Audit Chair experience, increasing gender diversity of the Board to 50%. We also continued to support the transition to a marketplace model and focus on senior engineers with a leaner (remote) staffing model.

Investment Detail

Year Invested

2018

Back Market

What it Does

Back Market is the largest online marketplace focused on refurbished consumer electronics, with nearly five million customers and 1,500 professional sellers worldwide. The company was founded in 2015 by three friends who had realised the positive environmental impacts of buying refurbished consumer electronics and launched a platform to remove the challenges that willing buyers experienced.

System Positive Thesis & Solution

With its sorting and curation technology and a clear consumer interface, Back Market brings price transparency, quality, trust and customer service in line with what consumers experience when buying a new device, removing frictions holding demand back. The company’s circular system also extends the lifetime and value of consumer electronics, reducing carbon emissions, the pressure on raw materials and unsustainable sourcing (e.g., worker exploitation, environmental impacts).

Impact Insights

- What. We supported Back Market with a Lifecycle Assessment of its service, demonstrating that emissions avoided by Back Market account to a substantial 310k tCO2e and 1,600 metric tonnes of e-waste avoided.

- How. In 2021 Back Market focused on using partnerships to remove barriers to reused goods sales. This included launching a “Certified Renewed” collection with known brands (Samsung, Microsoft, Dell) to increase the credibility of used electronics and spread the philosophy of “thinking second hand first.”

Investment Detail

Year Invested

2021

Benevity

What it Does

Benevity is a provider of corporate purpose SaaS, providing an integrated suite of community investment and employee, customer and non-profit engagement solutions that help large enterprise and mid-sized companies attract, retain and engage today’s diverse workforce, embed social action into their customer experiences and positively impact their communities.

System Positive Thesis & Solution

Corporate purpose is becoming an increasingly important topic on corporate agendas, as a talent and customer attraction and engagement strategy. Yet, many companies lack the resources to offer comprehensive scalable solutions. Benevity solves this problem with a holistic solution that connects companies and their people with the causes they care about through an all-in-one platform that facilitates online donations, matching programmes, disaster/crisis relief support, flexible volunteering, community engagement, pro-social learning and actions, and the mobilisation of affinity groups and Employee Resource Groups. In this way, Benevity enables companies and their people to support causes critical to creating a more sustainable economy, such as climate change, social justice and health.

Impact Insights

- What. Generation supported Benevity’s first beneficiary survey. In total, Benevity helped 77% of clients build a stronger, more connected culture and provided 64% of causes with an increased ability to raise funds.

- How. In September, GIM hosted a roundtable with our Chairman, Al Gore, for Benevity on “Climate Action for CSR Executives,” including a dozen accounts and prospects and resulting in several high-quality introductions.

Investment Detail

Year Invested

2021

Convoy

What it Does

Convoy is a digital freight marketplace that connects shippers with carriers to move hundreds of thousands of truckloads, saving money for shippers, increasing earnings and reducing hassle for carriers, and reducing carbon waste for the planet.

System Positive Thesis & Solution

Truck freight accounts for 7% of all US greenhouse gas (GHG) emissions, (i.e., 436.5 million tCO2e per year). Of this, 49% are booked as full truckloads, of which ~30-35% are empty miles, leading to 72 million tCO2e in avoidable emissions from this segment alone.6 By improving trucking utilisation, we believe that Convoy can deliver higher earnings for carriers, lower shipping costs and reduce empty miles driven and carbon emissions.

Impact Insights

- What. With help from Generation, Convoy published its inaugural Sustainability Report. Convoy’s positive impact continues with litres of fuel saved increasing 56% and GHG emissions avoided improving 55% year on year.

- How. In April 2021, Convoy joined The Climate Pledge. Signatories of The Climate Pledge commit to reaching net-zero carbon emissions by 2040, ten years ahead of the goal set out in the Paris Agreement.

Investment Detail

Year Invested

2019

Elation Health

What it Does

Elation Health is a healthcare technology company powering the future of independent primary care. The company works with 23,000 independent clinicians serving more than nine million patients across the US. Elation’s clinical-first roots, value-based tools, application programming interfaces (APIs) and data exchange tools enable organisations to shift to value-based care (VBC) and to transform the patient and provider experience.

System Positive Thesis & Solution

In the US, primary care is an underinvested part of the healthcare system. Salaries and reimbursement rates are lower than specialty care, constraining physician supply. Many incumbent software tools for primary care are not cloud hosted or API-enabled, with poor user experience. Elation addresses these inefficiencies, unlocking improvements to physician work experience, reducing stress and burnout and improving quality and efficiency of care.

Impact Insights

- What. During 2021, Generation supported the company’s first beneficiary survey. In total, 57% of physician users surveyed reported increased ability to deliver patient-centred care and 43% reported decreased levels of stress and burnout due to Elation.

- How. Generation supported the search for an independent Director at the Board level, which resulted in the addition of Al Ko, CEO at Early Warning/Zelle and former executive at Intuit. In tandem, Elation supported its physicians by launching its first risk-bearing MedGroup in Hawaii, bringing over 4,000 lives into value-based care arrangements, enabling more holistic patient care and outcomes-aligned reimbursement.

Investment Detail

Year Invested

2020

Guideline

What it does?

Guideline is a comprehensive, low-cost retirement platform for small and medium-sized businesses (SMBs) across the US. The company has built an inhouse technology solution that automates record keeping and administration and allows employers to seamlessly onboard employees (through auto-enrolment) while ensuring plan and regulatory compliance.

System Positive Thesis & Solution

There are 5.8 million small businesses in the US; only 10% offer a 401(k) plan to their employees, and when they do, historic participation is around 52%.7 Incumbent 401(k) providers have struggled to adequately extend services to small companies, leaving this segment with few options. Guideline’s focus on small businesses helps close the retirement savings gap by driving 401(k) penetration in SMBs.

Impact Insights

- What. Among Guideline customers, 96% of plans acquired in 2021 were first-time plans, meaning the businesses had never offered staff a 401(k) before choosing Guideline. This is a significant improvement over the status quo.

- How. In 2021, Generation helped Guideline hire new Board member Ginny Lee, former President of Khan Academy and SVP at Intuit, as the first woman on the Board.

Investment Detail

Year Invested

2020

Gusto

What it Does

Gusto is a software platform designed to automate and simplify payroll, HR and benefits for micro, small and medium-sized business (SMBs).

System Positive Thesis & Solution

Between 2009 and 2018, workers in the bottom tenth percentile of wages saw benefits fall by around 2% in real terms.8 This is particularly poignant for small businesses, employing over half the US’s private sector workforce. Many payroll and benefits products, which play a critical role in economic inclusion for SMB workers, are designed for larger organisations and not fit for purpose. Gusto is a key intermediary, providing more bargaining power to SMBs, enabling workers to get better rates on health insurance and benefits. Ultimately, Gusto can increase take-home income for populations that are traditionally underserved.

Impact Insights

- What. In our most recent beneficiary survey, 81% of SMB customers reported a positive impact on their business due to Gusto. Gusto also continues to leverage its internal data to derive sustainability insights, publishing a report on the pandemic’s gender pay gap impact. Generation invited the author Luke Pardue, Economist at Gusto, to share the report’s findings at our Pay Equity Roundtable.

- How. In 2021, Gusto added Lori Dickerson Fouché and Vicki Fuller as two new independent members to their Board of Directors. Both women bring considerable financial services experience. Further, Gusto launched the Payroll Network, a set of partnerships that puts consumers in control of how their sensitive data is shared with third parties, to prevent potential harm through privacy breaches.

Investment Detail

Year Invested

2019

Nature's Fynd

What it does?

Nature’s Fynd is a Chicago-based food tech company creating versatile alternative proteins to nourish the world’s growing population while nurturing the planet. Born out of research conducted for NASA on microbes in Yellowstone National Park, the company’s breakthrough technology produces Fy Protein. Nature’s Fynd uses Fy to make nutritious and sustainable meat and dairy alternatives.

System Positive Thesis & Solution

The food supply chain is responsible for 26% of global GHG emissions. Agriculture also causes 80% of land-use change and habitat destruction, and is responsible for two thirds of fresh water withdrawals, driving 90-95% of global, scarcity-weighted water use.9 Nature’s Fynd produces a highly nutritious complete protein using only a fraction of the resources required by traditional agriculture and with minimal processing, to help efficiently feed a growing global population in a net-zero world.

Impact Insights

- What. This year, Nature’s Fynd focused on the launch of its meatless breakfast sausage and dairy-free cream cheese in retail stores on the West Coast, including video-based education and key messaging around the nutrition and sustainability value proposition of Fy fungi protein.

- How. With support from Generation, the company revised its Environmental Performance and Lifecycle Assessment. Angela Du from SoftBank also joined the company’s Board of Directors.

Investment Detail

Year Invested

2020

Pivot Bio

What it Does

Pivot Bio has unique and defensible intellectual property related to biological nitrogen fixation pathways and has developed a family of naturally-occurring microbes which convert (“fix”) atmospheric nitrogen into plant-usable nitrogen.

System Positive Thesis & Solution

The production of synthetic nitrogen fertiliser accounts for 2% of global energy usage10 and 7% of downstream carbon emissions11; almost half of synthetic nitrogen fertiliser leaches into groundwater, causing significant environmental damage.12 Pivot Bio provides a more reliable and consistent method for delivering plant nutrition, improving crop yield by an average of 15% compared to synthetic fertilizers. Further, the microbes are naturally-occurring (though genetically edited) and do not destroy the soil microbiome, preserving its nutritional richness and staving off depletion.

Impact Insights

- What. In 2021, Pivot Bio launched a dedicated programme, N-Ovator, to validate nitrogen fixation benefits in the field for farmers. Additionally, with our Chairman Al Gore, Generation supported Pivot Bio in convening a Regenerative Ag and Soil Health roundtable in 2021 to showcase the company’s products as an industry-leading climate solution.

- How. In 2021 Pivot Bio, with the help of Generation and the Nominating & Governance Committee, focused on expanding Board gender diversity. The search was successful in identifying two new Board members who joined in 2022: Monica McGurk, formerly with Kellogg’s, and Susan Kim, CFO of Pacific Biosciences. Pivot Bio also established a framework for Impact and ESG reporting which went through initial Board review.

Investment Detail

Year Invested

2021

Vestiaire Collective

What it Does

Vestiaire Collective is a global online marketplace for pre-owned luxury fashion with more than 7.5 million members in over 50 countries. Close to 30,000 items are added weekly across fashion categories. The company was founded to promote circularity in the fashion industry to make it more sustainable and to broaden access to high quality goods.

System Positive Thesis & Solution

In 2021, the fashion industry and its supply chain was the world’s third largest polluter, producing 5% of the world’s GHG emissions.13 Encouraging circularity by reselling fashion goods extends their life, reduces waste and reduces fashion goods’ carbon footprint, contributing to reducing the footprint of the fashion industry as a whole. Vestiaire Collective plays a critical role in facilitating this shift to a more sustainable fashion industry worldwide.

Impact Insights

- What. Generation supported Vestiaire Collective in conducting an LCA, building on the company’s own initial work.

- How. In 2021 Vestiaire Collective received a B Corp Certification with a score of 89.4. Generation also supported the company in calculating its full carbon footprint this year.

Investment Detail

Year Invested

2021

In Focus: Equity, Diversity, and Inclusion (EDI)

Context

Generation continues to consider diversity to be a critical sustainability factor that drives business and investment success, with our vision focused on ensuring not only a net-zero but also an equitable and safe world. To this end, we are pleased to see increasing interest in diversity disclosure by the regulators governing corporate disclosure in the markets in which we operate. As we move toward greater and more systematic disclosure, we are broadening and enhancing our definition of what diversity really means and how to best represent this in our reporting. As a result, this year marks an important evolution in our conceptualisation of gender and our reporting approach, in which we report on our companies’ workforce gender diversity including a non-binary category.

Engagement

Across our portfolio, the momentum building behind EDI in 2020 continued into 2021. Our engagement strategy continued to focus on disclosure and in setting the tone from the top, engaging with portfolio companies on Board composition to improve diversity of the Board, providing a spotlight on diversity at our System Positive Summit, and connecting our companies with the resources to support development of their workforce EDI strategies. To name a few examples over the course of 2021, we supported Andela in hiring a new female independent director, helped Guideline add their first female executive to the Board, and worked with Pivot Bio to identify two experienced female executives to join their Board, including one who joined as Chair of the Audit Committee.

Sources: Percentage Female & Non-Binary14, Percentage POC15

Definitions: Management16, Technical Staff17, Other Staff18

Insights

We note continued improvements in diversity at the management level with 40% identifying as a person of colour (POC) and 42% as female or non-binary (up from 38% and 30% in 2019, respectively). Disclosure of gender diversity significantly improved in 2021, with 100% of companies reporting on the Board and 92% also reporting on workforce composition. EDI is getting strategic attention with two companies making their first dedicated EDI leadership hires, two initiating strategic EDI consultant partnerships and three setting up dedicated EDI taskforces or committees.

Example initiatives within the portfolio

One of our companies has recently updated their approach to hiring diverse candidates, with a partnership programme to ensure a pipeline of talent from underrepresented groups, representative interview panels and the use of a de-biasing software platform to ensure written hiring communications are inclusive.

Another company recently created their first three-year EDI strategy, merging international EDI goals (improvements in gender, disability and LGBTQ+ representation) with a localised implementation approach, including e.g., a focus on improving veteran and ethnic representation in US offices. The same company also implemented training for all employees, inclusive hiring processes, an accessible workplace, an employee resource group, policies around harassment, gender salary reviews to ensure pay equity and a renewed parental leave policy to support inclusion.

In Focus: Environmental Impact

Context

We believe it is critical for our portfolio companies to measure and reduce their climate impact, regardless of whether their business is tackling outcomes in Financial Inclusion, People Health or Planetary Health. Understanding our portfolio’s total Scope 1, 2 and 3 GHG emissions is also an essential first step to achieving our firm-wide commitment to align our portfolio to net zero by 2040, and to support our companies in setting Science-Based Targets, in line with our additional firm-wide commitment to achieve 60% SBT coverage across assets under management by 2025.

Engagement

For the second year, we have focused our engagement on driving ‘carbon-consciousness’ by conducting a comprehensive evaluation of Scope 1-3 GHG emissions for every private company in SSF III. We also supported Lifecycle Assessments (LCAs), which measure the net (negative) impact of a company’s product and services versus business-as-usual, for five of the six companies contributing to outcomes in the domain of Planetary Health.19

Scope Breakdown (Aggregate Portfolio)

Insights

The portfolio as a whole emitted 163,131 tCO2e in 2021, now over 13 companies relative to 8 companies in 2020. This includes two circular economy companies with substantial revenues and significant operations, Back Market and Vestiaire Collective; on a like-for-like basis, portfolio emissions intensity actually decreased by 30% from 2021 over 2020. As expected, the largest contribution was from Scope 3 (91% of portfolio emissions), with share of emissions from Scope 3 up slightly on last year. Of the Scope 3 emissions, the largest share is still derived from Purchased Goods and Services and broadly in line with last year.

Beyond measurement, this year marks a turning point in action. Three companies have set carbon emissions reduction targets, two of which are Science-Based Targets,20 and a further three are actively developing targets and reduction strategies, comprising efforts to reduce employee travel, reduce use of single-use plastics and manufacturing process optimisation to reduce lifecycle footprint. As just one example, Andela’s move to fully remote working reduced its emissions intensity substantially. It is also worth noting that care must be given to interpreting these results as certain companies, such as Back Market, Convoy, Nature’s Fynd, Pivot Bio and Vestiaire Collective, are producing products that are designed to reduce emissions from the economy. This impact is included in our LCA analysis and impact metrics, and effectively serves to counteract on a net basis the carbon footprint displayed in the chart above.

Data Partners for this Report

Click on the logos below to read more about the data partners for this report.

60 Decibels

60 Decibels is an end-to-end impact measurement company. Their aim is to make it easy to listen to the people who matter most, measuring impact from the ground up.

Using their Lean Data approach, 60 Decibels speak directly to customers, employees or beneficiaries, returning high-quality data in weeks to help customers maximise their impact and grow their business. They have 750 researchers conduct local-language voice surveys in 50 countries, who use tested social impact survey tools, aligned to industry standards.

Over the course of over 730 projects with 384 companies, they have helped clients listen to 162,992 people in 125 languages. Clients include Acumen, CDC, Ceniarth, the UK Department for International Development (DFID), Omidyar Network, Omnivore, Soros Economic Development Fund, Unilever and many others.

Environmental Capital Group

Environmental Capital Group (ECG) advises investors and companies on impact and ESG issues, with deep expertise in quantitative Life Cycle Assessment (LCA) of carbon, energy, pollution and resources across investment portfolios. Starting in 2007, ECG served as an environmental advisor to CalPERS’ Clean Energy and Technology Program, developing one of the largest programmes of sustainability impact accounting and reporting in the world. ECG has advised 30+ funds on $15 billion of investments in over 300 portfolio companies.

Cliff Brown, Managing Director of ECG, has led this work for 13+ years, advising investors and companies on strategy and sustainability, including ESG issues. Cliff has prepared the ESG assessment of our portfolio companies in accordance with best practices for ESG accounting and reporting.

For this report, ECG performed the impact analysis for Back Market, Convoy, Nature’s Fynd, Pivot Bio and Vestiaire Collective, including the lifecycle assessments compared to business-as-usual.

Emitwise

Emitwise’s AI technology empowers companies to automatically measure, report and reduce their carbon footprint across their operations and supply chain, future-proofing businesses for a net-zero carbon world.

Based in London, Emitwise is a software solution enabling companies to automate their carbon accounting across business units and suppliers, liberating them from the burden of collecting and processing emissions data. The platform utilises artificial intelligence to precisely measure or estimate emissions in real-time, enabling businesses to identify and tackle carbon hotspots and devise a trackable roadmap to net-zero carbon. Used by companies internationally and across various sectors, the platform aligns businesses with global climate targets and reporting standards, helping them mitigate risks and accelerate their transition to net zero.

For this report, Emitwise has calculated greenhouse gas emissions inventories for all private companies in Generation’s 2021 portfolio, as well as Remitly.

Glossary of terms

| Terms | Definitions | Terms | Definitions |

| API | Application Programming Interface | KPI | Key Performance Indicator |

| BQ | Business Quality | LCA | Lifecycle Analysis |

| CDP | Carbon Disclosure Project | MQ | Management Quality |

| CO2 | Carbon Dioxide | NASA | National Aeronautics and Space Administration |

| CSR | Corporate Social Responsibility | NED | Non-Executive Director |

| EA | Executive Assistant | POC | People of Colour |

| EDI | Equity, Diversity and Inclusion | SASB | Sustainability Accounting Standards Board |

| ESG | Environmental, Social, Governance | SDG | Sustainable Development Goal |

| GHG | Greenhouse Gas | SMB | Small and Medium-sized businesses |

| GIM | Generation Investment Management | TCFD | Task Force on Climate-related Financial Disclosures |

| IFRS | International Financial Reporting Standards | tCO2e | Tonnes of carbon dioxide equivalent |

| IPCC | Intergovernmental Panel on Climate Change | UN PRI | United Nations Principles for Responsible Investment |

| IMP | Impact Management Project | UNEP FI | United Nations Environment Programme Finance Initiative |

| IP | Intellectual Property | VRF | Value Reporting Foundation |

| ISSB | International Sustainability Standards Board |

Disclosure Frameworks

Generation believes in the principle of integrated reporting on financial and sustainability activities, performance outcomes and risks. In certain cases, we also publish supplementary reporting to ensure our reporting meets specific regulatory or voluntary commitment requirements. A summary and links to these disclosures is below.

| Task Force for Climate-related Financial Disclosures (TCFD) |

Generation has made a commitment to use the TCFD’s recommended framework for disclosing its climate-related exposure each year. Our first TCFD report, covering 2020, was published in 2021. | TCFD Report 2021 |

| Sustainable Finance Disclosure Regulation (SFDR) |

Generation adheres to the European regulatory framework SFDR and discloses its sustainability risks, remuneration, consideration of Principal Adverse Impacts (PAIs) and the classification of its funds, in its fund offering documents and/or on its website, according to SFDR’s required practices. | Sustainability in the Investment Process |

| UK Stewardship Code | Generation is pleased to have been accepted by the Financial Reporting Council as one of the initial signatories to the UK Stewardship Code last year. Generation’s Stewardship Report has just been submitted and is available publicly on our website under Our Strategies. | Stewardship Report |

Key Frameworks

|

|

|

|

|

|

|

|

Read the report in full

Download- We have been investing for 15 years as a Growth Equity team – beginning with our research ahead of the final close and launch of our first Sustainable Solutions Fund in 2008.

- Growth Equity team as at 31 March 2022, excluding individuals who are not 100% allocated to the Growth Equity team and long-term consultants.

- 100% carbon emissions disclosure excludes Sophia Genetics, which is now a public company.

- Data comes from a survey of a sample of AlayaCare’s care workers conducted by 60 Decibels. For more information on the survey and 60 Decibels, please see Data Providers for this Report.

- https://homehealthcarenews.com/2022/02/former-vp-al-gore-sees-home-based-care-as-central-to-a-sustainable-health-care-system/

- US EPA “Fast Facts: U.S. Transportation Sector GHG Emissions” 2019, Convoy data and estimates, ECG analysis. Data refers to truck freight within the US only — it does not include international transport or rail and shipping freight.

- Guideline. “Exposing the small business 401(k) access gap.” March 29, 2019. https://www.guideline.com/blog/defining-the-small-business-401-k-access-gap/

- U.S. Bureau of Labour Statistics.

- Poore, J., & Nemecek, T. (2018). Reducing food’s environmental impacts through producers and consumers.

- Institute for Agriculture and Trade Policy. https://www.iatp.org/new-research-chemical-fertilisers

- Pivot Bio. “Synthetic Fertilizers in Ag.” July 19, 2021. https://blog.pivotbio.com/press-releases/series-d

- MDPI. “Review Nitrogen Fertilization. A Review of the Risks Associated with the Inefficiency of Its Use and Policy Responses.” May 18, 2021.

- World Economic Forum (2021), Net-Zero Challenge: The supply chain opportunity https://www3.weforum.org/docs/WEF_Net_Zero_Challenge_The_Supply_Chain_Opportunity_2021.pdf

- Percentage of workforce self-identifying as female & non-binary across the portfolio represents the weighted average, with total employees as the denominator. A total of 12 out of 13 companies reported gender representation of the workforce in 2021.

- Percentage of workforce self-identifying as POC across the portfolio represents the weighted average, with total employees as the denominator. A total of eight out of 13 companies reported ethnic representation of the workforce in 2021.

- Management is defined as C-Suite employees.

- Technical Staff is defined as non-administrative employees (excluding functions such as building maintenance, security and other ancillary staff).

- All other staff fall into the Other Staff category.

- For companies with planetary impacts, the LCA analysis of the impact of the company’s products and services vs. ‘business as usual’ also includes analysis of those categories of the company’s carbon footprint that are directly related to the product/service production lifecycle. This is intended to provide a fair comparison of lifecycle impacts that aligns with the GHG Protocol Product Standard and ISO 14044 standards for LCA.

- Vestiaire Collective is currently awaiting validation of its Science-Based Target.

Important Information

The material contained in this document (the “Document”) has been prepared by Generation Investment Management LLP (“Generation”) for informational purposes only and reflects the views of Generation as at May 2022. It is not to be reproduced or copied or made available to others without the consent of Generation.

The Document is compiled in part from third party sources believed to be accurate, including the Fund’s investee companies themselves. Generation believes that such third party information is reliable, but does not guarantee its accuracy, timeliness, or completeness. It is subject to change without notice. The information should not be considered independent; it may be subject to error or omission and should not be relied upon.

Generation accepts no liability for loss arising from the use of this material. Any opinions expressed are our current opinions only. This Document is not meant as a general guide to investing. It is expressly not a source of any specific investment recommendations. It makes no implied or express recommendation concerning the manner in which any client's account should or would be handled. Under no circumstances is it to be considered as an offer to sell or a solicitation to buy any investment referred to in this Document. It is not investment research. Should you disregard this caution, you should further be aware that, in consequence, it does not take into account your individual circumstances nor your financial situation or needs. Securities can be volatile and entail risk and individual securities presented may not be suitable for you. You should not buy or sell a security without first consulting your financial advisor or considering whether it is appropriate for you and your respective portfolios.

Generation, its employees, partners, consultants, and/or their respective family members may directly or indirectly hold positions in the securities referenced.

Any statements of opinion or belief contained in this Document, all views expressed and all projections, forecasts or statements relating to expectations regarding future events or the possible future performance of any product in respect of which Generation or any affiliates provide management or advisory services (or any other product) are those of Generation and represent Generation's own assessment and interpretation of information available to it as at the date of this Document and are subject to change without notice. No representation or warranty is made, nor assurance given, that such statements, opinions, projections or forecasts are correct or that the objectives of Generation or any products in respect of which Generation or any of its affiliates provide management or advisory services (or any other products) will be achieved. No responsibility is accepted by Generation or any affiliates in respect thereof.

The Fund is a private and unregulated fund and is not registered for distribution to the public or for private placement in any jurisdiction. Specifically, the Fund is not and will not be registered under the Securities Act of 1933 or registered or qualified under any US state securities act. The Fund is not and will not be registered as an investment company under the Investment Company Act of 1940. No regulator has approved the units in the Fund or their distribution.

Nothing in this Document should be interpreted to state or imply that past results are an indication of future performance. There is no assurance that any securities included within this report will remain in the Fund portfolio.

This communication has been issued in the United Kingdom by Generation Investment Management LLP ("Generation IM"), which is authorised and regulated by the Financial Conduct Authority of the United Kingdom and is a limited liability partnership registered in England and Wales. Registered No: OC307600. ARBN: 116 045 526. It is not a financial promotion. Generation IM is the parent entity of Generation Investment Management US LLP ("Generation US"), an investment adviser registered with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser with the SEC does not imply a certain level of skill or training. Generation IM and Generation US may only transact business in any state, country, or province if they first are registered, or excluded or exempted from registration, under applicable laws of that state, country, or province. In particular, Generation IM does not conduct business in the United States and persons in the United States should engage with Generation US only. Generation IM and Generation US are collectively referred to above as “Generation”.

If you have any questions relating to this report, please contact Generation Client Service at Generation Investment Management LLP, 20 Air Street, London W1B 5AN. Email: [email protected] Tel: + 44 (0) 207 534 4700.